Economic Expansion or Overheating?

Last Week This Morning

- 10 year Treasury climbed to 2.87% before falling back to 2.77%

- German bund held steady at 0.49%

- 2 year Treasury dropped 0.01% to 2.27%

- LIBOR hit 1.895%

- SOFR, presumptive replacement for LIBOR, was printed for the first time ever on Tuesday and printed at 1.80%.

- It finished the week at 1.75%

- This further highlights the growing spread between LIBOR and Fed Funds

- Just 103k jobs added last month, vs 185k forecast and previous month’s 313k

- Unemployment rate held steady at 4.1%

- Average hourly earnings ticked up slightly from 2.6% to 2.7%

- Combination of trade war fears and Fed-speak about additional rate hikes caused DJIA vol to hit a 7 year high

- Trump attacked Bezos Amazon, causing a ripple effect through tech stocks.

- Like I’ve always said, being a billionaire is overrated

Job Report

The March employment report was mildly disappointing, showing a gain of just 103k jobs vs forecasted 185k. DB pointed out that the March report typically misses forecast by an average of 62k, so Friday’s number shouldn’t be that much of a surprise. Additionally, February’s number was so strong (313k) that some giveback was likely. At first glance, it appears much of the weakness is attributed to weather-related factors, not a change in the underlying economy.

There was also a net revision lower of the previous two months by a combined 50k. Despite this, the 2018 average remains at 202k, above last year’s average of 183k.

Obviously, the Fed will be closely watching next month’s report to help determine if this was a hiccup or the beginning of a new trend, but Powell is unlikely to shift gears based on one disappointing print.

Tariffs

When Trump first announced his plan for tariffs on some Chinese goods, we highlighted the market impact when Bush announced tariffs in 2002. Both equities and the 10yr Treasury saw a 33% drop in the next six months. This threat raises some questions, such as:

- will the Fed pull back on rate hikes?

- dampened GDP?

- increased inflation?

- stock market correction and the impact that has on Trump and Powell?

This is setting the stage for an interesting push/pull between growth (down) and inflation (up).

In the near term, it is tough to envision a scenario where the T10 tests 3.00%.

Over the long run, inflation pressures could arise out of the protectionist policies and massive issuance to fund the growing deficit.

The outcome may be dictated by whether tariffs escalate into a trade war.

Overheating?

The expansion cycle is in its 35th month, the second longest on record. Recessions create an output gap where the economy produces less than its potential. After most recessions, it takes about 6 years for this gap to close. This cycle, it took 10 years for that gap to close. Given the severity of the 2008 crisis, it intuitively makes sense that it would take longer for the economy to reach full potential.

As the economy gains momentum, actual GDP eventually exceeds potential GDP, meaning the output gap turns negative. The economy overheats. In response, the Fed hikes more aggressively until the economy breaks and we enter a recession.

BNP released an interesting research piece this week that illustrated the previous two cycles experienced an overheating of 3 and 4 years, respectively. They also concluded that the US entered the initial phase of overheating about this time last year, which means we are a year into it and have 2 to 3 years of runway left. This ties out nicely with the fact that an inverted yield curve typically precedes a recession by about 2 years.

Of course, the tax cuts could turbocharge the overheating, shorten the runway, and create an interesting situation in 2019 and 2020. There is some potential for overheating to occur that will force the Fed to react in a way that could throw us into the next recession.

Rates

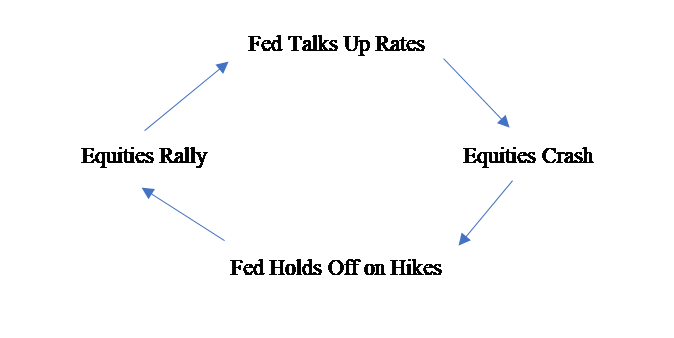

Futures markets have the odds of a June hike at about 88%. If the yield curve flattens or stocks selloff, this probability will drop. Powell is about to become intimately familiar with this cycle.

Whether we have two more hikes this year or three is not as important as the final landing point. We think the Fed is intent on pushing Fed Funds towards 2.50%-3.00%. Does it really matter whether LIBOR finishes this year at 2.25% or 2.50% if it finishes 2019 at 3.00%?

Barring an incredible surge in inflation, we don’t envision a scenario where Fed Funds significantly exceeds 3.00% this cycle.

On the long end of the curve, there are a lot of near term concerns that will keep a lid on rates. Not only fears of a trade war, but weakness in the Eurozone as well. Inflation has cooled off and Draghi is more dovish than Yellen. This suggests the recent drop in the Bund below 0.50% may be a persistent trade rather than a quick retracement. That, in turn, will help keep a lid on yields here.

If these fears subside and economic data here and in the Eurozone firm, it will allow for the underlying technical factors to kick in and push yields higher again. Until then, the 10T seems stuck below 3.00% and could drive significantly lower if fears of a trade war escalate.

This Week

Tariffs and tariff-speak will continue to dominate news. Additionally, FOMC minutes from the most recent meeting will be released Wednesday and should provide some insight into the Fed’s thoughts on tariffs and how that could impact rate hikes.

We also get inflation data this week, but that will take a backseat to trade war fears.