ChatGPT Says the Fed Won’t Talk About Pausing This Week

Huge week ahead as we get CPI on Tuesday before the FOMC meeting Wednesday, but I have to start with the chatGPT (https://chat.openai.com/chat) AI/ML toy that was released last week and cost my team hundreds of hours of productivity. The stuff that comes back is pretty impressive. It will add about two minutes to your morning routine to read some of the stuff it came up with, but it will be a fun two minutes.

Last Week This Morning

- 10 Year Treasury up 10bps to 3.59%

- German bund up to 1.94%

- 2 Year Treasury up to 4.34%

- LIBOR at 4.27%

- SOFR at 3.80%

- Term SOFR at 4.30%

- PPI MoM came in at 0.3% vs expected 0.2%

- Core PPI MoM came in at 0.4% vs expected 0.2%

- PPI YoY came in at 7.4% vs expected 7.2%

- Core PPI YoY came in at 6.2% vs expected 5.9%

- UMich 5-year inflation expectations came in at 3.0%

FOMC Primer

The Fed will hike rates 0.50% this week, which will take the upper bound of Fed Funds to 4.50%. The real issue at stake is whether Powell signals a potential pause. I think not.

1. Financial Conditions are actually easing. Powell wants conditions to be restrictive, so the drop in financial conditions since October suggests the Fed has rope to play with.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

2. He’s afraid to give back hard-fought ground on inflation expectations. One year forward inflation expectations are on top of 2%. If he downshifts too early, he runs the risk of allowing expectations to start higher.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

3. Real Rates are still negative and, if inflation holds at current levels, would need another 1.00% in hikes just to break into positive territory. That’s the starting line for talk about a pause. This graph is Fed Funds (4%) minus Core PCE (5%) = -1.0%.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

Powell hopes inflation does its part to impact this equation and put real rates into positive territory, but that isn’t going to happen this week. In fact…

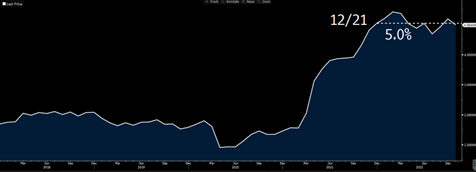

4. Inflation has remained stubbornly persistent. Core PCE y/y is 5.0% today. Guess what it has averaged over the last year? 5.0%. You may be thinking, “Well, if Core PCE drops to 4% and Fed Funds is at 5%, then real rates are + 1.0%.” And that would be correct. But assuming Core PCE will drop 1% is a huge assumption and one that Powell is unlikely to bake into Fed-speak right now.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

5. The Fed is telling us they will hike higher than expected. “Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level,” Powell said.

“It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy,” he added. “We will stay the course until the job is done.”

There is a greater likelihood of the Fed hiking to 5.50% in the first half of 2023 than there is of pausing at 4.50%.

10 Year Treasury

If the massive tightening slows the economy as expected, the 10T will likely test 3.0% next year, particularly if the odds of a recession surge.

Keep in mind, this may happen while the Fed is still hiking. In fact, it might be more likely if the Fed has to hike to 5.50%. Why?

Imagine you are considering buying a 2 Year Treasury yielding 4.50% or a 10 Year Treasury yielding 3.50%. No brainer, right? Buy the 4.50%.

But…if you believe there is a recession on the horizon and the Fed will be cutting aggressively in 2024, your 2 Year Treasury will be maturing at the same time the bottom is falling out on rates. Now what? Let’s say 2 Year Treasurys are yielding 2.0% and 10 Year Treasurys are yielding 2.50%. You’ll wish you were holding onto that 3.50% 10T coupon from today.

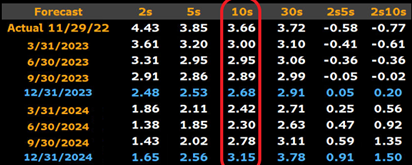

That’s the dynamic that has caused the yield curve to be inverted much of this year. In fact, Bloomberg Rates is forecasting a 3.0% 10T by the end of Q1.

I happen to believe the 10T has room to pop higher over the next couple of months as the Fed keeps hiking and the data shows resiliency, but a year from now it’s tough to envision the 10T above 4% after all the tightening has had an opportunity to slow down the economy.

Key resistance/support levels in the coming months

Low side: 3.50%/3.25%/2.75%

High side: 3.90%/4.05%/4.35%

Week Ahead

Next week will be a big one with November’s CPI report ahead of Wednesday’s FOMC meeting. Retail sales and PMI inflation data will follow later in the week.

If we are indeed heading for a recession following the nearly unprecedented tightening, I wonder what the next easing cycle will look like?