Are Rates Falling Because of Recession Fears or Excess Liquidity?

Last Week This Morning

- 10 Year Treasury got as low as 2.368%, but finished at 2.41%

- German bund fell another 0.04%, closing at -0.07%

- Japan 10yr down to -0.09%

- 2 Year Treasury down another 0.06% to 2.26%

- LIBOR at 2.49% and SOFR at 2.43%

- GDP missed forecasts, coming in at 2.2% vs 2.3% expected

- Core PCE (inflation) also missed, coming in at 1.8% vs 1.9% expected

- Trump was fully exonerated in Mueller investigation, prompting the immediate reversal of all 199 criminal charges that previously arose from the investigation, a full apology to Paul Manafort and General Flynn for besmirching their good names, and the promise to never ever ever look into financial ties between the Trump organization and Russia

- Democrats now forced to rely on the pesky election process to remove Trump from office

- Larry Kudlow is calling for an immediate 50bps rate cut by the Fed

Convexity Buying

When I worked on the trading floor and we couldn’t explain rate movements (a common occurrence), we would jokingly blame it on one of two things. If you’ve ever been told rates were swinging because of “buying out of Asia” or “convexity buying”, it was because no one had a clue why rates were moving.

Convexity buying is a real thing, though, and it’s contributed to the recent plunge in rates.

Mortgage traders are generally considered to have one of the tougher jobs in trading. I worked with a particularly feisty Irishman, who fit every stereotype possible, who was notorious for smashing the phones against his desk until the would break. His personal best was 17 phones in one year. We made wagers on how long a new phone would last. Sometimes he’d have a new one installed just so he could smash it again. If you ever wondered why banks need to make revenue on swaps, don’t forget to account for repairs to damaged phones.

Why was he constantly smashing phones? Because trading mortgages is a brutally volatile business.

Pretend you’re our plucky Irishman. You don’t really have a view on rates right now, so your portfolio is in a neutral position. As rates start to fall, homeowners start refinancing their homes. For you, that means some of your mortgages are sold. Without you doing a single thing, you are shorter mortgages.

If you want your portfolio to remain in a neutral position, you need to get longer. Maybe you buy more mortgages, but probably not at the top of your wish list with owners refinancing en masse. Instead, you might buy Treasurys to hedge the rate risk impact on your portfolio.

What happens as you buy Treasurys? Rates go down further, causing more homeowners to prepay. This, in turn, makes you shorter mortgages. So you buy more Treasurys to hedge yourself, shoot yourself in the foot by pushing rates down further, and smash a phone.

Generally speaking, there are levels at which trigger massive, simultaneous hedging by mortgage traders which causes rates to move very quickly…convexity buying.

Couple this with quarter-end buying of Treasurys as well as algo trading, and you have a rapid plunge in rates.

But maybe the stage is set for a possible rebound in rates in the coming weeks. I’m not talking anything crazy, but north of 2.50% doesn’t feel ridiculous.

Unless of course there’s buying out of Asia.

Why Are Rates Falling?

Are rates falling because the market is adapting to the new Fed position? Or out of recession fears?

As I’ve said repeatedly, it seems highly unlikely we have a recession in the next 12 months. It just seems challenging to be in a recession with unemployment below 4%.

And since Powell backpedaled on January 4th, it seems unlikely that Fed policy will be the immediate cause for the economy tipping over. If he had stuck to the same script as last year, I would be far more worried. I won’t bother you with another financial conditions graph here, but his change in rhetoric should help extend the expansion.

If the Fed is notoriously bad at forecasting, its suddenly dovish tone shouldn’t have really changed too many minds. Was the market really asleep at the wheel until the last FOMC meeting and then woke up, “Oh shoot, the Fed isn’t hiking anymore…we must be heading for a recession. Those guys really know what they’re talking about!”

It should come as no surprise that I think the recent drop in rates is more closely linked to continued excess liquidity than to recession fears.

The Fed is ending balance sheet normalization. The ECB announced a new round of LTRO’s. China’s central bank is injecting liquidity into the system and is discussing rate cuts.

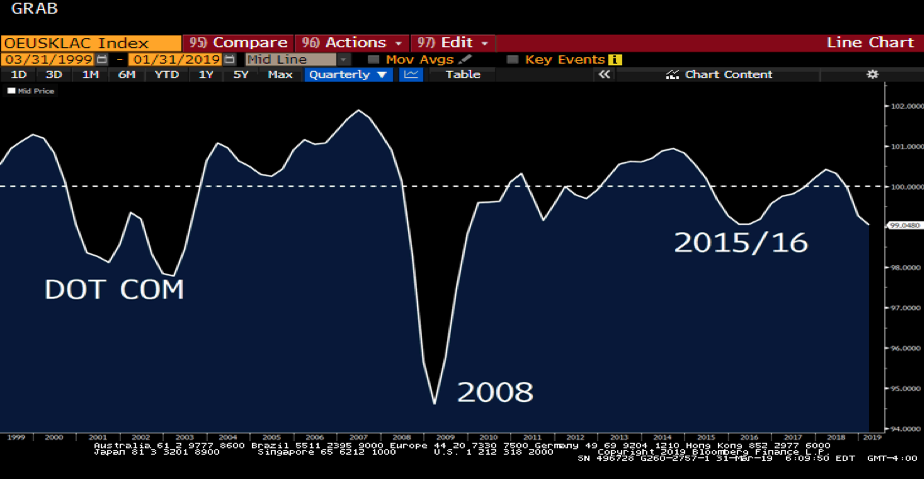

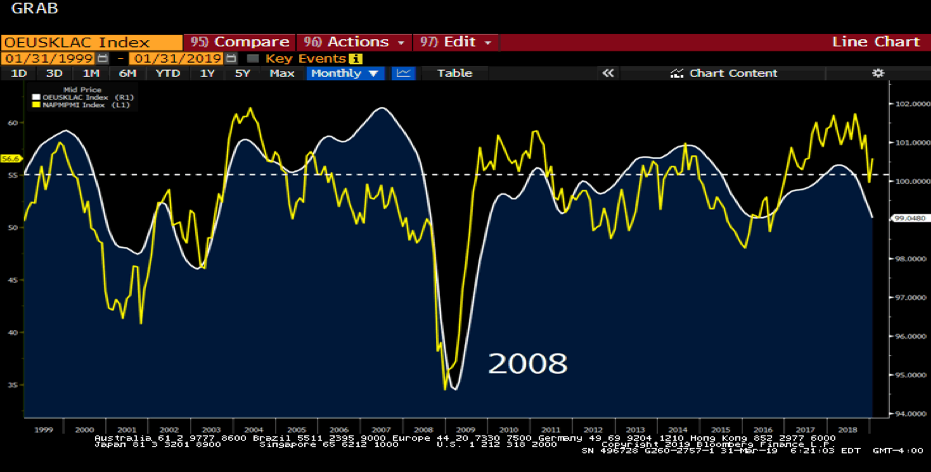

But most leading indicators of a recession are flashing signals due to market-driven data, not economic data. For example, consider the US OECD (Organization for Economic Cooperation) Leading Indicator Index. It is already down to levels seen in late 2015 and early 2016 when the economy cooled significantly. Bad news?

Maybe. But keep in mind OECD Leading Indicators aggregates both market data and economic data. Now layer the PMI Business Optimism Survey on top of the same graph. Note the gap today between the two.

In other words, I wonder if the market driven component (eg, falling bond yields) are driving the Leading Indicator Index lower, rather than actual underlying economic data?

How big is the disparity between the Leading Indicator Index and the Business Optimism Survey? As you’ll see below, it’s matching the 20-year high. And even when the relationship corrected, it was gradual.

The takeaway here is not that rates are likely to move higher.

The takeaway is that excess liquidity is distorting the market-driven component of the Leading Indicator Index.

Excess liquidity is driving rates lower, not recession fears. Just like QE liquidity has artificially propped up stocks, QE liquidity has artificially depressed rates.

What would normally be a flashing red light about a recession is really the result of all that liquidity. If the underlying data doesn’t continue to weaken, then the market-driven indicators may be signaling a false positive recession warning.

1995 Tightening Cycle

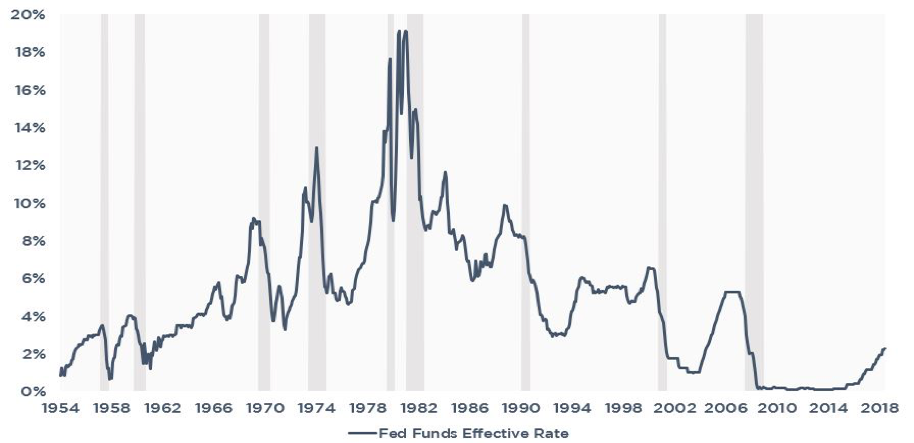

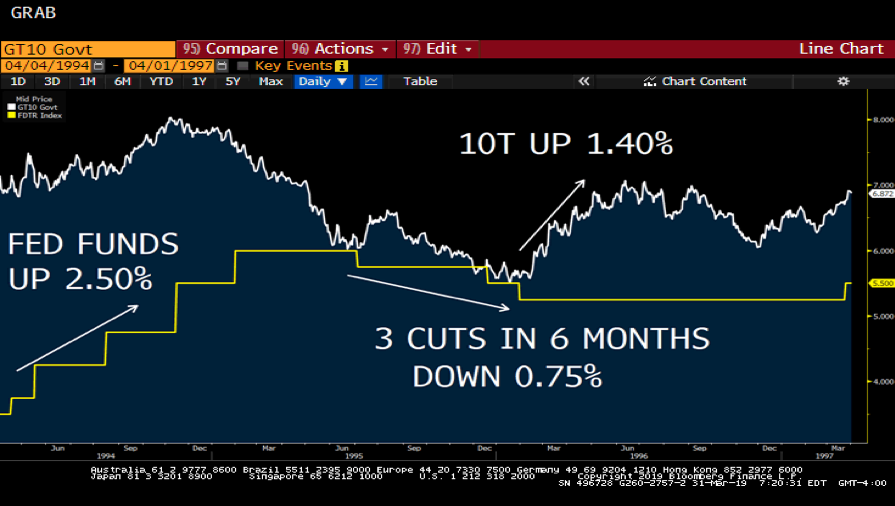

We’ve included the graph below quite a few times to illustrate how successfully the Fed has hiked us into a recession over the years. There’s one notable exception, however, when the Fed moved to quickly cut rates and temporarily avoided a recession – 1995.

The Fed cut rates three times in 6 months…and the 10 Year Treasury climbed 1.40%.

The Fed’s proactive steps to avoid a recession led to a risk-on mentality. This, in turn, pushed up the 10 Year Treasury yield.

While the market is adapting to the Fed’s new stance (more liquidity for longer) and pushing down yields, will that momentum last? If rates are falling because of liquidity, and not recession fears, isn’t it possible that the accommodative stance of the Fed will ultimately result in more risk-on mentality?

It probably depends on why the Fed is on hold or cutting rates.

- if the market views a recession as imminent, then the 10T has more room to run lower

- if the data continues to soften, then the 10T has more room to run lower

- if the global economy struggles, then the 10T has more room to run lower

But if rates are lower because of excess liquidity as I think they might be, FOMC policy could actually result in higher rates at some point (but probably not before the market feels the economy isn’t tanking).

Then again, maybe rates keep falling because of convexity buying…

This Week

Tons of economic data this week. Retail Sales and ISM Manufacturing data on Monday. Durable Goods Tuesday. ADP Employment Wednesday. Fed speakers.

Most importantly, March’s job report on Friday.