CBA Exits Cap Auction Biz (and is SMBC’s Cap Book Too Big to Fail?)

Last Week This Morning

- 10 Year Treasury climbed to 2.12%

- German bund up substantially to -0.21%

- Japan 10yr at -0.13%

- 2 Year Treasury finished the week flat at 1.85%, but swung wildly +/- 10bps along the way

- LIBOR at 2.33% and SOFR at 2.41%

- Market has a 100% probability of cut at month end, with a 20% probability of a 50bps cut

- Both headline and core CPI came in 0.1% higher than expected

- Both headline and core PPI came in 0.1% higher than expected

- Powell strongly suggested a rate cut is coming at month end

- Stocks set all-time highs because the Fed is going to cut rates

Powell Has Gone Full Dove

Last week we suggested that if there was a chance the Fed wouldn’t be cutting rates at month end; Powell would need to start sending signals during his Congressional testimony so the market could reprice.

Needless to say, he did not.

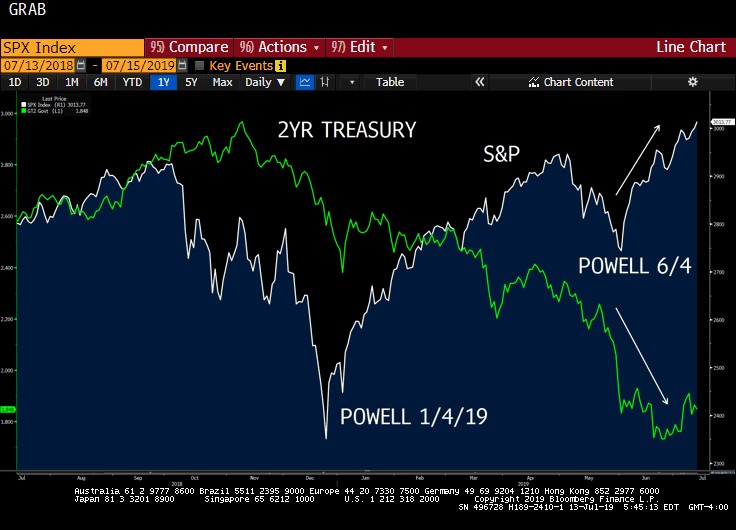

It is clear the Fed will be cutting rates at month’s end. Every time Powell suggests lower rates, stocks rally and the 2 Year Treasury falls. His most prominent statements came on January 4th and June 4th.

Some highlights from Powell’s Congressional testimony last week:

- “act as appropriate to sustain the expansion”

- “risk that weak inflation will be even more persistent than we currently anticipate”

- “it appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the US economic outlook while inflation pressures remain muted”

- Highlighted uncertainties “yet to be resolved, including trade developments, the federal debt ceiling, and Brexit”

Again, with market odds of a cut on July 31st at 100%, Powell would have used last week’s testimony to correct market expectations. He did not.

The Fed is cutting rates at the end of the month.

Where Have all the Cap Providers Gone?

On Thursday, Commonwealth Bank of Australia (CBA) announced it is exiting the cap auction business. They are working on approvals to sell caps on a negotiated basis, but have no timeframe for when, or if, that approval will come.

Until further notice, CBA will not be a cap provider on new financings.

This leaves one common provider – Sumitomo Mitsui Bank Corp. Or as you probably know it, SMBC.

A very common question we are asked is, “Why is it so hard to find banks willing to bid on caps?”

The simple answer – because they require a lot of effort for minimal gain.

Let’s go back to pre-crisis. When I was working at the bank, we could sell a cap with no lead time. If you called me and asked me to bid on a $50mm 3yr cap at 3.0%, I could give you a number. If you liked it, you’d tell me I was done and we would begin documenting the trade. It didn’t even matter if we had never spoken before. While the profit margins were thin, the effort was minimal. I only really put in work if I won the trade. That made it worth it. If you traded with someone else, I just hung up and went back to my day.

With the enactment of Dodd-Frank (DF), the pre-trade requirements are much more intensive, and for good reason. Dodd-Frank has its flaws, but a more robust KYC process for derivatives isn’t one of them.

Now it takes quite a bit of documentation, KYC information, background checks, etc before a bank can even bid on a cap. Each bank has its own internal documents to fulfill the DF requirements.

Step into our time machine and go back to 2014, right after DF was enacted. You call us to place a cap. We go to 20 banks and ask for bids. We get back 20 quotes and begin the pre-trade process with each. Then we run the auction.

SMBC wins. They sell the cap to you for $75k and book about $5k in profit. The other 19 banks lose, but they thank us for the opportunity to bid.

You call us again the next month. Repeat the process. SMBC wins. The other 19 banks lose again, but again thank us for the opportunity to bid.

Repeat that process 5,000 times over the next two years. At some point, those banks get tired of putting in the effort to bid, only to lose to SMBC. Wouldn’t you? So, they stopped bidding. “We will pass on this one but thank you for reaching out.” Eventually, they just stop responding.

Additionally, those banks have other more profitable ways of making money, like swaps. Swaps aren’t usually done on an auction basis since the lender can secure the exposure with the underlying real estate. The effort required has a clear reward. Plus, instead of making just $5k like they would on a cap, they can generate several hundred thousand dollars in swap revenue.

Simply put, banks were faced the following decision – do we spend time bidding on caps we will probably lose? Or do we spend our time on swaps that we will make much more revenue on?

Which would you choose?

And for that reason, the pool of willing participants has continued to shrink over the years. Banks have dropped out of the cap auction business. Now with CBA out of the market, that leaves SMBC as the most prominent provider that will bid on basically any cap.

Other banks will quote, but have various contingencies. For example, BofA will bid if their initial indication is competitive and they have a relationship with the buyer, but they won’t agree to any credit downgrades. BoNY will bid on some agency caps if their quote is competitive. Wells will provide a quote to borrowers they have a relationship with, but will only sell the cap on a negotiated basis – they won’t participate in an auction. US Bank will bid if they have a relationship, but has different credit charges based on the rating requirements. Stuff like that.

Every bank has unique conditions and considerations like these, whereas SMBC and CBA were basically game to bid on any structure. Here’s a link to the white paper we published two years ago on this topic that includes a matrix of bank by bank requirements: https://www.pensford.com/resources/shrinking-pool-of-cap-providers/

Some other FAQ’s

Q: So why have SMBC and CBA been so prominent in the cap market?

A: Because they don’t lend in the US, so they can’t sell swaps on their own loans. If SMBC and CBA had the sort of lending presence that a bank like Wells does, they might choose to spend their energy elsewhere. But since they don’t, selling caps is how they planted a flag in the US.

Selling caps is how they make money. That’s not true for the other banks.

Q: Why is SMBC so good at caps?

A: Cap pricing is more art than science and they have always been aggressive on interest rate options. Additionally, because they can’t sell swaps like other banks, they need to make their money somehow. Lastly, they have an incredibly robust and efficient team in place to handle the massive volume. They have an infrastructure to support the cap business, whereas traditional lenders do not.

Q: Are my caps with CBA worthless?

A: No. CBA is still a viable counterparty and will honor its hedging commitments. They just won’t provide new caps.

Q: CBA was one of the few agency-approved hedge providers, what now?

A: I have spoken at length with both Fannie and Freddie over the last few years on this very topic. Both had concerns about the growing exposure to SMBC.

Unfortunately, their answer always seems to be, “let’s get more banks approved.” But that doesn’t make those banks any more likely to win vs SMBC. Ultimately, those banks will just stop bidding, just like the banks in my earlier example.

The agencies could approve 50 cap providers, but it won’t matter if they just keep losing to SMBC.

Q: Will SMBC’s pricing widen if they are the only game in town?

A: Yes.

But not just because they aren’t being shopped against CBA anymore. We can help monitor and negotiate that premium as part of our involvement.

The bigger issue is that with CBA out of the market, SMBC just lost the ability to assign caps to the most likely replacement cap provider – CBA. All those rating downgrade triggers lenders require? If SMBC gets downgraded and has to transfer the cap, who do they transfer to? Before now, it was CBA.

Maybe Wells, or US Bank, or JPM, or someone like that will be open to those assignments. But they aren’t in the cap business the way CBA was, so it is unlikely to generate as much interest internally. In order for management to get comfortable taking assignment of those caps from SMBC, they will likely charge more than CBA would have.

Therefore, SMBC has to price in the potential cost of an expensive assignment process if they were to get downgraded in the future.

The cap process has been undergoing an evolution towards a more negotiated transaction, and CBA’s announcement will likely accelerate that. Knowing which banks will agree to which triggers, terms, strikes, etc will become increasingly important instead of just hitting send on a mass email to every potential provider.

Q: What happens next?

A: If SMBC’s pricing widens too much, other banks will step in once the revenue justifies the effort. Caps will still be available, and the market will find an equilibrium, but perhaps at a higher price than today. Maybe falling rates will help mute that effect.

I noted earlier that the cap process has been undergoing an evolution over the last five years. I suspect we will continue to see more negotiated caps. Everyone expects caps to be auctioned because that’s how it’s always been done. But there’s no requirement that caps be auctioned. If you are concerned about exposure to SMBC and choose to pay a premium to trade with another bank, that’s your decision. We can still get all the quotes lined up and you can decide who to trade with. We are agnostic as to who you trade with.

But I have found that customers like to talk about diversifying their exposure, but when push comes to shove, they go with the lowest cost. Borrowers do the same risk reward analysis the banks do when deciding whether to bid or not. Is the risk worth the effort/cost?

I should also note that both SMBC and CBA have always been great to work with. The employees care deeply about the clients, their reputation in the market, and their role in the financing process. I have lots of banking horror stories in my career, but none with these firms.

One Final Warm and Fuzzy Thought

Remember when I said Dodd-Frank has its issues? Well one of those issues is that it has unintentionally loaded up derivative exposure onto the back of one provider – SMBC. If the intent was to prevent another situation of “too big to fail”, it has not accomplished its goal. The cumbersome onboarding process has made banks unwilling to expend the effort required to bid on a cap.

And now, SMBC’s cap book may be too big to fail.

Or at least we hope it is.

And as my mentor used to tell me, hope is a terrible hedge.

Week Ahead

Retail sales, inflation data, and some manufacturing numbers should highlight this week’s economic calendar.