A Steep Yield Curve is a Good Sign

I can’t believe I’m saying this, but I might be rooting for Tom Brady. I have a soft spot for Andy Reid, but the idea that a Brady win might further disrupt Foxborough is very appealing. Plus, we all need a feel-good story and Tampa winning in Tampa fits the bill. I’m still undecided about who I will end up rooting for – it might be a game time decision.

I love that vaccinated health care workers will be among those in attendance. I will set aside my cynicism about the NFL marketing (cough cough breast cancer awareness in October) and instead focus on the upside. Watching the vaccination sites on TV has served as a good reminder of how hard health care workers have worked this year. Work all week, exposing yourself to COVID, and then spend your weekend vaccinating people? Thank you.

Last Week This Morning

- 10 Year Treasury hit its highest level in 11 months and closed out at 1.16%

- German bund at -0.45%

- 2 Year Treasury down slightly to 0.10%

- LIBOR at 0.12%

- SOFR is 0.05%

- Rates jumped on signs that the Dems will press forward with a $1.9T stimulus bill with or without bipartisan support

- The economy added 49k jobs last month vs expectations for 105k.

- 90k gains were temporary jobs, so absent that we would have experienced another net loss

- Last month’s loss of 140k was revised down to a loss of 227k

- The unemployment rate fell from 6.8% to 6.3%

- Average hourly earnings (considered a leading indicator of inflation) came in at 5.4% vs expected 5.0%

- I literally forgot there was an impeachment trial coming up…

Steepness

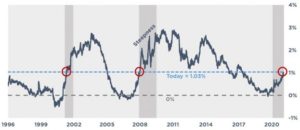

The traditional measure of yield curve steepness is the delta between the 10T and the 2T. If a flattening/inverting yield curve is a warning sign of an economic slowdown, a steepening curve suggests expectations for economic expansion. I think it also suggests the market is taking some of the most severe downside scenarios off the table. For example, the market has been pricing in some possibility for a vaccine snafu, but as that process continues to gain momentum the market will back those odds out.

Today’s steepness of 1.06% is at the highest levels since Trump won in 2016.

The median GDP forecast for 2021 is about 5.0%, and we may start seeing those revised higher (with an upside likely around 8%). That could cause a steeper yield curve.

In a more normal environment, that delta is coupled with an absolute movement up and down. The curve can steepen while rates rise or fall.

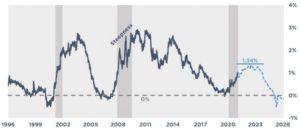

But with the 2T firmly anchored around 0.10%-0.15% because of Fed monetary policy, almost all of the steepness changes this year will come from swings in the 10T. Bank of America raised its year end forecast of the 10T to 1.75%, while the market still puts it around 1.35%.

If we take the same proportionate steepness moves from previous cycles and apply it to the current cycle, the 10 Year Treasury would top out around 1.34% (which ties in nicely with the market expectations for year end).

The curve would steepen over the next two years while it waits for the Fed to start hiking, and then gradually start flattening again in years 4 and 5 while LIBOR/SOFR start climbing.

The Fed wants a steeper yield curve (and not just because it helps banks). A steeper yield curve or higher inflation expectations does not suggest the Fed will suddenly jump in and start hiking Fed Funds. The front end of the curve is anchored for years. This is all part of Powell’s plan.

There is, however, some scenario where the 10 Year Treasury gets high enough (2.00%?) where it impacts the housing market or other long-term borrowing costs and the Fed reminds everyone it could put a cap on rates through Yield Curve Control measures.

Bottom line – a steep yield curve is a positive sign for the economy and makes life a little easier for the banks (which, in turn, helps lending). It also tends to push borrowers towards floating rates to pick up the 1.00% + savings.

Jobs

Another disappointing jobs report, with the economy adding just 49k jobs last month. With 90k gains in temporary jobs, we would have actually lost jobs again without those. We still have about 10mm fewer jobs than this time last year.

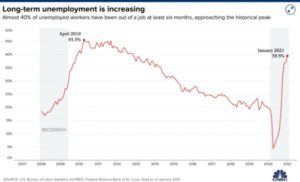

Almost 40% of the unemployed last month were “long term” unemployed, meaning they had been out of a job for at least six months.

The job recovery is going to be a very long story. Years.

It took 10 years for the unemployment rate to drop back to pre-financial crisis levels. I suspect this time around will be quicker, perhaps much quicker, but it’s not going to happen in the next few years.

Leisure and hospitality lost 61k jobs on top of the staggering 563k jobs that industry lost last month. I really hope additional stimulus can more precisely help the industries that have been the most impacted.

Week Ahead

Obviously, stimulus package news will be the big economic driver this week. Impeachment shouldn’t have any impact (in more ways than one).

We do get some inflationary data as well as consumer sentiment data.