Deflation is Coming

OK, that title was a little misleading, but Disinflation is Coming doesn’t have quite the same ring. And I really really really wanted a GoT reference.

Last week, I taught a couple of classes for my brother in UGA’s real estate school. Juniors and Seniors. They were a good bunch of kids. I assured them I would interview on campus once the Dawgs beat Bama. Overall, I was impressed. They gave me hope that maybe it’s just my kids, and not the entire younger generation, that has a long way to go before they are ready to enter the work force.

I was stressing the importance of working hard, and that the employee that was first to arrive in the office and last to leave got more rope than others. No one ever gets fired for working too hard. Sometimes just putting in face time early in your career can really help pay dividends in the long run. Blah blah blah.

A few days later I heard from my brother. One of the students raised his hand in class and asked, “How early is too early to call your boss on FaceTime?”

So then again, maybe it isn’t just my kids.

Last Week This Morning

- 10 Year Treasury slowly moved higher to 2.56%

- German bund also pushed higher to 0.05%

- Japan 10yr flat at -0.04%

- 2 Year Treasury up to 2.39%

- LIBOR at 2.47% and SOFR at 2.44%

- Factory Orders and Durable Goods both came in weaker than forecasted

- Minutes from the most recent FOMC meeting point to a patient Fed, content with the current level of rates

- Inflation data came in as expected or slightly weaker than expected

- Tiger Woods somehow managed to make me root for him again

- Apologies to Texas Tech fans, you got the patented kiss of death in the last newsletter

Inflation – The King Joffrey to Eddard Stark

Inflation is public enemy #1 for bonds. It beheads yield. If you have a bond with a 2.50% coupon and inflation is climbing through 3.00%, you are losing money. Treasury holders sell to get out of their losing position, pushing up rates.

Lower inflation has the opposite effect. It makes bonds look more attractive, driving down Treasury yields.

With the economy still doing reasonably well, I wonder if the flattening yield curve is more the result of disinflation than recession fears?

If the market expects inflation to fall, bonds will be more attractive. Money flows in, 10T yields fall.

Check out this graph of the T10 vs Core PCE, the Fed’s preferred measure of inflation. The 10T has a tough time detaching and pushing higher without inflation moving up as well.

Same graph, but now just the spread between the two. Since 2011, the relationship hasn’t exceeded 1.50%. Quantitative Easing anyone? Holding inflation at current levels, a 1.50% spread would imply a T10 of 3.30% – basically where the T10 peaked last year.

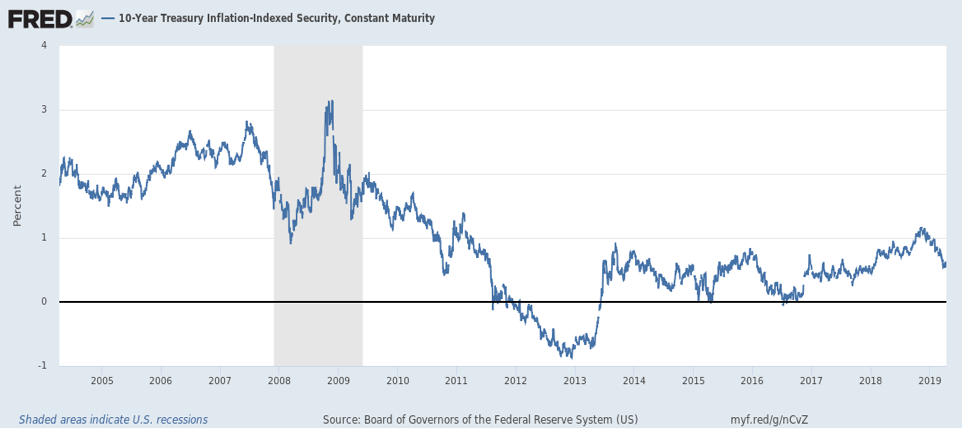

10 Year TIPS

Without inflation, maybe bonds simply look like an attractive investment and the flattening isn’t really a recession signal (remember, we haven’t officially inverted). Treasury Inflation Protected Securities are yielding just 0.57%. The market is not concerned about inflation (even though I can hear every real estate developer crying foul right now).

Global Debt

Global negative yielding debt is back up over $10 trillion (yes, with a T), so a 2.50% T10 looks pretty good.

Takeaways

Setting economic data aside, the Treasury curve flattening may have a lot to do with the market’s expectations of falling inflation. The more inflation falls, the better bonds look.

Even if inflation doesn’t actually fall, the lack of fear around rising inflation may be enough to persuade bond buyers they don’t have much to lose. Throw in the possibility of a slowing domestic economy, slower global growth, trade fears, etc, and our bonds look pretty good.

So maybe the flattening yield curve has less to do with recessionary fears and more to do with a distinct lack of inflation?

This Week

After I recover from whatever favorite character dies, we have a slew of earnings due and a heavy economic calendar.

Markets close early on Thursday and are closed all day Friday for Easter. Get your trades down by lunch on Thursday if you have a loan closing this week.