How to Price a Floor

Last Week This Morning

- 10 Year Treasury jumped as much as 12bps, but the retraced some and closed at 1.82%

- German bund up 8bps to -0.20%

- Japan 10yr basically unch -0.01%

- 2 Year Treasury up 5bps to 1.57%

- LIBOR settling in around 1.68% and SOFR at 1.55%

- Iran feigned retaliation against a US airbase in Iraq, but then also shot down a Ukrainian passenger jet

- On Thursday, China publicly confirmed it planned on signing a Phase 1 trade deal this week

- The economy added 145k jobs last month, the least since May

- Unemployment rate held steady at 3.5%

- The U-6, or “real unemployment”, fell to a record low 6.7%

- Average hourly earnings, a leading inflation indicator, came in below expectations at 2.9%, the first sub-3.0% print since July 2018

- ISM Non-Manufacturing came in stronger than expected (manufacturing bad, service industry good)

- Bank of England policy makers are making public statements about possible rate cuts

- I knew Roy Williams was insincere about his post-game “fire me” comment when he turned the rest of the interview over to a life size cutout of Matt Doherty

- My son said about Derrick Henry, “he looks like a super hero”

Jobs

December’s job report was mildly disappointing, but not really a red flag. October and November were revised down by a combined 14k jobs. Some highlights:

- Manufacturing lost 12k, transportation 10k, and mining 8k

- Retail added 41k, hospitality 40k, and health care 28k

The six-month average stands at 188k, well above the Fed’s own estimate of breakeven (115k-145k).

For the year, hiring in 2019 was the slowest since 2011 with 2.1mm new jobs. That’s down from 2018’s total of 2.7mm new jobs. Manufacturing gained 46k jobs vs 264k in 2018. Thank goodness trade wars are easy to win…

This report has negligible impact on Fed policy one way or the other. The job market is still going strongly and one slight miss vs expectations a red flag does not make.

How to Price a Floor

I was a little surprised at how many responses we got last week after mentioning the importance of floors. Let’s take a very quick look at how these are priced. As a caveat, this isn’t meant to be a textbook edumacation, but more like a real world explanation.

Floors are just like caps, just going the other direction. Here are the two primary drivers of cost/value for options like these:

- Expected economic value

- Uncertainty

Let’s take a look at each. In this example, we assume:

Notional $25mm

Term 3 years

Floor 1.50%

Market Cost $230k

Expected Economic Value

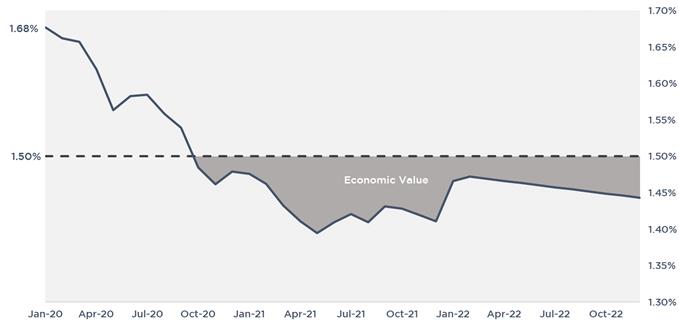

This is easy. Drop a forward curve into excel. Drop in a column of “1.50%” next to it. Add an “if then” statement for when LIBOR is below the floor strike of 1.50%, multiply by notional.

In layman’s terms – how often will LIBOR be below the strike? Here’s an illustration of the projected economic payout. In this example, it amounts to $30k.

Uncertainty

If the expected economic value is just $30k, why is the market charging $230k? Uncertainty.

We see this on caps all the time, right? The forward curve peaks at 1.96% over the next 10 years. If a cap only cost as much as the expected economic value, a 2.00% strike should be free. A 2.50% strike should be free, a 3.50% strike should be free, etc.

But they aren’t because of uncertainty. Put yourself in a trader’s shoes when you are buying a cap from them. They don’t think LIBOR is going above 2.50%, but they aren’t certain. So there is some value attributable to the various potential outcomes.

Same with floors. A trader may think this floor will cost them $30k, but what if LIBOR goes to 0% tonight and stays there? They have to pay out $1.125mm over the next three years.

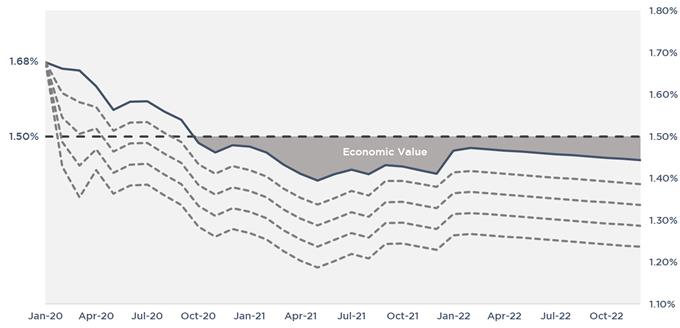

In our graph below, we include just four potential alternative paths of rates, but really it’s an infinite number of outcomes. So the trader charges $200k for this uncertainty, or about 0.27% per year.

Therefore, if LIBOR averages less than 1.23% for the next three years, the trader still loses money even though they charged $200k for uncertainty. Does a 1.23% LIBOR seem impossible? No. And the greater the potential for variance, the greater the cost to hedge against that.

10 Year Treasury

I was surprised that simply not going to war with Iran was enough to cause rates to jump 10bps above levels before the drone strike. What actually changed in that 48 hour period that would cause the market to say, “Hey, you know what, time to take some risk!”

But that really won’t matter because we have a huge week ahead. The Chinese delegation should be arriving by the time you read this with a public signing ceremony scheduled for Wednesday. There may be a minor pop in rates once the signatures are actually on the paper, but I wouldn’t expect anything major at this point as long as everything goes as planned.

Just as importantly, we are set to receive a ton of inflationary data.

While CPI isn’t the Fed’s preferred measure of inflation (Core PCE), it isn’t irrelevant, either. Core PCE may be a better indicator for Fed monetary policy, but inflation is inflation. If CPI moves up or down, the first place the market will respond is in longer term bond yields like the 10 Year Treasury.

Look how rarely over the last 20 years CPI has exceeded 2.3%. Since the financial crisis, CPI has tested this level at least four times before retreating. Will we see CPI fall from here or rebound and resume its climb higher?

While CPI really captures the consumer. Inflation for producers is reflected in PPI. It peaked in December 2018 at 2.9% and then spent all of 2019 falling.

Inflation tends to move relatively slowly month to month, but PPI dropped sharply in the second half of 2019, moving from 2.3% to 1.3% in just four months.

While unlikely, if CPI or PPI come in dramatically different than expectations, it could have an immediate impact on rates.

If you haven’t caught on by now, inflation is going to be a key driver of the 10 Year Treasury this year.

This Week

In addition to the inflation data, we also get retail sales and consumer sentiment data. Obviously, news on Iran and China will dominate headlines while Clap Back Nancy will likely send articles of impeachment to the Senate in what will undoubtedly be an open-minded trial.

Most importantly, Clemson and LSU square off. Maybe it’s just because Bama isn’t in it this year, but I haven’t been this excited for the title game in a long time. This feels like it has the potential to be a USC vs Texas Rose Bowl type of game. It takes a lot to get me to stay up past 9pm, but I will do it for this game. I wouldn’t be shocked if Clemson wins, but this feels like LSU’s year.

LSU 44

Clemson 41