About that Enhanced Unemployment Ending…

Last Week This Morning

- 10 Year Treasury fell another 10bps to 1.45%

- German bund fell 20bps -0.28%

- 2 Year Treasury down 10bps to 0.50% (that’s a 20% decline in one week)

- LIBOR at 0.09%

- SOFR at 0.05%

- The economy added 531k jobs vs an expected 450k

- The unemployment rate dropped to 4.6%

- The BofE shocked markets by not hiking rates

- The infrastructure bill was finally passed, at a much smaller price tag than originally envisioned

- The Dems got whacked on Tuesday. I thought VA Rep Abigail Spanberger summed it best referencing Biden, “Nobody elected him to be FDR, they elected him to be normal and stop the chaos.” If my daughters are any indication, there’s a group of progressives that simply can’t come to grips with the fact most of the country doesn’t want to move that far left…or spend that much.

FOMC Recap – 3 Main Takeaways

#1 – Powell thinks markets are wrong

Q: “Markets are pricing in two hikes next year. Are they wrong?” – first question asked at press conference.

A: (snort)

Powell went on to give a classic Fed-speak response, but his body language said, “Yes, markets are wrong.”

#2 – Higher threshold

The threshold for rate hikes is much higher than the threshold for tapering.

#3 – Labor market

Rate hikes will be tied to the labor market. But don’t just cite a sub-4.0% unemployment rate – we need to see a broad-based recovery across all groups.

You can find our full post-meeting analysis here.

Jobs Report

The economy bounced back nicely from last month’s disappointing gain of “just” 194k, posting a gain of 531k. Just as importantly, the previous two months were revised higher by a combined 235k.

Remember all those articles last month that suggested the disappointing print was evidence that enhanced unemployment wasn’t to blame? Do they change their tune now? Print a retraction?

A report by BNP Paribas concluded that the those in the bottom 50th percentile of income had accumulated 4 months of excess cash, while those in the middle percentiles had accumulated 7 months of excess cash.

I think those savings have temporarily dampened the sense of urgency to find work, especially with so many openings. I have a sneaky feeling all the talk of the Great Resignation is overdone. Sure, everyone wants better working conditions. But they are only going to hold out as long as their excess savings and the government safety net allows them to. Reality will settle in.

There are six million Americans that claim they want to work but are not counted in the unemployment rate because they gave up searching for work. As their safety net reduces, I suspect they will courageously find their way to Indeed.com and start applying for jobs.

Fewer Americans employed since covid 4mm

Americans not looking for work 6mm

Total 10mm

Guess how many job openings there are? 10.4mm.

Like my mom, a retired math teacher, used to tell us, “It’s not magic, it’s math.”

Bottom line – I think the coming months are going to be very strong for jobs reports.

Some other interesting highlights from the report.

- Those unemployed for 6 months or longer fell by 357k (but still make up 32% of all unemployed)

- Hospitality and leisure spiked by 164k, twice as much as last month (delta fading?)

- Although headline participation rate dropped, the prime age participation rate improved (Child care issues easing? Enhanced unemployment ending?)

- 5mm women are still without jobs

- Black unemployment is 7.9%

Just remember the phrase, “broad based and inclusive.” It won’t just be about the headline number.

Tapering

I’m not sure the 2014 tapering will tell us much about the upcoming tapering. We’ve clearly rebounded much faster than post-financial crisis.

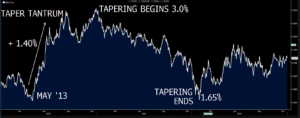

The Fed spent all of 2014 tapering and the 10T fell from 3.00% to 1.65%. I don’t think the conclusion should be, “rates drop during tapering,” because much of that is attributable to the initial overreaction. But I do find it interesting that during 2014 the 10T fell all the way back down to 1.65%, matching the pre-Taper Tantrum level.

Source: Bloomberg Finance, LP

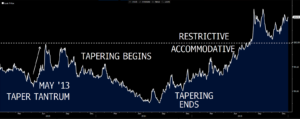

Same time frame as above, but for financial conditions. I was surprised that financial conditions eased during tapering. Once tapering concluded, financial conditions began tightening. There are a million other factors that influence this measure, but I do wonder if Powell is hoping that taking his foot off the gas will tighten conditions.

Source: Bloomberg Finance, LP

This could be an issue for Powell. If the hope is tapering will help gently cool things off, it may not. As the Fed has made clear, they are just easing off the gas.

Don’t be surprised to see the Fed increase the pace of tapering if they conclude things aren’t cooling off.

10 Year Treasury

Remember a month ago when I said we were sitting on the fence at 1.62% and we would either see a short squeeze or a further piling on and rates would move one way or another? The short squeeze won.

But now that the reset button has been pressed, I think 1.45% is too low. If we keep getting 500k per month job gains, how can the 10T stay at current levels?

One answer is supply. With the Treasury planning on much less issuance next year than this year, demand should be robust. I still think there’s a bias towards rising yields, but it’s not a runaway freight train.

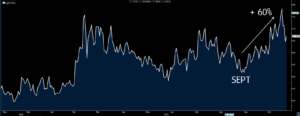

It also appears volatility could be settling down following a wild ride over the last six weeks. The BofA MOVE Index tracks Treasury implied vol and it had spiked dramatically since September. Last week’s FOMC meeting may temporarily calm markets following Powell’s reassurance that the Fed isn’t close to hiking.

Source: Bloomberg Finance, LP

Week Ahead

Lots of inflation data, plus Fed speakers will look to clarify/massage/tweak last week’s messaging.