Debt Management Platform

Centralize your debt portfolio to better manage your interest rate exposure across all loan types, not just those with hedging needs.

Debt Management Platform Custom Features

- Every metric is customizable, you choose what is displayed here.

- Daily interest rate feeds to capture current data.

- Run shock analysis and instantly measure impact on metrics.

Pensford Portfolio Management

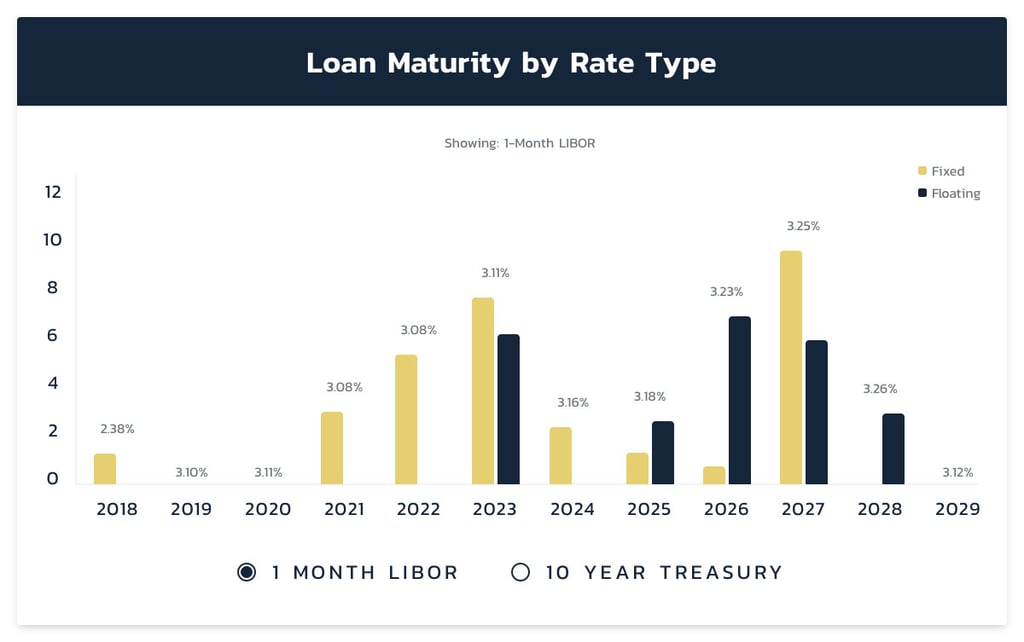

Manage debt maturities across the entire portfolio with LIBOR and 10 Year Treasury futures overlaid to easily identify potential areas of risk.

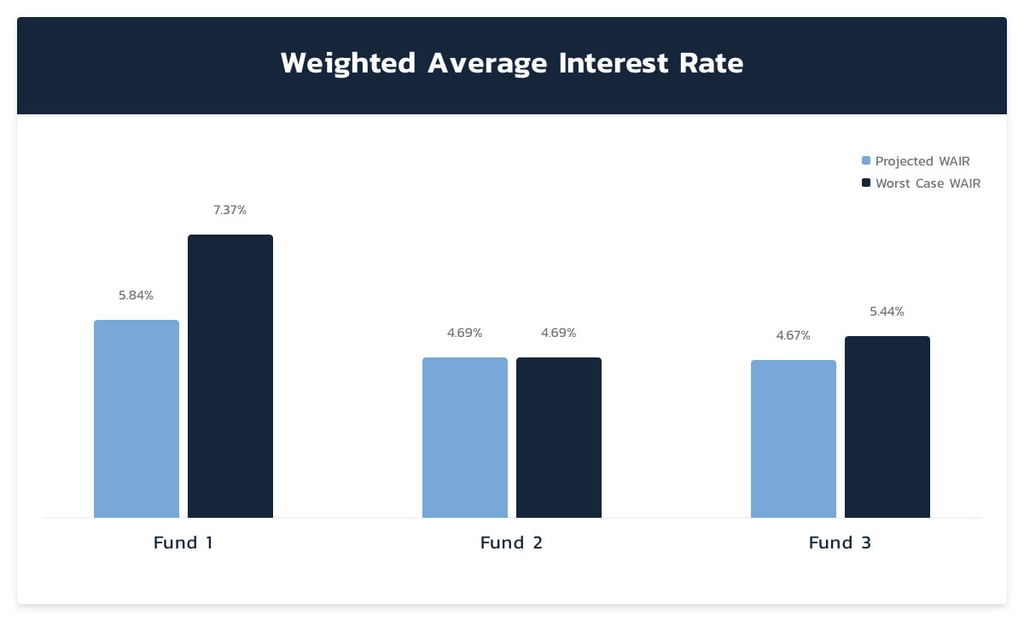

Or view a fund by fund breakdown of projected interest rate vs worst case interest rate. Here, Fund I has a worst case interest rate of 7.37% – perhaps a little more digging is in order?

Fund I Details and Analysis

Just like the individual Loan View, the Fund View is totally customizable. If you don’t use a fund model, you will simply provide a descriptor (eg “Industrial”).

Stress Scenarios

Just as importantly, you can run stress scenarios by shocking interest rates or NOI and measure the resulting impact immediately.

Portfolio Overview

Ultimately, all funds flow up to a Portfolio View that aggregates all the underlying data in one easy view.

Hedges

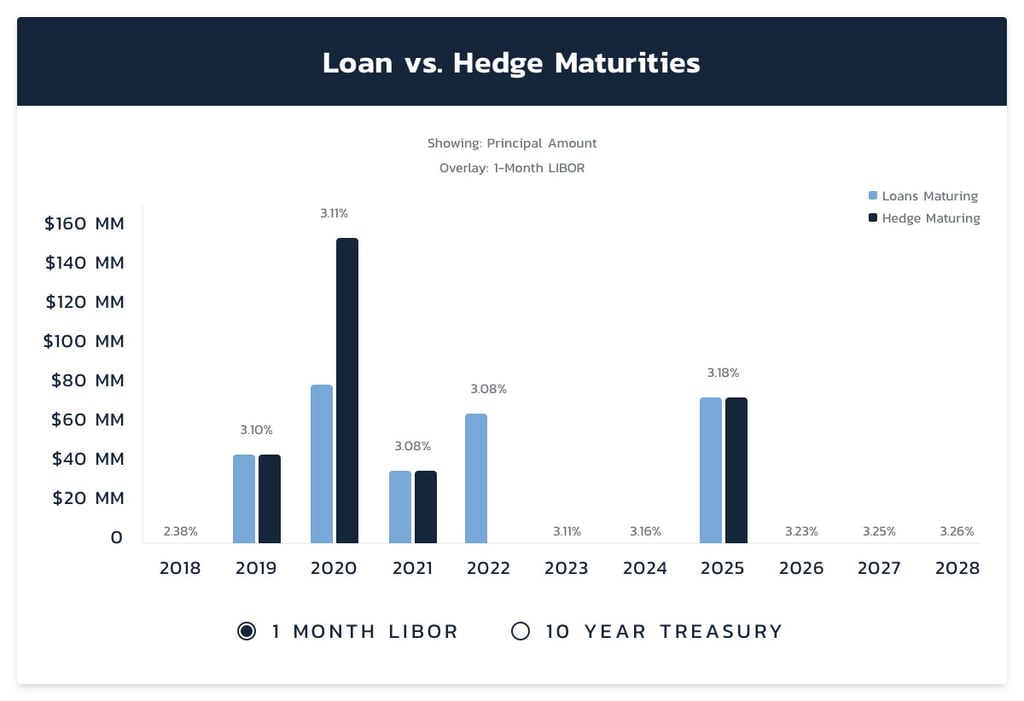

And of course we capture all hedges so you can easily track maturities, strikes, MtM or breakage costs, etc. This example shows the total notional hedged as well as the weighted average strike of the caps.

Quickly identify potential mismatches between loan maturities and hedge maturities. Below we can easily identify a large amount of hedges rolling off in 2020 that may need to be replaced. Is further investigation warranted?

Going Forward

As new loans are added to the portfolio, we add them to the platform.

As existing assets are sold, we move the loan to an Archive tab and retain the data for future use.

This tool empowers commercial real estate borrowers and enhances strategic dialogue so you can make a more informed decision that is best for your business.

Generally, this material is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Your receipt of this material does not create a client relationship with us and we are not acting as fiduciary or advisory capacity to you by providing the information herein. All market prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. This material may contain information that is privileged, confidential, legally privileged, and/or exempt from disclosure under applicable law. Though the information herein may discuss certain legal and tax aspects of financial instruments, Pensford, LLC does not provide legal or tax advice. The contents herein are the copyright material of Pensford, LLC and shall not be copied, reproduced, or redistributed without the express written permission of Pensford, LLC.