FAIT Accompli

Last Week This Morning

- 10 Year Treasury back down to 0.72% following the Fed statement

- German bund up 10bps to -0.41%

- 2 Year Treasury unch at 0.13%

- LIBOR at 0.16%

- SOFR is 0.07%

- Powell said the Fed will not be taking rates negative, while the BOE is definitely going to considering negative rates (futures markets put England into negative territory December 2021)

- China and the US are playing nice nice again

- Consumer Confidence is down, likely from the combination of the surge in cases plus the expiration of enhanced unemployment benefits

- The Big 10 is backpedaling and may have a season after all. They will likely cite “science”, which is really just a much more concise way to say, “we stand to lose a ton of money and players are going to transfer and we’re being sued so if we can rationalize it, game on!”

SOFR Cap Providers – Update

There are a couple of banks like Goldman that are willing to offer SOFR caps right now, but it’s still a thin market. And none of them are Agency-approved hedge providers.

SMBC has internal approval to offer SOFR caps, but is still in the final stages of negotiating templates with the Agencies. US Bank has approval as well, but only on a negotiated basis. We’ll likely see the first SOFR caps on Freddie deals in the coming weeks.

Contact us directly for the most up to date status of each cap provider.

Flexible Average Inflation Target – FAIT

Powell unveiled the Fed’s new monetary policy, Flexible Average Inflation Targeting (FAIT). The Fed will now “seek to achieve inflation that averages 2.0% over time” and as a result, “judges that, following periods when inflation has been running persistently below 2.0%, appropriate monetary policy will likely aim to achieve inflation moderately above 2.0% for some time.” No admission of propping up the stock market, but a girl can dream…

Punchline first – rates will be lower for longer. Being Fed Chair is going to be like being a weather forecaster in SoCal – lots of tv time with not much to talk about.

Firstly, the Fed is abandoning the Phillips Curve. That’s one of those core Econ 101 concepts that says there’s an inverse, yet stable, relationship between inflation and unemployment. As unemployment falls, inflation climbs. That’s why the Fed started hiking in 2015. But inflation never took off, even as we set record low unemployment. The Phillips Curve is dead and the Fed is finally admitting it.

So now the Fed will allow inflation to run past 2.0% and forget about unemployment. What Powell has not addressed is how the Fed will calculate “average.” If inflation is 0% for a year, and 2.0% the next year, will the Fed allow inflation to run up to 4.0% in year 3? I doubt it.

I think this is just to reassure the market that if we see inflation move towards 2.0%, it doesn’t have to wonder if the Fed is about to start hiking. Inflation above 2.0% will be encouraged if it means the long term average is 2.0%.

How would this policy have changed the 2016-2018 tightening cycle?

Below is a 5 year forward inflation expectations graph from the St Louis Fed. Inflation expectations are likely to matter just as much, if not more, than current inflation levels when the Fed is making decisions going forward. Some quick thoughts.

- The Fed almost certainly would not have hiked in December 2015 (that was the oddball hike the market puked over. The Fed paused for a year and I suspect Yellen regrets it.)

- The 2nd hike (December 2016) probably wouldn’t have happened

- The Fed may have started hiking at some point in 2017 or 2018, but…

- Probably only a couple of hikes instead of 8 hikes

- The pace of hikes may have been more gradual

The Fed probably would have hiked at some point in 2017 or 2018, but only a few times. They would have gotten started later and stopped earlier. Those hikes would likely have been more gradual.

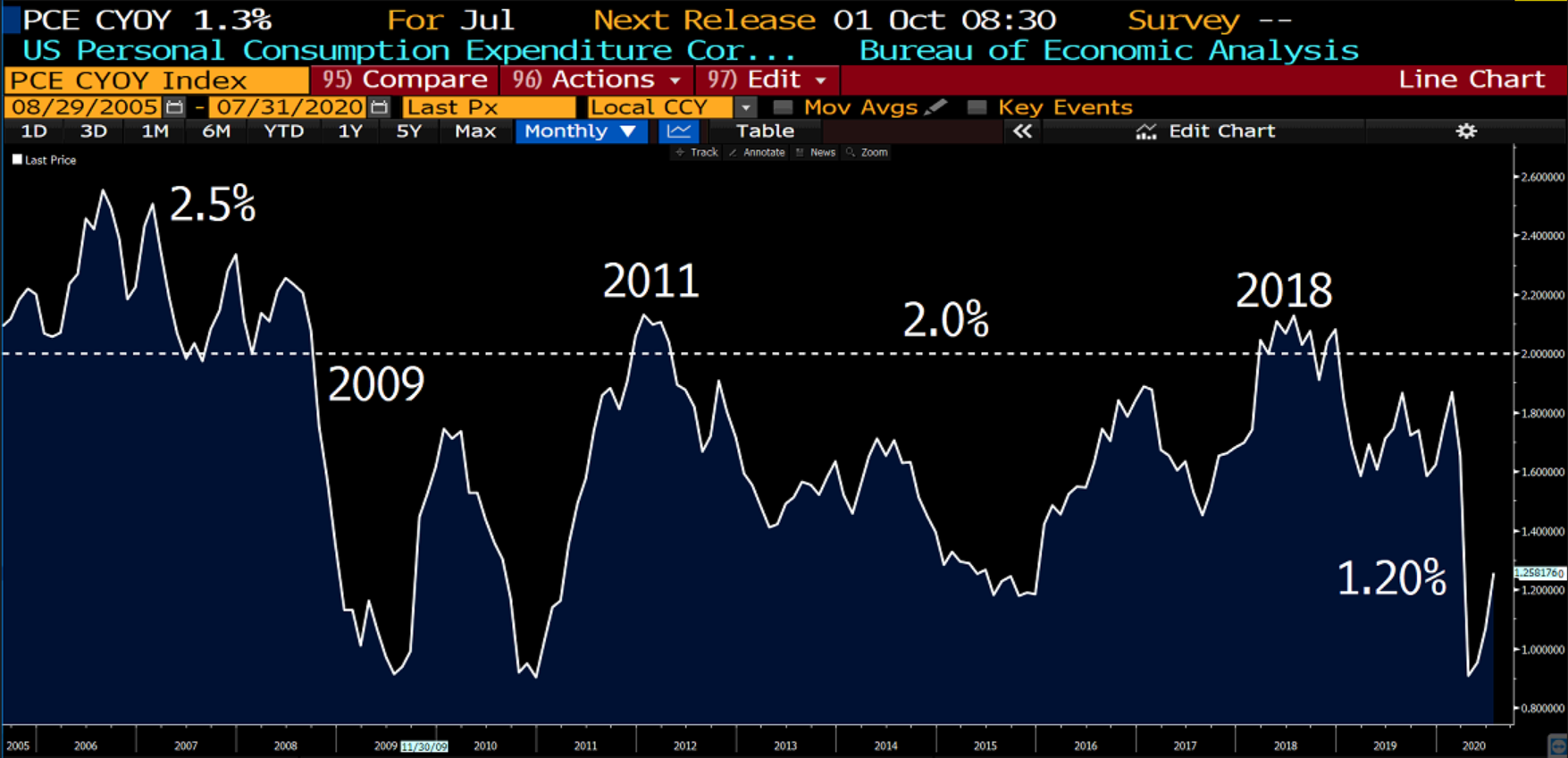

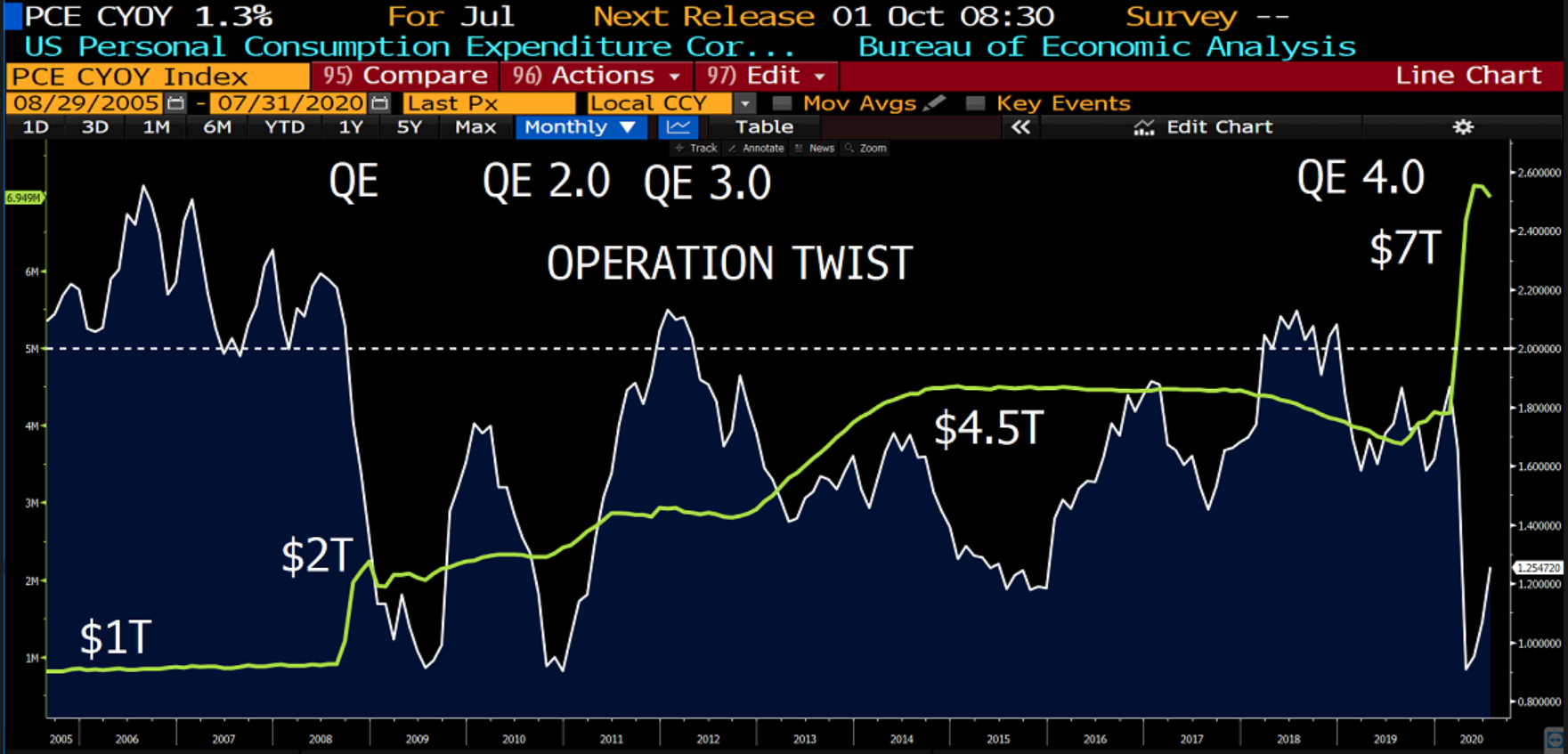

So when will inflation pose a threat to 0% interest rates? Not anytime soon. Following the financial crisis, inflation only briefly hit 2.0% twice in a decade – 2011 and 2018.

But the Fed is all types of accommodative and Congress is injecting stimulus, right? Oh, have we already forgotten about the four rounds of QE and multiple rounds of bailouts the last time around? With such a recent track record, why are we so worried about inflation this time around? What’s so different?

We need to retrain our brains that massive government spending, deficits, ZIRP, and quantitative easing all lead to rampant inflation (pipe down MMT’ers!).

Risks to this assessment

- Inflation could come back unexpectedly – past performance is no promise of future results

- Powell’s term expires February 2022, so this new policy may not be in effect forever.

Market Response

Floating Rate Borrowers

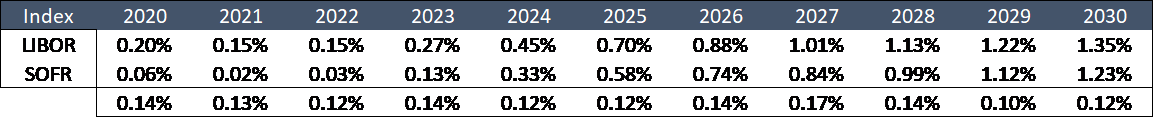

Forward curve flattened, with LIBOR futures not expected to hit 1.00% until 2027 and SOFR in 2029.

Takeaways

- floating rates are likely to be low for a very long time, probably 5+ years and maybe a decade

- the first hike will come later than it would have previously

- there won’t be as many hikes as there would have been previously

- rate hikes, once begun, will likely be more gradual

- unless the Fed suddenly decides transparency isn’t helpful, it will send signals to the market to avoid shocks

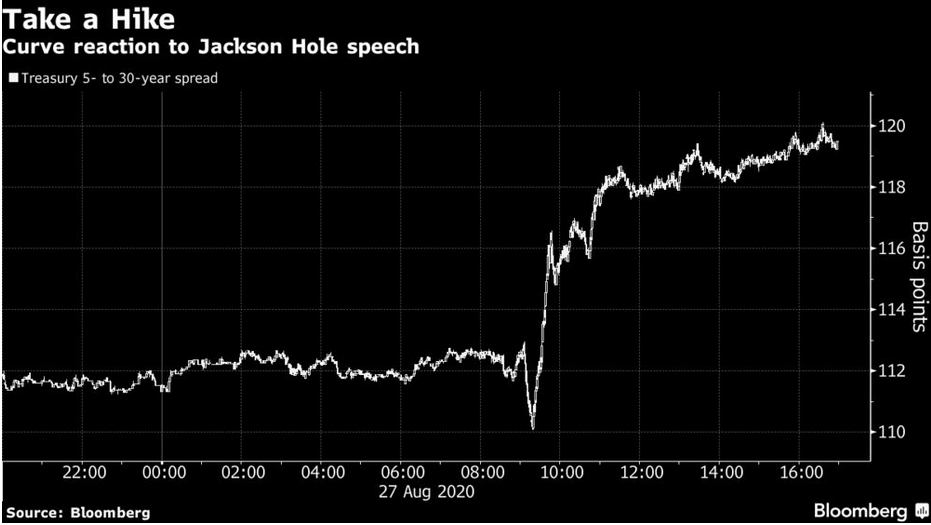

Fixed Rate Borrowers

The yield curve steepened. Fed Funds at 0% forever? Risk on!

Takeaways

- Trickier proposition, but all else being equal this likely means a steeper yield curve and a higher T10

- But not a lot higher. We’re probably dealing with a sub-1.0% 10 Year Treasury until there is a light at the end of the coronavirus tunnel

Stocks (and assets in general)

Duh.

Powell has done his part. The Fed has set the stage for a strong economic recovery. But have we learned our lessons from the financial crisis?

Monetary policy is really effective at encouraging borrowing, but not necessarily spending. Purchases affected by interest rates (real estate, cars, etc) will do better than other types of purchases (clothing, eating out, airfare, etc).

But monetary policy alone isn’t enough. Congress got awfully comfortable letting the Fed handle the last recession, but we need fiscal policy to truly encourage growth lest we lose another decade.

Week Ahead

Jobs report on Friday, with the typical headline risks around covid and China in between.