Banking Crisis or Risk Mismanagement Crisis?

Last Week This Morning

- 10 Year Treasury at 3.473%

- German bund at 2.283%

- 2 Year Treasury at 4.038%

- LIBOR at 4.85%

- SOFR at 4.82%

- Term SOFR at 4.80%

- PCE YoY 4.6% actual vs 4.7% expected

- PCE MoM 0.3%, down from last month’s 0.5%

- UBS announced 36k layoffs once CS acquisition is complete

- OPEC+ announced a surprise reduction in production from May through year end

Here’s my Current Take on the Fed

With things changing so much day to day, here’s my executive summary.

- The Fed has a bias towards hiking at least one more time, and maybe two

- The divergence between the Fed and the market expectations for rates will narrow in the coming months

- The Fed says “We’ve been right for the last year, get on board”

- The market says, “One time. You’re back to your old selves now”

- Friday’s Core PCE release wasn’t necessarily good news, but at least it wasn’t bad news

- Core PCE came in at 4.6%, down slightly from last month

- Core PCE peaked at 5.4% in March of last year (same month of the first hike)

- Despite improving just 0.8% in one year, the Fed’s own projections call for a 1.1% improvement over the next 9 months

- The best news from Friday’s Core PCE was the m/m increase of just 0.3%, a critical improvement over last month’s surprise 0.5% increase

- Financial stability issues will likely dictate whether the Fed hikes on May 3rd

- If things feel calm, they hike

- If someone else has issues, they don’t hike

- Whenever the Fed pauses, they will expend considerable energy trying to convince the market they will not be cutting anytime soon

- The credit crunch might end up being a bigger concern for the Fed than more banking fallout

- The next survey of senior loan officers isn’t until May 8th, so they won’t have updated info before the next meeting. But if that implies a slamming on the credit brakes, it might be the final nail in the rate hiking coffin.

- Stuff breaks when you hike 5% in one year, but it might not break all at once

I’m not sure we are categorizing the banking crisis correctly. What if it’s not a banking crisis at all? What if banks were just the first shoe to drop in a broader risk mismanagement crisis? What if the banking sector as a whole is largely ok, but there are pockets of mismanagement around the country that are starting to be punished by 5% increase in rates?

Jobs Report

The next job report is due out Friday. Our office is playing a drinking game where anytime an economist or CNBC commentator says the word “resilient”, bottoms up.

The forecast is for a gain of 223k jobs. As you know by now, over the last 10 hiking cycles (back to 1969), the economy averaged 203k jobs heading into a pause. It’s not weird that we are still hiring. Also, keep in mind that 150k, not 0, is the contraction signal because it means we didn’t keep pace with population growth.

My argument is not that the labor market is weak, but that it is not as strong as the Fed suggests. It will be weak at some point, but that takes time. Since we don’t typically start losing jobs until after the Fed starts cutting, we might have job gains all year.

But winter is coming. Just like we are seeing cracks in the financial system, we are seeing cracks in the labor market.

The Challenger Job Report tracks publicly announced layoffs. The most recent report said, “US-based employers announced 77.77K job cuts in February of 2023, the most for the month of February since 2009 and compared to 102.943K in January which was the highest reading since September of 2020. So far this year, employers announced plans to cut 180,713 jobs, up 427% from the 34,309 cuts announced in the first two months of 2022 and the highest January-February total since 2009.” (Challenger Job Report)

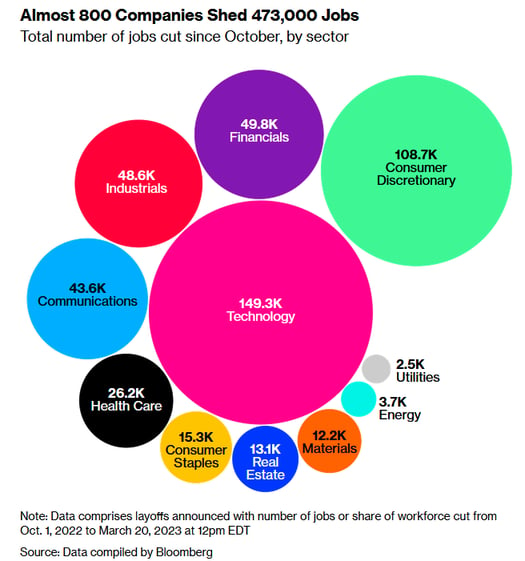

Here's a list of some publicly announced layoffs:

- Roku layoffs: 6% of workforce laid off (March, 2023)

- Lucid Group layoffs: 18% of workforce laid off (March, 2023)

- Meta layoffs: 13% of workforce laid off (March, 2023)

- Twitter layoffs: 10% of workforce laid off (February, 2023)

- Twillo layoffs: 17% of workforce laid off (February, 2023)

- Roomba layoffs: 7% of workforce laid off (February, 2023)

- Disney layoffs: 3% of workforce laid off (February, 2023)

- Zoom layoffs: 15% of workforce laid off (February, 2023)

- Dell layoffs: 5% of workforce laid off (February, 2023)

- HubSpot layoffs: 7% of workforce laid off (February, 2023)

- PayPal layoffs: 7% of workforce laid off (February, 2023)

- IBM layoffs: 1.5% of workforce laid off (January, 2023)

- Gemini layoffs: 10% of workforce laid off (January, 2023)

- Yankee Candle layoffs: 13% of office workers laid off (January, 2023)

- Spotify layoffs: 6% of workforce laid off (January, 2023)

- Google (Alphabet) layoffs: 6% of workforce laid off (January, 2023)

- Microsoft layoffs: 4-5% of workforce laid off (January, 2023)

- Amazon layoffs: 1-2% of workforce laid off (January, 2023)

- Carta layoffs: 10% of workforce laid off (January, 2023)

- Coinbase layoffs: 20% of workforce laid off (January, 2023)

- DirecTV layoffs: 5-6% of workforce laid off (January, 2023)

- Salesforce layoffs: 10% of workforce laid off (January, 2023)

- Vimeo layoffs: 11% of workforce laid off (January, 2023)

- Goldman Sachs layoffs: 8% of workforce laid off (January, 2023)

- Stitch Fix layoffs: 20% of workforce laid off (January, 2023)

“That JOLTS survey though!” Powell cries. “Two job openings for every unemployed American!”

Our friends at the WSJ must be newsletter readers, because look what popped up recently, That Plum Job Listing May Just Be a Ghost. (Plum Job Listing may be a Joke)

Indeed, the online job site, announced layoffs of 2,200 employees totaling 15% of its workforce. Why would they do that with such a robust job market? They should be killing it if that JOLTS survey is to be believed.

ZipRecruiter recently conducted a survey of laid off workers (ZipRecruiter Laid off Workers Survey). Some interesting highlights:

- 52% of workers were caught off guard

- One third received severance, on average 4 months (think about the lag effect before they apply for unemployment)

- Laid off workers can afford not to work for 3.3 months

- Of those who have already found a new job, 70% say they experienced financial pressure after their layoff (how will that impact consumer spending…which leads to GDP)

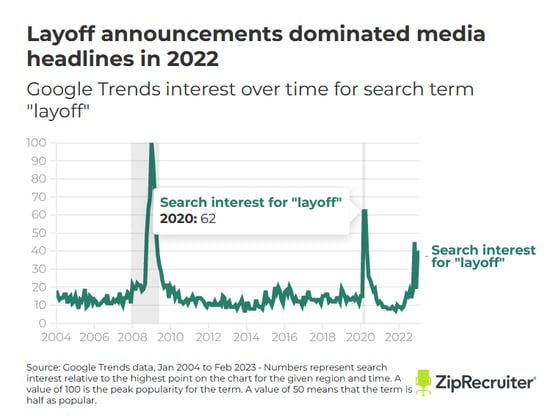

Google searches for “layoff” have surged.

Yes, tech has led the way in layoffs. But as this Bloomberg graphic highlights, layoffs are more-broad based than that. (Bloomberg Layoffs Article)

At this point, I just assume Friday’s job report will be “incredibly robust” leading to talk of a “very tight labor market”.

But there are cracks. There just hasn’t been enough time.

Speaking of Cracks

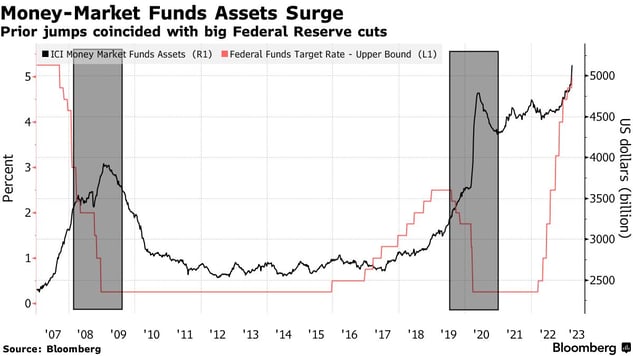

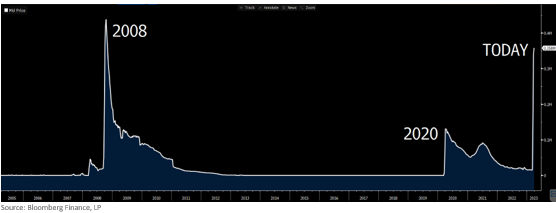

According to a Bloomberg article, “Global cash funds had inflows of nearly $143 billion, the largest since March 2020 in the week through Wednesday — adding up to more than $300 billion over the past four weeks, according to the note citing EPFR Global data. Money market funds assets have soared to more than $5.1 trillion, the highest level on record. Prior surges coincided with large Fed interest rate cuts in 2008 and 2020, Bank of America strategist Michael Hartnett said.” (Bloomberg Article)

Don’t worry about that discount window borrowing, either. Everything is fine.

Caps

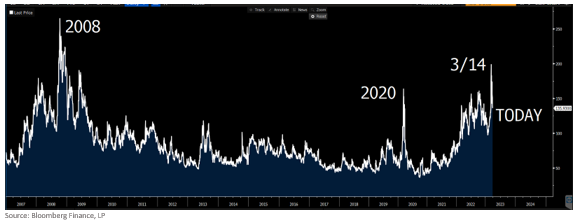

Volatility is off the peak from two weeks ago, basically plunging back to levels experienced last summer.

Generally speaking, caps are down about 20% from two weeks ago. Unfortunately, as volatility dissipates it is being offset by a move higher in rates.

Week Ahead

Some manufacturing data early in the week could move rates, but really all eyes are on Friday’s job report.