Powell Takes Worst Case Off the Table

The Fed raised rates with a 0.50% hike for the first time since 2000. The unanimous decision will push Fed Funds to 0.75% - 1.00%.

Powell began his press conference with, “I want to speak directly to the American people…. inflation is much too high.” When asked by a reporter in his Q&A about why he started off that way, Powell said it was important that the American people know that the Fed knows inflation is impacting them.

That feels scripted by the White House. Diane Swonk, Chief Economist Grant Thorton, pointed out that inflation effects 100% of the population, while unemployment only effects 4% of the population. If the Fed has to be highly sensitive to political pressures, how will they handle changing political pressure when unemployment is rising and stocks are tanking?

Main Takeaway

Most importantly, “Additional 50 basis point hikes should be on the table at the next couple of meetings. A 75 bps hike is not something the committee is actively considering.”

- Two more meetings of 50bps, but maybe not three

- This would put Fed Funds at 2.0% at the September 21st meeting

o Assuming two more 25bps hikes at November and December, Fed Funds would end the year at 2.50%

Powell said the committee “won’t hesitate to go higher than neutral if needed”. That means the Fed is actively discussing putting us into restrictive territory. This isn’t breaking news, but it confirms they won’t stop hiking until inflation is controlled.

But then he went on to say that neutral is a broad estimate and is thought to be 2.0% - 3.0%. This is a huge deal because calls for 5% Fed Funds (cough cough Deutsche) could be far too high.

There was a collective exhale from the market that maybe the worst-case scenario of rate hikes is off the table. Rates dropped and stocks rallied.

Powell continued, “We will be raising rates expeditiously to plausible levels of neutral. We’re going to be looking at financial conditions – are they tightening appropriately? Then we are going to make a judgement about whether we have done enough.”

Ask and you shall receive…look how much tightening has already occurred in financial conditions since year end.

Source: Bloomberg Finance, LP

Rate Reaction

The Fed has hiked at just two meetings, but conditions have tightened substantially – thank you forward guidance. We are barreling towards restrictive territory already.

For this reason, I still think the Fed will either fail to get to its median forecast of 2.875% or get there but have to backpedal quickly.

“We’ve never been able to reduce inflation by 2.5% without inducing a recession,” Scott Minerd CIO Guggenheim Investments said on a CNBC interview before the meeting.

Powell made it clear that controlling inflation is their primary objective, so it seems likely that the Fed will hike enough to contract the economy.

Sooo….how long before we’re talking about cuts?

Rate Reaction

2T 2.78% down to 2.64%

10T 2.97% down to 2.93%

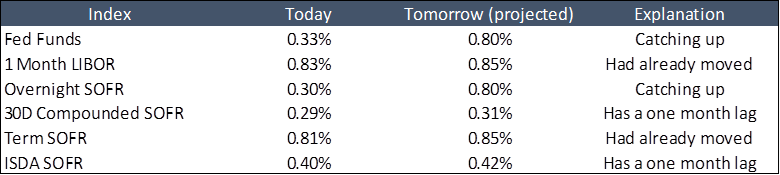

With the various SOFR indices and their calculation methodologies, here’s a synopsis of pre-meeting vs post-meeting.

Next Meeting

The next meeting is June 15th, which will include updates to the Summary of Economic Projections. These are the anonymous forecasts by Fed members for things like unemployment, GDP, inflation, etc. They are also the Blue Dots that suggest the path of Fed Funds for the next three years.