Extreme Caution Means Extreme Accommodation

Last Week This Morning

- 10 Year Treasury settled into 1.08%

- German bund at -0.51%

- 2 Year Treasury down slightly to 0.12%

- LIBOR at 0.12%

- SOFR is 0.04%

- Biden is requesting an additional $1.9T stimulus on top of the $900B passed last month

- Bloomberg revised its Q4 2020 GDP forecast, up from 2.5% to 4.8% (we get the real # Thursday)

- It has not revised Q1 2021 GDP forecast yet, still expected at -0.5%

- The Fed’s Treasury holdings doubled last year

- Janet Yellen was confirmed as the Treasury Secretary

- Inflation linked bonds are starting to see a pick up in demand

- Germany revised its GDP forecasts for 2021 down from 4.4% to just 3.0%

- According to a Bloomberg survey, 75% of economists expect Jay Powell to be offered a second term by Biden when Powell’s term ends a year from now

- Philly Fed Manufacturing Index soared as manufacturers gear up to repair the damage caused by disillusioned Eagles fans taking to the streets out of anger for keeping Howie and Wentz

FOMC Primer

The Fed has indicated it is on hold through 2023, so why are you even reading this? Is this seriously your best Monday morning reading material?! For at least the next several years you can gloss over anything related to floating rates – they aren’t going anywhere.

In fact, Trump may finally get what he wanted – negative floating rates.

No, that doesn’t mean your LIBOR/SOFR based loan will necessarily go negative (floors aside), but the real rate likely will. Or already has.

The Fed’s stance is one of extreme caution. It is walking on eggshells. The market is forward looking and trying to predict how the Fed extricates itself from these policies and what that will look like, but the Fed is going to avoid this topic at all costs for now. Powell wants to send nothing but warm and fuzzies through the market the first half of this year. Extreme caution means extreme accommodation.

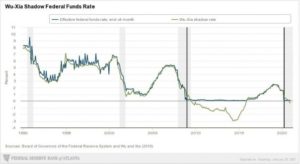

Long time readers will remember one of my favorite studies that arose from ZIRP, the Wu-Xia Shadow Rate. Two PhD candidates discovered that when Fed Funds goes below 0.25%, the real rate detaches from the effective rate. In other words, even though the Fed says Fed Funds is 0.0%-0.25%, it’s actually negative. They refer to this as the Shadow Rate.

Take a look at the Shadow Rate after the financial crisis in the graph below. The blue line is Fed Funds, and the green line is the Shadow Rate. While the “effective” Fed Funds (the one you know) bottomed out at 0%, the Shadow Rate got as low as -3% in 2014.

Why is that important? That same Shadow Rate dipped into negative territory last month.

Not by much, just -0.29%. I’ve recreated the graph below and have highlighted where we are in the cycle if it plays out the same way. We are at the very beginning stages of a potentially protracted negative interest rate cycle.

Real rates go negative for a variety of reasons. It starts with 0% interest rates (remember, Fed Funds has to be below 0.25% for the Shadow Rate to kick in). Forward guidance must suggest the Fed is on hold for a while. Quantitative easing. Commodity prices. Lack of volatility. Etc.

While you won’t benefit from an invoice with a negative rate on it, what this really means is extreme accommodation. And that is likely to last for quite some time.

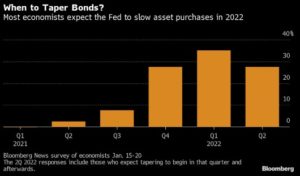

Not only is the Fed going to be on hold with rate hikes, it is not going to signal any changes to the current pace of $120B/mo in bond purchases (QE), either. “Now is not the time to be talking about an exit,” Jay Powell said on January 14th. He’ll likely reiterate that on Wednesday.

Most economists believe the tapering will begin sometime in 2022, but the risk to rates will come when the Fed first starts talking about it or when the market starts pricing it in (see Ben Bernanke 2013).

Powell knows this and there is less than 0% chance he wants to be discussing tapering right now. The second half of the year if all goes well? Maybe. But just weeks after the vaccine rolled out? No way.

In fact, we would expect Powell to reiterate that the time to begin discussing tapering is not anytime soon. He is fully accommodative for the foreseeable future.

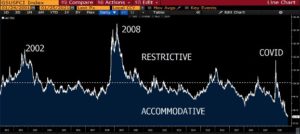

And you know when I start talking about accommodation, we’re about to revisit my favorite index ever – financial conditions!

Despite financial conditions never tightening anywhere close to the point of the financial crisis or even dot.com, the COVID-led massive Fed intervention has pushed conditions to all-time accommodative levels.

Negative short term interest rates. Low long-term rates. The most accommodative financial conditions ever. Massive stimulus. A vaccine.

Extreme caution means extreme accommodation. The stage has been set for a dramatic rebound in the coming years, particularly for asset owners (e.g., those reading this).

Week Ahead

Insanely busy week ahead. In addition to the FOMC meeting, we have Core PCE (Fed’s preferred measure of inflation), GDP, Durable Goods, Consumer Confidence, impeachment (if that matters anymore), etc.

It’s going to be a busy week.