Agency Cap Escrow Requirements For Commercial Real Estate

If you’ve had to buy an interest rate cap at any point in the past few months, then you’re probably painfully aware that the times of relatively cheap hedges are far behind us. However, even that cap you bought back in 2020 or last year for near minimum trading costs might wind up costing you more than you thought.

Freddie Mac and Fannie Mae require that borrowers escrow monthly for the cost of a replacement cap. To keep up with shifting markets, the replacement cap cost is recalculated every six months. Then, that cost less the amount already held in escrow is divided by the number of periods remaining on the existing hedge to arrive at the new monthly escrow amount.

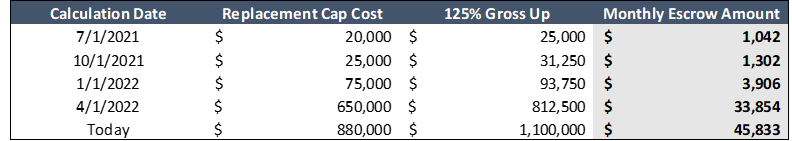

Let’s use Freddie’s escrow requirement as an example: 125% of the cost of a 2 year replacement cap. The table below illustrates how that escrow calculation has changed over just the past year.

If it’s been six months since your last Freddie cap escrow requirement was recalculated, you could be facing more than a tenfold increase in the near future. Even if your deal isn’t cashflow constrained, that increase could have a real impact.

And that’s just for Freddie’s requirement. If you’ve got a Fannie cap in place where the replacement cap requirement is a 3 year term or more, that cost increase could be even higher in magnitude.

Need a quick estimate of what your next replacement cap cost calculation could be? Check out our cap pricer. If you need help verifying an amount from a recent calculation from your servicer, don’t hesitate to reach out to the experts at pensfordteam@pensford.com or (704) 887-9880.