2023 – Year of the Stag

Last Week This Morning

- 10 Year Treasury at 3.83%

- German bund up to 2.02%

- 2 Year Treasury up to 4.54%

- LIBOR at 3.96%

- SOFR at 3.80%

- Term SOFR at 3.93%

- PPI came in 0.2% vs expected 0.4%

- Retail sales came in at 1.3% vs expected 1.2%

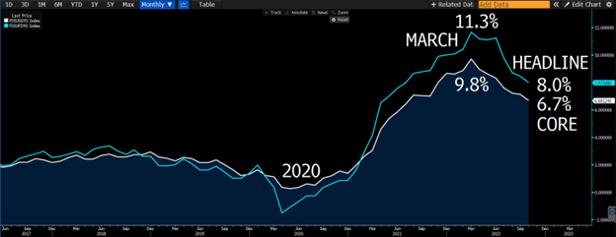

Producer Price Index

By all measures, PPI came in lower than expected and continued the trend lower overall. It was exactly the sort of print the market needed to reinforce last week’s softer than expected CPI. PPI is generally considered a leading indicator of CPI by about 2 months, so the continued trend lower offers hope that CPI will continue to trend lower as well.

PPI (annual) has improved considerably since the first hike in March. If this pace continues, Core PPI would hit 2% in August 2023.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

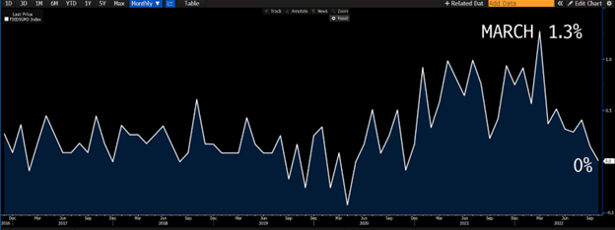

PPI (monthly) showed prices were actually flat month to month, which we hadn’t seen since 2020.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

The market started thinking about a Fed pivot, which was so premature that numerous Fed officials trotted out to disabuse the market of this notion.

- San Francisco Fed President said a pause is “off the table”

- St Louis Fed President James Bullard said the Fed should hike to at least 5%-5.25%

- Atlanta Fed President Bostic said he expects another 1.00% of tightening (5%) and then pause

Market is hopeful for a pivot and the Fed is pounding the table about continued hikes. Here’s the thing – I think they’re both justified in their views.

Market’s Perspective

The market just needs a light at the end of the tunnel. It already has a 5% Fed Funds baked in and just wants to take 6%+ off the table. A pivot doesn’t have to happen this this second, just some point in the next 3 months.

“Give me literally anything to be hopeful about. Please.” – Market.

Fed’s Perspective

Better to let off the brakes too late than too soon. If they start signaling a pivot, they risk allowing inflationary fears to creep back into our collective psychology. We’ve had two other similarly positive inflation reports this year that quickly turned out to be pump fakes in subsequent months. Whenever they pause, the market is going to react, so they want to make sure it isn’t premature.

“We need to keep sending signals about tightening until we have a very clear trend lower on inflation.” – what Powell would say if he would respond to my requests to be on our podcast.

Stagflation

Bank of America’s investment manager survey shows a whopping 92% expect a stagflationary environment in 2023. The other three potential scenarios combine for the remaining 8%.

Remember those graphs at the beginning that suggested we could get inflation back to 2% by year end 2023? Given those signs of progress, why are these investment managers so pessimistic?

- A drop in inflation of 0.5% per month is borderline unprecedented. The Volcker era saw a similar pace, so it is doable, but don’t just assume this pace can continue.

- Even if that happens, it means inflation probably averages about 4% in 2023. Slowing growth + above target inflation = stagflation.

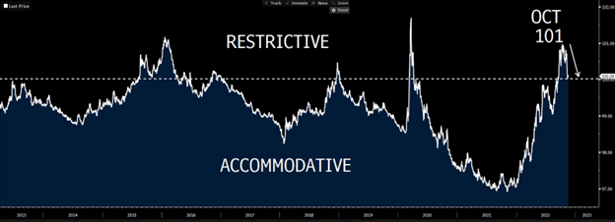

Financial Conditions

Things looked pretty bleak in October, with conditions tightening to 101 (where 101.5 is the general recession threshold). But signs of cooling inflation over the last few weeks helped drive conditions easier.

This tells me the Fed will keep talking up hikes, knowing they have some rope to play with now.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

In fact, most the inflationary pressures can be found in two places – Services and Shelter.

While CPI Goods have plunged, CPI Services is up 6.7% and still climbing.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Week Ahead

A slower week ahead with Thanksgiving on Thursday giving the markets a much-needed breather. But worry not! There’s still something to look forward to - ahead of digging into that perfectly fried (burnt) turkey, you get to dig into the FOMC Minutes on Wednesday. Aside from that, just some Fed speak, housing and PMI data.