CPI WTF

Of course the first inflation report after I pop off at the mouth and wager JMo would come in hot…of course it would. I immediately got texts from JMo after the CPI report. And by immediately, I mean 11am because he doesn’t roll out of bed before 10am. It’s good to be in sunbelt industrial over the last five years.

Some of this can be chalked up to seasonal adjustments, and some of it may be the consequences of Powell’s surprise pivot in December (thus easing financial conditions), but any way you slice it this was a hotter than expected report.

Even worse, Dr. Anna Wong from Bloomberg noted, “The core PCE deflator won’t be released until February 29th, but it can be estimated with decent precision after the CPI and PPI releases. We preliminarily estimate core PCE inflation for January was 0.4% (vs 0.2% prior).”

Remember for my JMo wager on 2024 Core PCE I get 2.9% and lower and he gets 3.0% and higher. I will start the year in the money, but is this the first sign of reacceleration?

This guy is barely tolerable when he’s self-deprecating, but if he actually wins this wager…I shudder at the thought.

Last Week This Morning

- 10 Year Treasury at 4.29%

- German bund at 2.39%

- 2 Year Treasury at 4.65%

- SOFR at 5.31%

- Term SOFR at 5.32%

- Fed Speeches:

- Fed Daly and Bostic: Patience needed on inflation fight; expect Lower But Slower™

- Fed Barr: Hotter-than-expected inflation data means road to 2% inflation could be bumpy

- UK and Japan have officially entered into a recession

- Germany did the same last quarter

- China’s growth is the slowest in 40 years

- CPI YoY 3.1% vs. 2.9% expected

- CPI MoM 0.3% vs. 0.2% expected

- Retail Sales much weaker than expected

CPI Report

Every aspect of the CPI report was hotter than expected, driving rates up. It wasn’t just CPI, though. PPI came in hotter than expected…Average Hourly Earnings popped…what gives? Seasonality.

It’s pretty common for goods prices and compensation to be reset in January. How many employees got raises in January? How many manufacturers established their 2024 prices in January?

It’s not unusual to see a temporary pop at the start of the year.

- December 2022 CPI m/m was 0.1%, and then January was 0.5%

- For the year, though, CPI still fell from 6.4% to 3.4%

- December 2022 PPI m/m was -0.3% and then January was 0.4%

- For the year, though, PPI still fell from 8.8% to -0.1%

Despite this predictable jump in inflation, this may end any hopes of optimistic Fed speak in Q1. I bet Powell looks back at his surprise December pivot as a mistake. Markets rallied aggressively, prematurely celebrating lower rates, exacerbating the January surge.

All is not lost on the inflation front, however. Inflation will likely continue to moderate. Dr. Wong still forecasts Core PCE falling to 2.5% by June. Keep in mind that:

- Shelter component lag still has to work its way through the system

- We are importing deflation from China

- Europe is in real trouble

- Oil is low, which helps limit a surge in inflation

- Retail sales suggest consumers are finally pulling back

I’m a silver lining kind of guy, what can I say?

Lower But Slower™

Rates jumped across the curve, dragging up cap prices with it. Just as importantly, this recent inflation report will force the Fed to reiterate patience on the rate cutting front. That will keep cap costs elevated, particularly one year caps.

Last week’s CPI report doesn’t change the fact that Powell has repeatedly said the Fed will begin cutting rates well before we hit the 2.0% inflation target. I just think this means they are slower to cut than the market was expecting.

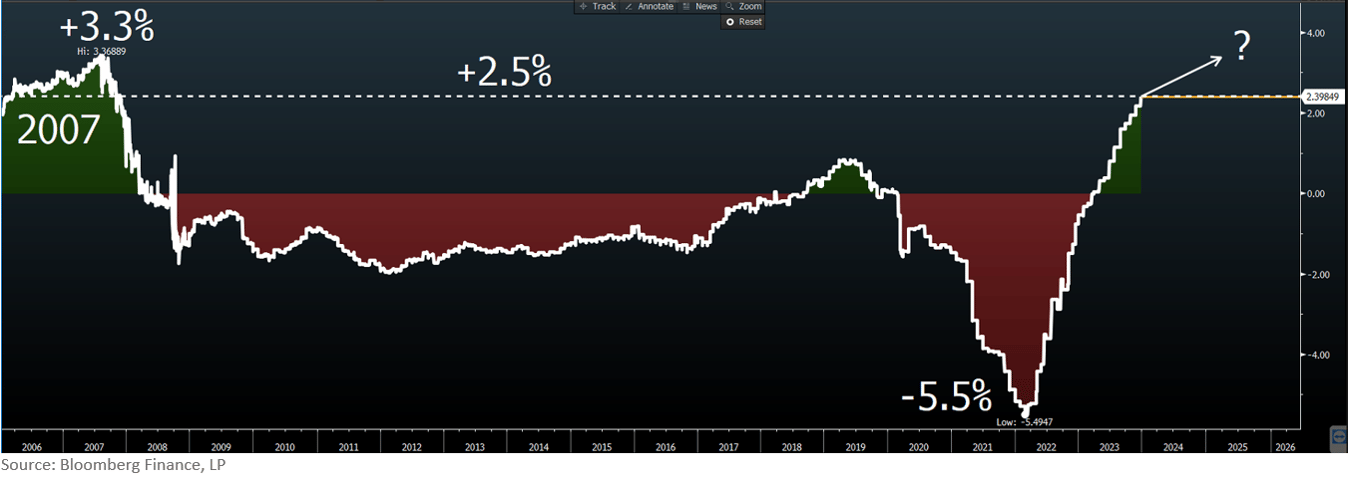

I continue to believe the economy will slow as positive real rates work their way through the system, but less confident about how quickly they will take their toll. If you look back at 2006 and 2007, the economy experienced positive rates at current levels for 18 months before the bottom fell out.

If Core PCE continues to fall, real rates will climb even without the Fed hiking. This will increase the odds of a hard landing. The Fed will cut just to keep the level of real rates constant. Still applying the brakes without slamming on them.

Powell will be trying to thread that needle starting sometime this summer.

The T10 popped because it is controlled almost entirely by expectations around Fed Funds right now. Very simplistically, the 10T is trying to predict where Fed Funds will end up. If the historical spread between the two is 1.25% and the 10T is 4.25%, the market is basically expecting Fed Funds to go to 3.0%.

For those hoping for the 10T to run to 3.0%, you are basically suggesting Fed Funds will go to 1.75%. That’s definitely possible, but only with a dramatically slowing economy.

T10: top end of the range is 4.35%...after that, there’s not a lot of technical resistance before 4.75%. I still think it is more likely we move towards 4.0%, but we won’t see a run to 3.5% until it is abundantly clear the economy is slowing and inflation is abating.

The Week Ahead

A ton of Fed speeches again this week, plus the FOMC Minutes from the last meeting.

Also, all that commentary in the intro was really part of my rope a dope strategy to lure JMo into upsizing the wager. Like Muhammad Ali in Zaire, I will emerge victorious after the final bell! This is him already thinking he’s won the wager.