Does the Un-Inversion Actually Confirm a Recession for 2020?

Markets are closed today, but the Newsletter never takes holiday (except maybe next week).

Last Week This Morning

- 10 Year Treasury ran up to 1.73%, and unlike last week, held on from there

- German bund spiked to -0.44%

- Japan 10yr up slightly to -0.18%

- 2 Year Treasury spiked 1.59%

- LIBOR at 1.91% and SOFR at 1.85% with that pesky quarter end spike behind us

- US and China reached a phase 1 partial deal in the 18 month long trade dispute

- Fed announced monthly bond purchases of $60B through Q2, but Powell really really really wanted to stress that this isn’t another round of QE

- PPI, the production side of inflation readings, fell to 1.4%, its lowest in three years

- CPI held steady at 1.7%

- The NY Fed puts odds of a recession within the next year at 37%

- With both of Hillary’s personal attorneys in jail or under federal investigation, the nickname “crooked” seems more and more accurate

- With each passing birthday, it becomes harder to remember a time when walking was the cool down and not the workout itself

Phase 1

The most immediate impact from the de-escalation is a delay on the tariffs that were set to take place Thursday. In exchange, China promised to buy $40-$50B annually from US farmers. Stocks jumped initially on the news.

Trump took a Twitter victory lap, “The deal I just made with China is, by far, the greatest and biggest deal ever made for our Great Patriot Farmers in the history of our Country.”

China also suggested it was open to limiting the devaluation of its currency, but it was very ambiguous on this topic. This reminds me of when my 11-year old pinky swear promises to “try his hardest” at something. OK…

Notably absent from the headlines:

– the December 15th tariffs were not addressed

– no mention of removing the “currency manipulator” tag on China

– Huawei’s removal from a government blacklist

Considering how much tensions have been escalating this year, any progress feels like good news. But this wasn’t a sweeping deal to resolve all the outstanding issues. While I appreciate the market’s initial optimism, I’m not sure how long it will hold if more good news doesn’t follow.

Un-Inversion

We have dedicated a lot of time to an inverted yield curve. Powell dismisses it. I, in my great and unmatched wisdom, tend not to mock things with a 1.000% batting average. While the 2/10 Treasury is the primary inversion metric, some observers prefer the 3 month T-bill vs 10 Year Treasury steepness.

That inversion first occurred in March. It just un-inverted last week.

The market is clearly nervous, with investors moving into money market accounts at levels not seen since the second half of 2008. Because I’m a silver lining kind of guy, the good news is that’s a lot of liquidity if markets start to feel upbeat. Money market accounts were net receivers of $322B in the last six months. That’s got rally written all over it.

But the thing about yield curve inversions is that they tend to front run a downturn by 6-24 months. Below is a graph of the 3 month T-bill and 10T inversion since 2000. The inversion occurred, and then un-inverted before the recession.

In other words, the fact that the curve just un-inverted may be confirming a recession rather than the all-clear signal.

2008 Financial Crisis

Let’s zoom in. Note how the inversion came in 2006 and un-inverted in 2007 before the Bear collapse.

Peak to trough, the 10 Year Treasury fell from 5.30% to 3.30%. Even choosing more moderate levels still resulted in a fall of more than 1.00% on the 10 Year Treasury after the inversion.

2001 Recession

The inversion came in 2000, the curve un-inverted, and the recession followed.

Peak to trough, the 10T fell nearly 2.00% after the inversion.

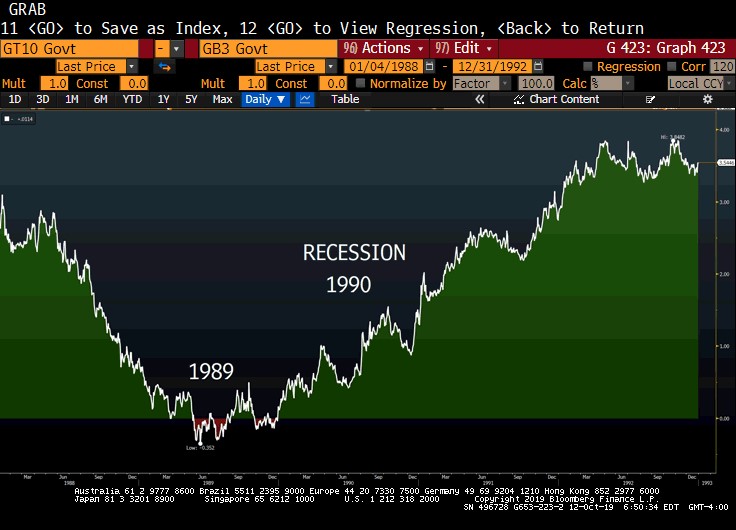

1990 Recession

The inversion came in 1989, the curve un-inverted, and the recession followed. You sensing a theme yet?

The T10 during 1990 was a little different. The 10T swung violently ahead of and right up until the start of the recession. But over the next two years, it fell 3.00% (or about a third off the peak).

Takeaways

The recent un-inversion may actually be confirming that a recession is coming in 2020.

While the T10 may experience volatility, it trends lower (and usually dramatically so).

Maybe the T10 experiences periods of higher movements, but in general the trend is very likely flat or lower.

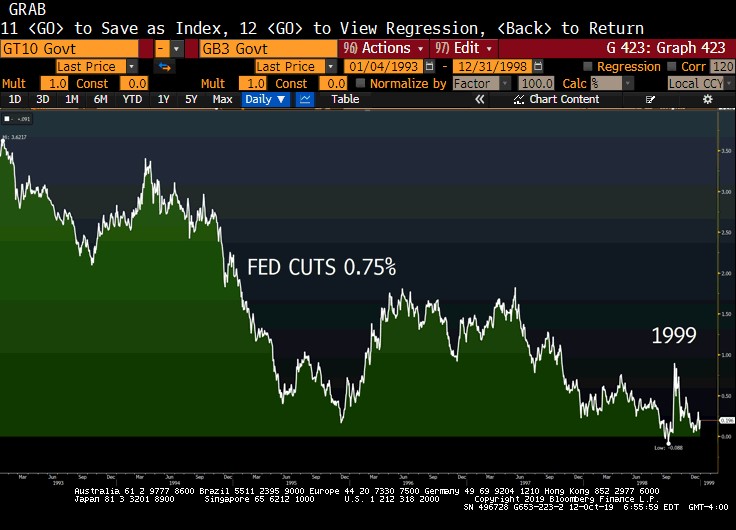

1995 Cycle

“But you keep saying how today’s cycle could be like the 1995 cycle, where the Fed backtracked quickly off of rate hikes and we avoided a recession. If that’s the case, could we see 10T rates spike?”

My readers are so astute. What a great question.

Here’s the steepness in the 1990’s, where the Fed cut and helped us avoid a recession. One notable difference between that cycle and today?

The 3 month T-bill/10 Year Treasury curve never actually inverted in 1995.

The 10T fell as the Fed cut rates, then rebounded once the market realized we weren’t in a recession. That’s the scenario where we could see higher 10 Year Treasury yields. But again, the curve didn’t invert in 1995.

Ultimately, the 10T fell by 3.00% in the subsequent three years.

Not a ton of precedence for a dramatic move higher in 10 Year Treasury yields until we get on the other side of a recession.

This Week

Nothing too dramatic on the data front. Perhaps we will have a benign week so I won’t feel guilty skipping next week’s newsletter as I travel to Happy Valley for the white out game against Michigan.