A Mother’s Day Reflection

COVID is disproportionately affecting the careers of working women and mothers. The National Women’s Law Center reported that through October, women accounted for nearly 54% of total job losses.1 According to a McKinsey study, women should have accounted for 43% of the job losses. “By our calculation, women’s jobs are 1.8 times more vulnerable to this crisis than men’s jobs.”2 In December, women accounted for 100% of the 140k jobs lost.

The playing field wasn’t level to begin with. A report by the Brookings Institute concluded, “Based on our own analysis of 2018 American Community Survey data, before COVID-19, nearly half of all working women—46% or 28 million—worked in jobs paying low wages, with median earnings of only $10.93 per hour.” Only 37% of men meet the same criteria.3

This was reinforced by a report by the Georgetown University Center on Education and the Workforce, “Women with the same college majors working in the same careers as men still only earn 92 cents for every dollar earned by men.”

That’s just gender inequality. As any parent can attest, let’s throw a kid in the mix to really stress things out.

In 2019, there were 25mm working mothers with children under the age of 17.4 Of those, 15% are single parents and 41% live in households below 200% of the federal poverty level (equivalent to about $43,000 for a family of 3).5

Now add a pandemic to the equation and inequalities grow. “COVID-19 has also increased the pressure on working mothers, low-wage and otherwise. In a survey from May and June, one out of four women who became unemployed during the pandemic reported the job loss was due to a lack of childcare, twice the rate of men surveyed.”6

Think about that – 25% of all women who lost their jobs reported it was due to a lack of childcare. Biden’s infrastructure bill feels like dramatic overreach to me, but in that context an argument could be made about the necessity of childcare.

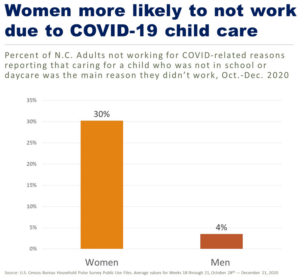

“Among adults who hadn’t worked in the past 7 days for reasons related to the pandemic, it appears that caring for children who are not in school or child care was the number one reason that women weren’t working.”7

Here’s North Carolina’s stats on unemployment and childcare.

And those that were lucky enough to keep their jobs still bore the brunt of the child rearing workload. “Mothers working full-time spend 50% more time each day caring for children than fathers working full-time.”8

This isn’t just an argument about equality, this impacts us all economically. “This report estimates that the risk of mothers leaving the labor force and reducing work hours in order to assume caretaking responsibilities amounts to $64.5 billion per year in lost wages and economic activity.”9 That’s lost productivity, growth, consumption, etc. “The impact on short-term work productivity and engagement appeared to be borne entirely on the backs of mothers of school age children,” Misty L. Heggeness, an economist at the U.S. Census Bureau said.

“The latest evidence shows that due to COVID-19 school and child care closures, mothers with young children have arranged reductions in their work hours that are four to five times greater than the reductions arranged by fathers. These disproportionate reductions have more than doubled the gap between the number of hours worked by women and by men.”10

The labor force participation rate among women aged 20+ is 56.3%. The same for men is 68.6%.11 “Last year, women’s labour force participation dropped by 3.4% compared with 2.8% for men.”12

Guess what happened when school started last fall? “Four times as many women as men dropped out of the labor force in September, roughly 865,000 women compared with 216,000 men.”13 We are not paying the price equally. I’m in that category – my wife has done all the in-home virtual learning/ tutoring/ counseling/ therapy/ coaching/ etc. while I got to go to work.

I get a little cranky every Veteran’s Day with the token, “thank you for your service” broadcasts (cue NFL giant flag unveiling and fighter jet flyover). I feel the same way this year about Mother’s Day.

For the readers in my own demographic, we would be wise to remember that much of our success is attributable to these women. Whether it’s the mom that raised us, the colleague that shows up for a zoom call in between virtual classes, a vendor that gets a deal across the finish line, or a tenant asking for a little grace during their struggle, we owe it to do and say more than just, “Happy Mother’s Day.”

Last Week This Morning

- 10 Year Treasury back up to key level of 1.577%

- German bund unch at -0.21%

- 2 Year Treasury down a touch to 0.145%

- LIBOR at 0.10%

- SOFR at 0.01%

- The economy added 266k jobs last month vs the forecasted 1mm

- Unemployment climbed from 6.0% to 6.1%

- Average hourly earnings came in up 0.7%, well above the expected and previous levels of 0.1%

- The Employment Cost Index had its biggest gain since 2007

- ISM Manufacturing slipped from last month’s 38 year high

- Equities fell most of the week out of fear of Biden’s tax plans

- Dallas Fed President Kaplan again suggested the Fed should begin considering tapering

- NY Fed Pres John Williams said he expects inflation to run above 2% the rest of the year

- Yellen said interest rate hikes might be warranted if the economy overheats

- Quail Hollow showed again why it is one of the premier spots on the tour and, on a personal level, I enjoyed seeing large groups of people without masks in an outdoor setting

Jobs Report

Welp, that sucked.

The economy added just 266k jobs last month when forecasts were generally in the 1mm range. February and March were revised lower by a combined 78k jobs.

Unemployment climbed slightly, but really because the labor force participation rate increased from 61.5% to 61.7%. That suggests growing confidence in hiring, meaning discouraged workers started looking again.

Unfortunately, the unemployment rate would be 8.6% if the participation rate from February 2020 was still in effect (63.3%). It’s data points like this that lead Powell to call for patience.

I said last week that markets have been too optimistic about a perfectly smooth recovery, and reports like this reinforce that feeling.

We are still down more than 8mm jobs pre-COVID. The most optimistic models assumed 800k jobs gained per month and everything is back to normal in March 2022. This report should reinforce the significant, long-term scarring that COVID will have on jobs and the bumpy path of recovery ahead.

At last month’s pace, it will be November 2023 before employment is back to pre-COVID levels. Probably just a coincidence that it ties out with Powell’s talk about no rates hikes through 2023…

Expectations for the first hike pushed back from March 2023 to June 2023. I still think the market is overestimating this and there won’t be a hike until 2024 at the earliest. Lots can go wrong between now and then.

More importantly, this eased the growing pressure around taper talk. I don’t think this report really changes the Fed’s timeline for those discussions as much as it forces the market to change its timeline. My money is on the Jackson Hole symposium in late August, which means the market really ramps up chatter in late July.

Next month’s job report will carry extra weight. Was the 266k an aberration? Or a more realistic monthly print going forward? I doubt we see lots of calls for 1mm jobs gained heading into the report, but consensus will still likely be around 500k. There’s also a chance we see a crazy range of forecasts, like 200k-1.5mm.

10 Year Treasury

Post-NFP, the 10T immediately tested the lower end of the range (1.47%), before rebounding to 1.577%.

Why the rebound?

Firstly, continued Fed accommodation means risk taking is alive and well. Bad news is good news.

More importantly, it suggests continued upward pressure on inflation. Not only is the Fed printing money, but employers may need to increase wages to fill job openings (if you buy the argument that firms are unable to find employees).

Guess what data we get this week? Inflation – headlined by CPI. Last month, it came in at 2.6%. Consensus for this month is 3.6%. But we also get PPI and University of Michigan Inflation Expectations.

In fact, the 10 Year Breakeven (a key measure of inflation expectations) hit its highest level since 2013.

A disappointing job report doesn’t mean the 10T is heading lower. Paradoxically, it could mean it’s heading higher.

I still think we’re range-bound, but I know that’s boring. My narrative would be “Expectations will drive yields higher, but failing to meet those expectations will eventually pull yields back down.”

Week Ahead

Nearly a dozen Fed speeches. Inflation data. Retail sales.

Sources

- https://nwlc.org/wp-content/uploads/2021/01/December-Jobs-Day.pdf

- https://www.mckinsey.com/featured-insights/future-of-work/covid-19-and-gender-equality-countering-the-regressive-effects

- https://www.brookings.edu/essay/why-has-covid-19-been-especially-harmful-for-working-women/

- https://tcf.org/content/report/how-covid-19-sent-womens-workforce-progress-backward-congress-64-5-billion-mistake/?agreed=1

- https://www.brookings.edu/essay/why-has-covid-19-been-especially-harmful-for-working-women/

- https://www.washingtonpost.com/us-policy/2020/07/29/childcare-remote-learning-women-employment/

- https://www.ncjustice.org/publications/womens-jobs-disproportionately-impacted-by-child-care-during-covid-19/

- https://www.brookings.edu/essay/why-has-covid-19-been-especially-harmful-for-working-women/

- https://www.americanprogress.org/issues/women/reports/2020/10/30/492582/covid-19-sent-womens-workforce-progress-backward/

- https://www.americanprogress.org/issues/women/reports/2020/10/30/492582/covid-19-sent-womens-workforce-progress-backward/

- https://www.bls.gov/news.release/empsit.t01.htm

- https://unctad.org/news/gender-and-unemployment-lessons-covid-19-pandemic

- https://www.americanprogress.org/issues/women/reports/2020/10/30/492582/covid-19-sent-womens-workforce-progress-backward/