What is Defeasance?

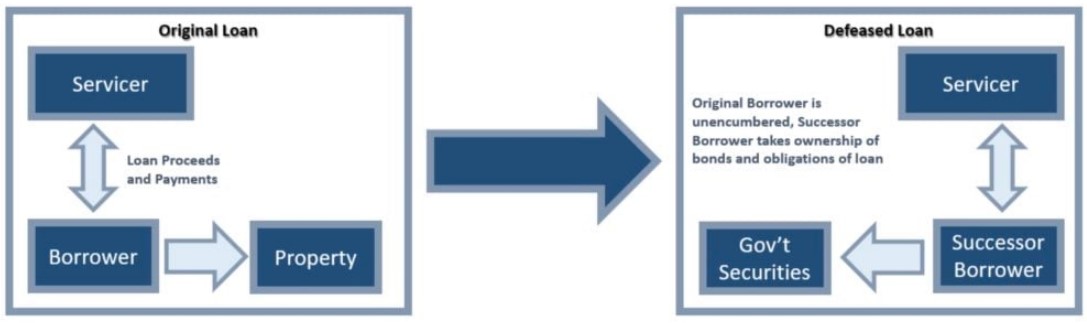

Defeasance is a process by which a borrower who had previously entered into a CMBS loan can unencumber themselves prior to the maturity of the loan. This process is accomplished by purchasing a portfolio of US Obligations that mirror the stream of payments owed to CMBS bond holders.

Defeasance vs. Yield Maintenance

Defeasance and Yield Maintenance follow the same calculation conceptually, but they differ in execution. Yield Maintenance is characterized by a lump sum payment to the lender, while a defeasance utilizes a portfolio of US Obligations to replicate the cashflows provided by the loan payments.

- You generally cannot “prepay” a CMBS loan, you have to replace the collateral. Protections are put into place for the bondholders to prevent a loss in revenue. Yield Maintenance opens the investors to interest rate risk (i.e. interest rates falling after the loan has been prepaid). Defeasance guarantees the payment stream continues uninterrupted.

- REMIC rules dictate that collateral must be held against the obligations of the loan. Debt Obligations of the US Government meet this criteria.

The Defeasance Process

While defeasing a loan is not technically difficult, its complexity often requires that a consultant is hired to help quarterback the deal.

- Provide notice to the lender that the loan is to be defeased within the notice period.

- Engage third parties, including:

- Broker-Dealer

- Security Intermediary

- Certified Accountant

- Successor Borrower

- Servicer and their Counsel

- Up to ~15 separate parties

- Coordinate Kick-Off and All-Hands Calls to discuss defeasance requirements.

- Circle Portfolio of Securities.

- Transfer Loan Obligations to Successor Borrower.

The Successor Borrower

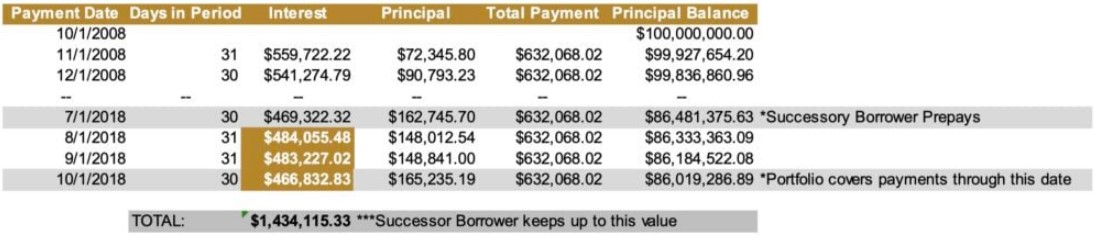

The role of Successor Borrower is to take over the obligations of the loan, as well as ownership of the Bond Portfolio. The Successor Borrower can be selected by either the servicer or borrower, dictated by the loan agreement. While each loan is different, they can often be prepaid 3 months prior to maturity, often referred to as the “Open Window”. Once the Successor Borrower is in control of the Portfolio, they can prepay the loan and keep any residual value for themselves. For example, on a 10-year, $100 Million dollar loan: CMBS loan:

Why Hire a Third-Party Advisor?

Checks and Balances

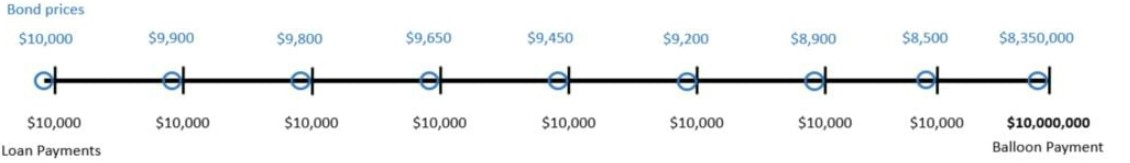

While the defeasance language in your loan docs requires that the portfolio make all of the payments in due to the bond holders, there is nothing that requires that the portfolio be the most efficient. An unchecked trader can easily use inefficient bonds in a portfolio without oversight.

Efficient Portfolio

Using the efficient portfolio, we buy $8,425,400 in bonds to cover $10,080,000 in bond payments.

Inefficient Portfolio

Using the inefficient portfolio, we buy $8,476,350 in bonds to cover $10,080,000 in bond payments. This Costs the borrower $50,950 vs using the efficient portfolio.

Your New CMBS Loan – Prepayment Terms

If you’re negotiating the terms of your new CMBS loans, it’s easy to overlook the defeasance terms. However, a few easy comments can make the defeasance a little less onerous:

- Allow the securities portfolio to be structured to the open window.

- If the Originator will not agree, then ensure prepayment is not negated by defeasance.

- Allow the borrower to select the Successor Borrower.

- Allow Agencies to be used in the portfolio.

- “Succeeding, on or prior to”. Make sure payment dates that fall on bad business days go to the next good business day. Also make sure the portfolio can include securities that mature on payment dates.

- Limit Servicer Processing Fees to some amount, like $10,000.

How We Can Help You…

…decide if now is the right time to defease:

Pensford Defeasance can provide you with a detailed Costs Summary, outlining expected portfolio costs and third-party fees. How exposed are you to interest rate movements and lending appetite? By using the terms of your new, prospective financing we can help quantify your breakeven point.

…defease your loan:

We can act as your Consultant to help guide you through the complex process.

…lock in your new CMBS loan.

We can review the defeasance terms of your loan and provide you with language to present to your originator. We can be on the phone with you and the bank’s trade desk when you rate lock, to ensure a fair and transparent deal.