2015 – Déjà vu All Over Again

Apparently tryptophan makes me more pessimistic than usual because this newsletter is a warning shot across the Fed’s bow regarding rate hikes in 2019. Also, tryptophan apparently makes me lazy because I used a lot of graphs as a sort of paint by numbers newsletter instead of bothering to write too much.

Last Week This Morning

- 10 Year Treasury drifted lower to 3.04%

- German bund drifted lower to 0.34%

- 2 Year Treasury unchanged at 2.808%

- LIBOR up to 2.32%, resuming its climb now that we are within 30 days of the next meeting with a hike priced in

- Odds of a December hike 72%, but market down to just one more hike in 2019

- Oil fell for the seventh straight week, with WTI closing just above $50/barrel (it was $75/barrel on October 3rd)

- Michigan gave the Ohio State Fanboy Club (more formally known as the BCS Committee) all the ammo it needed to put another underwhelming Buckeye team into the playoffs

2015 – Déjà vu All Over Again

I remember the second half of 2015 for being particularly slow on securitized loans that required caps. Oil crashed. GDP dropped to almost zero. Loan volume dried up. CMBS froze.

The slowdown extended through mid-2016, at which point the line got blurry between slowing economic data and hesitation around elections. Then Trump got elected and we were all saved.

One of the other takeaways from 2015 was that plummeting oil contributed to tightening financial conditions. That was what made Yellen’s December 2015 hike so bizarre. The Fed hikes to tighten financial conditions, but the drop in oil had already done the dirty work for the Fed. Yellen’s hike piled on at exactly the wrong time, exacerbating the problem.

The Fed didn’t hike for another year.

We’ve spent a lot of time recently discussing how most of the Fed hikes in 2017 and early 2018 came even as financial conditions were loosening. It has been one of the biggest reasons we believed Powell would keep hiking – despite the hikes, conditions were loosening. So keep hiking until conditions actually respond the way you want them to respond.

But that has changed. In recent months, financial conditions have tightened considerably. The Fed levers are working. Finally. The collapse in oil is piling on.

Let’s get graph happy. I want you to not only pay attention to the spikes in the middle of all the graphs, but also how the lines to the far right of each graph are starting to look a lot like 2015 all over again.

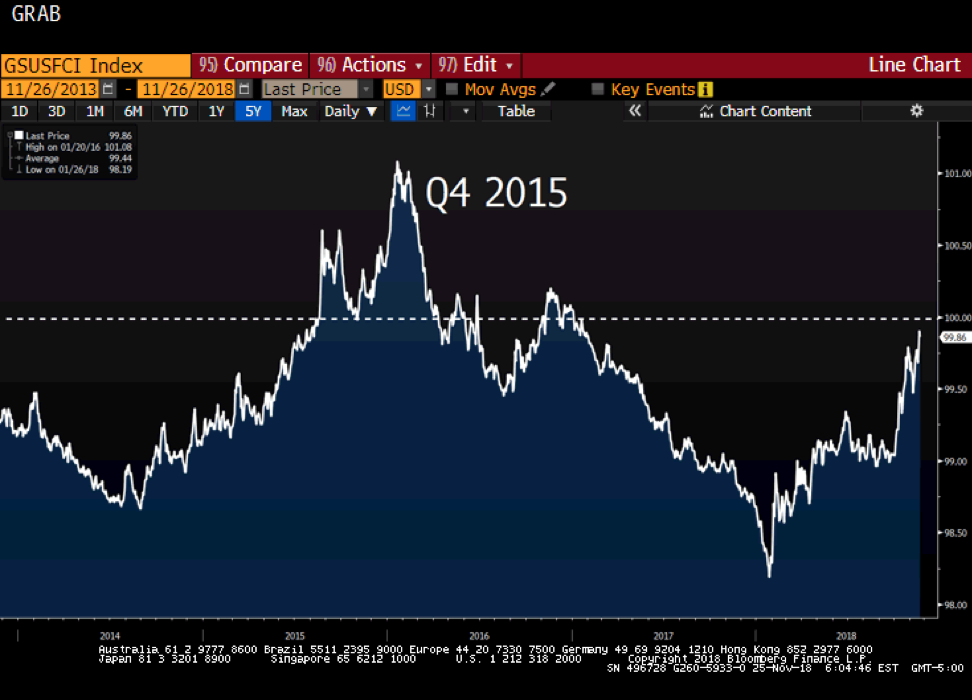

Financial Conditions

Notice how tight financial conditions were late 2015. The dashed horizontal line is the crossover between accommodative and tightening. Conditions got extremely tight and we noticed a considerable slowdown in our own business.

Bloomberg hasn’t asked us to create a Pensford Activity Index, but because we have diversity of exposure to asset/borrower types, geography, etc we may anecdotally serve as a good barometer for the industry as a whole. 2016 was a much slower year for us than 2015. I wonder if 2019 will be much slower than 2018?

Also pay attention to the far right side of the graph – conditions are on the verge of crossing over to tightening.

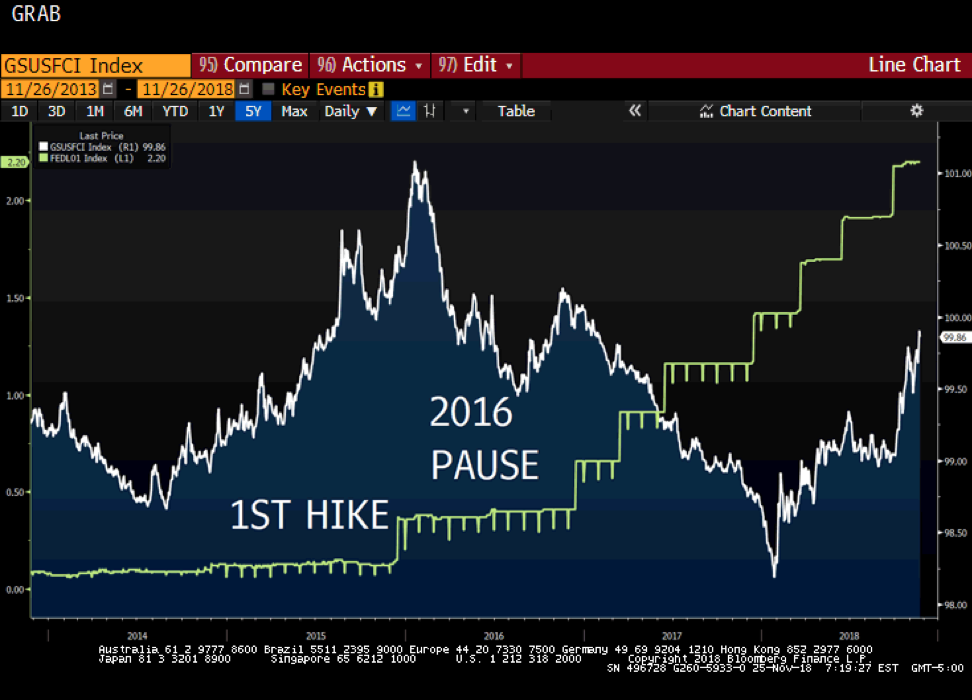

Financial Conditions vs Fed Rate Hikes

As noted above, Yellen hiked in December 2015 despite financial conditions having already tightened so much as to beg the question whether she should have been cutting instead.

The Fed ended up being on hold all of 2016 in order to let markets calm.

Throughout 2017 and early 2018, notice how financial conditions eased despite rising Fed Funds. That trend finally reversed itself abruptly a few months ago.

I hope Powell is paying attention.

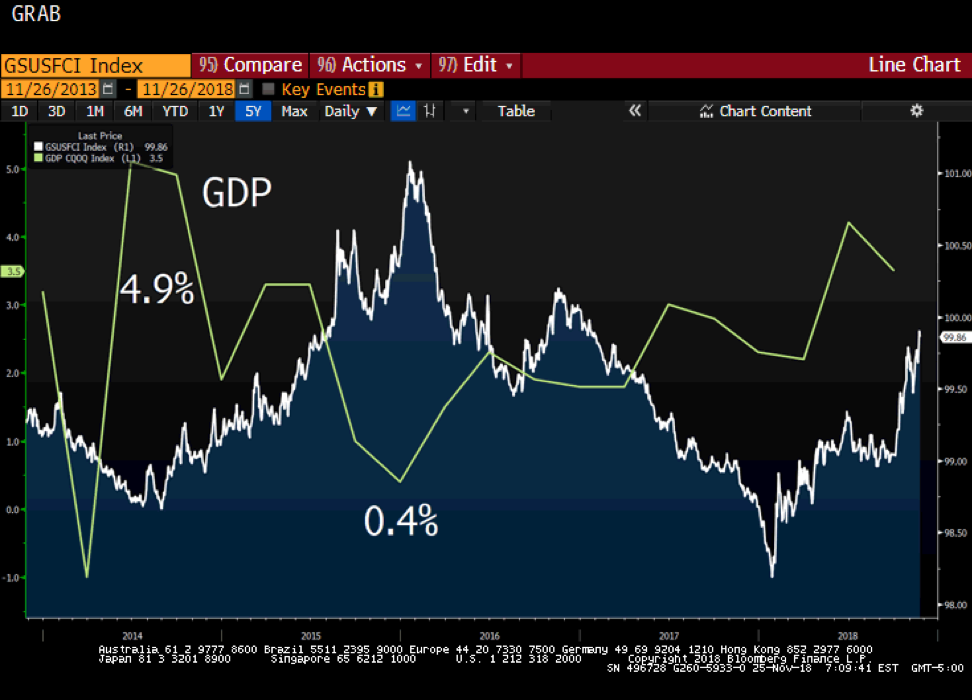

Financial Conditions vs GDP

Turns out GDP is pretty highly correlated with financial conditions.

GDP fell from 4.9% to 0.4% as financial conditions tightened. With most economists calling for declining GDP, it’s not hard to imagine the two lines in the graph below crossing in 2019.

Financial Conditions vs Oil

Oil plummeted from $106/barrel to $46/barrel over the second half of 2014. It then moderated for most of 2015 before falling again to below $30/barrel.

The Fed hiked in December 2015 even though financial conditions had already tightened substantially. Yellen admitted her mistake and spent all of 2016 holding off on hikes, allowing financial conditions to ease as oil stabilized.

Will the recent collapse in oil cause a Powell-led Fed to hold off on hikes in 2019?

Financial Conditions vs High Yield Bonds

Riskier credit tends to send the first distress signals in a slowdown, so let’s take a look at a high yield bond index.

Obviously, the correlation with tightening financial conditions is high and notice how on the far right the two share striking similarities with the late 2014 time period.

Financial Conditions vs Manufacturing

Manufacturing also slows as financial conditions tighten. Any ISM report below 50 is considered contractionary, so the most recent print of 57 still has some cushion but there’s no doubt the trend is negative.

Financial Conditions vs Dollar

A strengthening dollar also tightens financial conditions, so a rate hiking cycle unsurprisingly results in a stronger dollar and tighter conditions.

The Fed doesn’t have to cut in order to stem the rising tide on the dollar. It could simply lower the trajectory or send dovish signals.

Financial Conditions vs Delinquencies

The Fed tracks delinquencies on loan payments. While there is a high correlation between tightening conditions and delinquencies, there appears to be a lag.

Will delinquencies increase in 2019 as conditions catch up to borrowers?

Seriously Powell

Yellen learned her lesson quickly and held off on further rate hikes, but will Powell follow the same path? This is Powell’s first serious challenge as FOMC chair and he has been consistently more hawkish than his predecessor.

Less than two months ago, Powell said we are a “long way” from neutral, so there appears to be a real risk he doesn’t respond the way Yellen did.

This Week

Powell speaks on Wednesday, which given market conditions takes on more significance than usual.

Multiple other Fed speeches, including dovish Clarida on Tuesday.

FOMC Minutes on Thursday.

But most importantly, Trump and Xi are set to meet behind the scenes (probably Friday). Recent rhetoric has been pretty hardline, so markets are on edge.