A Historical Credit Crunch

Random thought to start the week - there’s a chance the yield curve un-inverts by year end. The 2 Year Treasury fell 100bps over the last month to 4%. Once the Fed pauses and the market believes cuts are on the table, the 2T could drop another 100bps+ below 3%.

There is a growing sense that the Fed will hike on May 3rd to 5.25% and then pause. As you know by now, once they pause, the next move is always a cut.

Last Week This Morning

- 10 Year Treasury at 3.391%

- German bund at 2.181%

- 2 Year Treasury at 3.981%

- LIBOR at 4.90%

- SOFR at 4.81%

- Term SOFR at 4.83%

- Factory orders came in at -0.7% vs. -0.6% expected

- JOLTS job opening survey dropped below 10mm

- ADP employment came in at 145K vs. 261K expected

- Nonfarm payrolls came in at 236K

- Average hourly wages

- m/m came in at 0.3% as expected

- y/y came in a little lower than expected

- Will a 2024 cutting cycle be the only thing that bails out strained real estate deals?

Money Supply

Money supply y/y % change is negative for the first time in history, including the early 1980’s when Volcker finally crushed inflation. This is the sort of thing that could lead to inflation rolling over.

.png?width=473&height=183&name=image4.10%20(1).png)

Jobs Report

The economy added 236k jobs last month. Although this was right on top of forecast, the market reacted as if it was a beat. All other job data last week was much weaker than expected, so the market had already priced in a miss on NFP.

Although it’s a reasonably strong number, keep in mind that it’s down from 311k last month and the slowest job growth since Dec 2020.

Other not so great news:

- JOLTS (job openings) dropped to its lowest level in two years

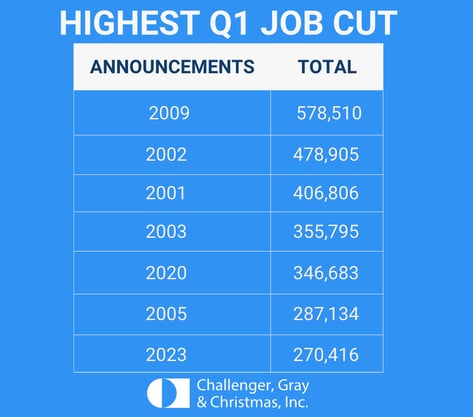

- Challenger Job Report: “Employers announced 270,416 cuts in the first quarter, a 396% increase from the 55,696 cuts announced in the same period one year prior.”

- This is one of the worst Q1s on record for layoff announcements

Despite my negative sentiment on this labor report, it probably increases the odds of a 25bps hike on May 3rd. Markets are currently pricing in a 71% probability of a hike, but we get CPI this week and one more Core PCE print before then so I wouldn’t put too much stock in that.

I believe the more important aspect of the job report was the average hourly earnings (considered a leading indicator for inflation), came in at its coolest since June 2021.

The monthly AHE came in at 0.3%, which is up a tick from last month’s 0.2%. But keep in mind one year ago today that number was 0.6%.

A Record Credit Crunch

The biggest surprise to me at the last FOMC meeting was the amount of energy Powell dedicated to discussing the upcoming credit crunch. Considering the Fed’s obsession with backward looking data, this was a refreshing change.

Without providing specifics, Powell very clearly stated that tighter credit would substitute for rate hikes. Very simplistically, if the Fed had been expecting to take Fed Funds to 5.75%, maybe they stop at 5.25%.

Welp, Bloomberg reported that “US bank lending contracted by the most on record in the last two weeks of March.” For those of us that worked through the financial crisis, this feels impossible.

“Commercial bank lending dropped nearly $105 billion in the two weeks ended March 29, the most in Federal Reserve data back to 1973.” We get the next senior loan officer survey on May 8th and this sort of data suggests it could be even worse than expected. This would tie out with what I heard at a recent ULI Capital Markets event where one firm described the last month as the worst lending market he has ever seen, including post-financial crisis. Another participant said it feels like the brakes have been slammed.

If this week’s CPI and month end Core PCE don’t show a sudden reversal of declining inflation, that senior loan officer survey could be the final nail in the tightening cycle.

Rates/Caps/Volatility

Following Friday’s job report, the front end popped up 15bps. This move was simply backing out the expectation for a weak report. I still think it was overdone when you consider how much the labor market seems to be slowing.

This pushed cap prices back up, but still nowhere near the peak from a month ago. If the Fed hikes on May 3rd and signals a pause, cap prices should be coming down in the summer. If the market starts pricing in aggressive cuts and the yield curve un-inverts by year end, it should be more positive news for caps.

The 10T has twice tested 3.32%, the bottom end of the current range. In the near term, I think it takes something significant to break through that level. The high end of the range is 3.90%, so there is an asymmetric risk/reward at these levels.

Volatility is off the peak, but still extremely elevated. Even after the recent plunge, we are still at the peak levels experienced during the early weeks of covid.

.png?width=473&height=187&name=image4.10%20(2).png)

Week Ahead

Huge week ahead. CPI on Wednesday is the main event, but we also get the FOMC minutes and a ton of Fed speeches.