Fed Soft Landing + Trade War Resolution = Risk On

Markets are closed for Veterans Day.

Last Week This Morning

- 10 Year Treasury spiked to 1.94% on news of a trade war resolution

- German bund all the way up to -0.26%

- Japan 10yr approaching positive territory at -0.05%

- 2 Year Treasury jumped to 1.67%

- LIBOR at 1.76% and SOFR at 1.56%

- Moody’s downgraded the UK to “negative” on Brexit paralysis

- Michael Bloomberg is throwing his hat in the ring because what Democrats have been lacking are enough choices

Fed Soft Landing + Trade War Resolution = Risk On

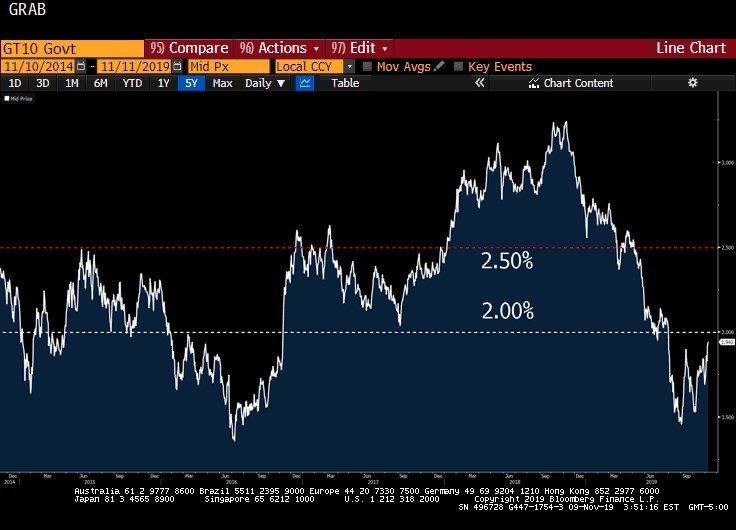

The 10T had its single biggest day jump since the day Donald J Trump was elected president. It topped out at 1.94%, with 2.0% clearly in view.

If the 10T breaches 2.00%, the next logical stopping point is 2.25%. But as you’ll see below, there’s really not a lot of precedent for the 10T stalling out at 2.25% – it tends to test 2.50% instead.

I don’t think we’ll break 2.0% until we have confirmation that there’s actually a deal with China, but with every positive headline the risk grows that the 10T will break out even higher.

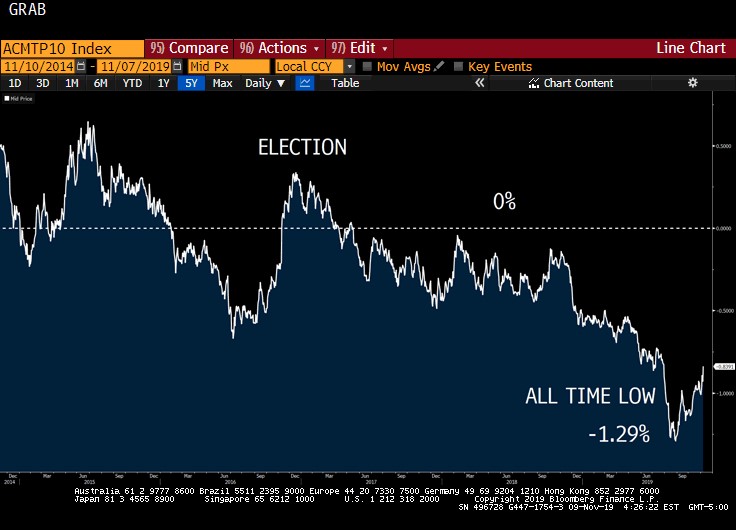

Compounding the move higher was the snap back in term premium. If you compare buying shorter term Treasurys and rolling them over at maturity vs buying longer term Treasurys, you should receive a premium for locking up your money for longer, but….

In a falling rate environment, you might be afraid that you’ll roll your short-term bonds when rates are much lower. So you buy long term bonds. In fact, you may accept less and less term premium the more you believe rates will fall.

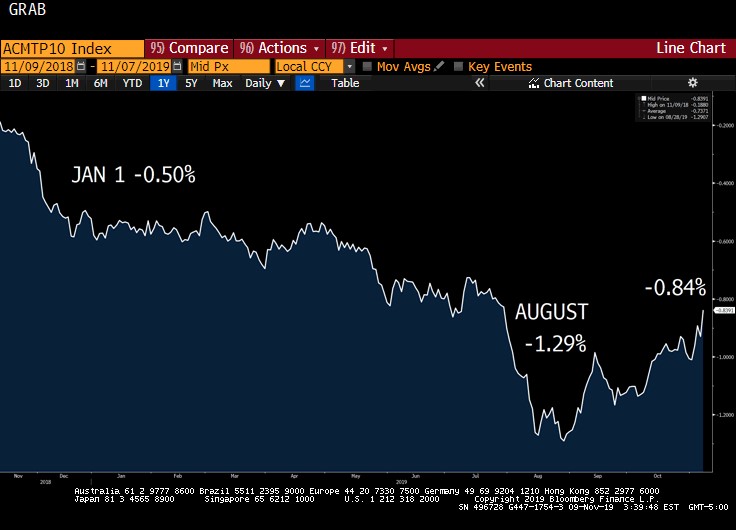

Look how term premium has fallen since the 2016 election. Bond buyers have grown accustomed to accepting negative term premium on expectations of falling rates. In fact, it hit an all-time low of -1.29% in August.

But with the Fed on hold and a resolution with China on the horizon, term premium has rebounded sharply. If we just return to the levels at the start of the year, the 10T could push higher towards 2.25%.

Where we go from here will be dictated by the pace of actual progress. There are very few real details about the deal with China, just a continued reference to some ambiguous Phase 1 and tariff rollbacks. No timelines, no signatures, and even Trump himself has been quiet on Twitter.

Last week’s move was largely psychological – animal spirits and such. That kind of rate spike doesn’t happen if the Fed hadn’t cut rates over the last three months. Those cuts gave the market enough cover fire to take a risk.

If actual progress is made and the rollbacks come relatively quickly, the risk on sentiment could push the 10T into the mid-2.00%’s. With impeachment increasingly likely and an election a year away, Trump may be unwilling to draw a line in the sand with China right now.

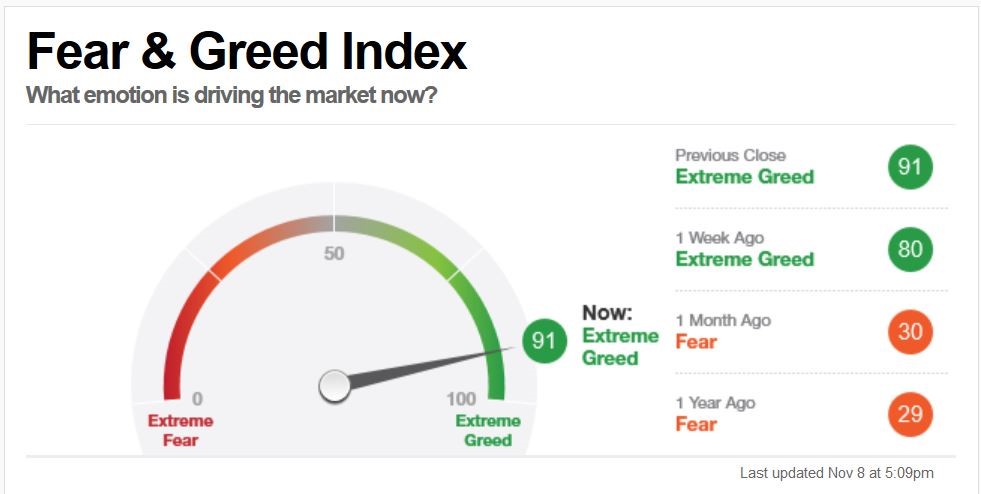

Fake News CNN’s Fear and Greed index is reading “extreme greed”, meaning tons of risk-taking and bullish positioning. Just one month ago, it was reading “fear”.

But if progress stalls out, rates could retrace. The market bought the rumor, but what if that’s all it is? And what if the Democratic Kentucky and VA election wins convince Xi that Trump’s position is weakened?

A movement lower is probably somewhat limited right now with the Fed’s soft landing, but the T10 falling back down below 1.80% is a possibility.

This Week

Tons of inflation data. Inflation will play a major role in rate movements. The economy is doing well, the Fed is on hold, and the trade war is winding down…inflation (and inflation expectations) have a direct impact on bond returns.

Inflation data is usually pretty slow to move one way or another, it tends to grind higher or lower over time. But if we get a surprise outlier, expect it to have an outsized effect on rates.

Obviously, any news on China will dominate for the foreseeable future.