Omaha! Omaha! – Jay Powell

You’re probably in about as much of a mood to read this as I am to write it, although my head probably hurts a little bit less since it’s Sunday morning.

Last Week This Morning

- 10 Year Treasury fell as low at 2.62% (key support level!) before rebounding to 2.68%

- German bund closed at 0.17%

- 2 Year Treasury fell from 2.59% to 2.50%, but got as low as 2.45%

- If the 2T is on top of LIBOR (both at 2.50%-ish), it means the market expects no hikes for two years

- LIBOR at 2.51% and SOFR at 2.58%

- FOMC held steady on rates and signaled an extended pause

- Odds of a rate hike at any given meeting this year are below 6%

- Economy added 304k jobs last month vs expected 165k

- The Unemployment Rate ticked up to 4.0% on improved participation rate

- Average hourly earnings (inflation) came in y/y at 3.2% – as forecasted

- M/M came in at just 0.1%, below the forecasted 0.3%

- Atlanta Fed GDPNow forecasts GDP at 2.5%, essentially the same as consensus forecasts

- Core inflation in the Eurozone ticked up ever so slightly to 1.1%

Job Report

The government shut down has meant no economic data releases, so the temporary re-opening came just in time for Friday’s job reports. Finally – something to talk about!

The only things with a longer winning streak than the Pats is Non-Farm Payroll. For the 100th month in a row, the economy added jobs. This month’s gain was 304k jobs, well above the consensus forecast of 165k; however, last month’s report was revised lower by 90k jobs (312k to 222k). This muted the impact, but nonetheless it would be challenging to feel negatively about this news. The three month average is still 174k.

The unemployment rate ticked up from 3.9% to 4.0%, but that was largely driven by improved participation rate. Given the robust hiring numbers, we expect the UR to move lower in the coming months as labor force participation rate stabilizes. We could be talking about a 3.5%-3.7% UR later this year.

This report came on the heels of a newly dovish Fed, but this alone isn’t enough to suddenly put hikes back on the table. It will likely take several more strong prints for the Fed to start talking hikes again.

“Omaha! Omaha!” – Powell

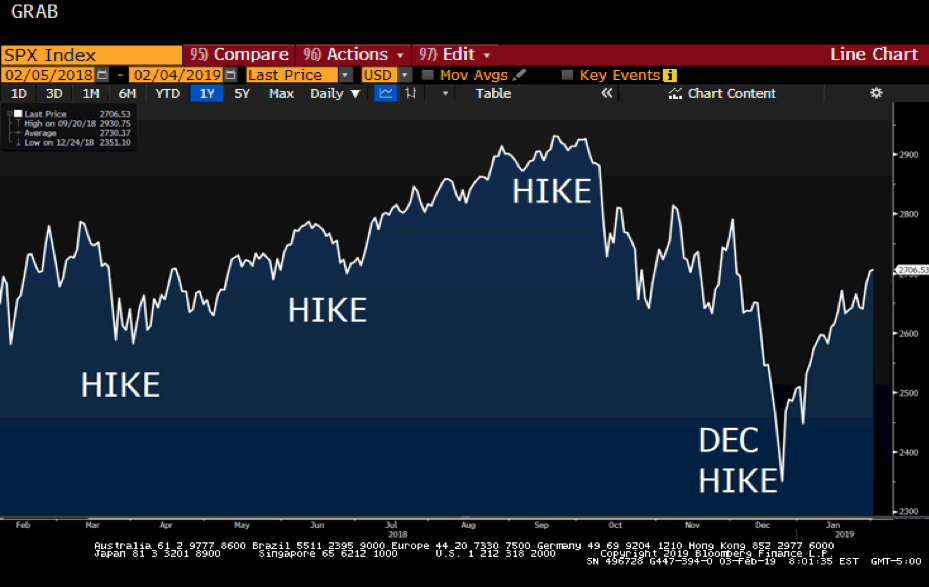

Even my grandmother knows the Fed has a remarkable track record of hiking us into a recession. Check out the S&P over the last year. In October, the market started panicking that the Fed was at it again.

But a week after the rate hike, Powell said the Fed would patient with rate hikes and would be willing to hold off on further balance sheet normalization. The Powell Audible! Cue stock market rally.

Remember the December 2015 rate hike? Yellen tried hiking rates for the first time in a decade, but it came at a time when financial conditions had already spiked – primarily because oil had collapsed.

Yellen hiked even though she shouldn’t have…and didn’t hike again for another year.

Financial Conditions. I feel like I’m beating a dead horse, but this measure is so critical. When financial conditions tighten, it restricts growth. The economy cools off. That’s the whole reason the Fed is hiking, right?

So when financial conditions are already restrictive (above the dashed line), the Fed doesn’t need to hike.

I can’t help but wonder if the recent December 2018 hike is just a replay of the December 2015 hike. Financial conditions were already restrictive – the hike wasn’t necessary. And that’s why markets were puking.

This probably gave Powell the cover fire he needed to send the signal that the Fed would be holding off on further hikes for now. Rate hikes are meant to make financial conditions more restrictive…once that happened, why keep hiking?

Also note how quickly financial conditions eased over the last month as soon as the Fed started sending signals about no further rate hikes and a stock rally.

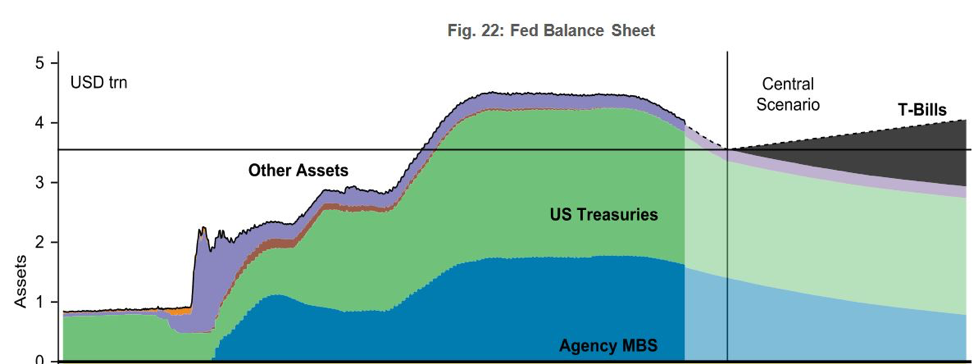

One other big impact on easing financial conditions over the last month – balance sheet normalization. In late December, the Fed suggested it was open to revisiting the $50B per month burndown if it believed this was contributing to market weakness.

We think there’s a very real chance the Fed slows the pace of burndown this year, and maybe even starts growing the balance sheet again. BNP Paribas believes the Fed will shift focus and allow MBS to roll off and replace those maturities with front end bond purchases (t-bills).

Bottom line – the Fed is taking its foot off the brakes. At a minimum, this should help avoid a Fed-induced recession. At best, it probably bought more time for the economic expansion. This is all good news.

What Does This Mean For Rates?

Floating rate borrowers, you have weathered the storm and are probably at the top end of your borrowing costs. The Fed may hike in June if the first half of the year shows solid growth and the market tolerates it, the Fed will hike again. But it is clear that tightening cycle is nearly over.

The effect on the 10 Year Treasury is more challenging to predict. In general, we think this should apply upward pressure on the long term fixed rates. A flexible Fed willing to adapt to changing market conditions is a good thing. It should also help steepen the curve. The T10 at 2.80% – 3.00% could be a comfortable landing spot for the time being.

But there’s also a chance that the Fed is holding off on hikes because the economy really is weakening. If we see slowing GDP, fewer monthly job gains, lack of inflation, etc, there’s no real reason for the yield to spike.

But we also think a dive to 2.25% is temporarily off the table. Fed missteps were the most likely catalyst for another panic trade that would cause that type of movement.

Super Bowl

What the Patriots have done over the last 17 years is tough to wrap my brain around. Tom Brady is the GOAT, and it’s not even close any more (you have no idea how tough it was to type that). Belichick is the GOAT, and it’s not even close any more.

Last year, the Eagles punted just one time and had no turnovers. That’s a recipe for a blowout…but the Pats didn’t punt at all! Brady had over 500 yards against one of the best defenses in football! I rewatched the Super Bowl this weekend and I was still holding my breath as Brady was driving. Who knows, maybe he’s got the ability to warp time and actually win?!?!

But as the greatest Super Bowl in history taught us, the Eagles can beat the Patriots. And if the Eagles, with a backup quarterback, can beat the Pats, so can the Rams.

I really hope I’m not jinxing it, but I got the Rams over the Pats 31-27.

And don’t worry Pats fans, Brady still has another five years in him so you’ll be here again next year.