Fed Funds to 5% in Q1

It’s Always Sunny in Philadelphia is one my all-time favorite shows (trailing only Curb Your Enthusiasm in the comedy genre). It’s one of those shows you either love or hate, and I’m in the former category. We landed in Philly Thursday at lunch time and my wife headed off to the bathroom. While standing there, in walks Rob McElhenny and Kaitlin Olson! They played the roles of Mac and Dee…I was losing it. They are legends!

I was totally star struck, so I was desperate for my wife to bail me out. I was texting her furiously, no response. I’m going nuts, it’s clear they are about to head out to their plane. I am running out of time, but too scared to approach solo. She’s a huge fan of the show, too, so I know she’ll be just as excited as me…where is she!? I watch as they walk out the door, my opportunity lost. I was crushed.

I finally see my wife in the kitchen and walk briskly towards her. “They have soft pretzels!” she excitedly proclaims, proudly holding up two pretzels and blissfully unaware of the star sighting. She knows I’m a sucker for soft pretzels. But she also knows I’m a sucker for sarcastic comedies. “You just missed Mac and Dee from Always Sunny!!!! Where were you!?!?!?”

“Really, where?!” as she looked around hopefully.

I explained how they had just left and we missed them. She was bummed, but pointed out that at least we had the pretzels to console ourselves.

That night, we watched the Phillies gift Justin Verlander his first ever World Series W by leaving something like 48 guys on base. The insane catch against the wall didn’t help either. I was crushed…again. But God wasn’t done with me yet.

The next morning, guess who I bump into at the airport? Justin Friggin’ Verlander. Guess where my wife was? Yep, the Friggin’ Bathroom Again. Flashbacks of Mac and Dee raced through my head. I’m texting my wife furiously all over again. Silence. I think I texted “bruh” like 9 times. After he finished talking to the front desk woman, he turned to walk away. I summoned my courage.

“Justin…you willing to take a photo with a Phillies fan?”

“Ummm…sure, ok.”

He was not ecstatic. He probably figured I was one of the 45,000 people screaming obscenities at him a few hours prior. He wasn’t wrong. It probably didn’t help out I was rocking my powder blue Phillies jacket.

As I reach for my phone to take the most awkward selfie in history, my wife mercifully walks up. Without missing a beat, she pulls out her phone and says, “Here, I can take it.” We posed, she clicked, we wished him well and he walked off.

I had just taken a pic with the guy that had probably won the WS for the Astros. The Philly Fan in me was a little ashamed. I’m not sure I could even admit it to my friends. And that’s not even the worse part…

The worst part? Unlike McElhenney, Justin wasn’t hanging out with his wife. I was crushed…again.

It was a great trip despite all the soul crushing that transpired.

We’re dipping our toes into the webinarverse and hosting our first ever Interest Rate Quarterly Update in December. One hour of nothing but interest rates, which is probably the most exciting thing you’ll do that day.

Last Week This Morning

- 10 Year Treasury at 4.16%

- German bund up to 2.29%

- 2 Year Treasury at 4.66%

- LIBOR at 3.86%

- SOFR at 3.80%

- Term SOFR at 3.81%

- Nonfarm payrolls came in at 261,000 vs expected 200,000

- Unemployment rate came in at 3.7% vs expected 3.5%

- Average hourly earnings are still up nearly 5%

- Bank of England also hiked 75 basis points

- The elections might be Tuesday, but don’t hold your breath that the results will be known

FOMC Meeting

Any hopes of a Fed pivot evaporated as Powell said it would be “premature” to talk about a pause. But at least he hinted at a potential slowdown of hikes, and that gave equities all it needed for a nice rally.

His comments reinforced the view that the Fed will keep hiking, albeit at a slower pace. The statement read, "the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments." This is the Fed’s way of reminding the market to not get caught up in monthly readings when the lag effect is 12+ months.

Right now, the consensus is 50bps in December, then 25bps in January and March. That would put Fed Funds at 5% by the end of Q1.

Over the next 6-9 months, I still think the risks are to a higher Fed Funds, not a lower one. Put yourself in Powell’s shoes…the monthly inflation data is still accelerating, the Fed has consistently underestimated inflation, the labor market is hanging in there, he’s trying to avoid a repeat of the early 1970’s, average hourly earnings are up almost 5%, etc. Six months ago I thought a 5% Fed Funds was absurdity…can we really rule out 6%?

Floating rates at 5% are the baseline, but 5.50% is more likely than 4.50%.

Thursday’s CPI will probably reinforce this. The annual number will likely show improvement (8.2% to 7.9%), but the monthly headline number is expected to accelerate from 0.4% to 0.6%. Even if Powell knows there’s a lag, the optics are terrible if he’s talking up a pause while monthly inflation is still climbing.

Real Fed Funds has pushed aggressively into positive territory in the second half of the year. If monthly inflation data can at least stop climbing, this should give Powell cover fire to slow in the coming months.

Source: Bloomberg Finance, LP

Source: Bloomberg Finance, LP

We’ve got two more CPI prints, one PCE print, and one more job report before the next Fed meeting. I think 50bps is the baseline for December 14th, putting Fed Funds at 4.25% - 4.50% at year end.

Dark Clouds on the Horizon

The labor market is decelerating. Through the first half of this year, we averaged 450k jobs gained each month. Over the last 3 months, this has slowed to 289k – the slowest since the start of 2021.

That’s still a strong number, but I continue to believe hiring doesn’t turn on a dime. I think the slowdown will be exacerbated with year-end budgeting, where 2023 hiring budgets could dramatically impact the monthly gains. If not, Powell may have to talk about more hikes to cool off the labor market.

Multiple measures of global shipping have fallen off a cliff. Shipping conglomerate Maersk reported all-time record profits but warned about an impending slowdown, revising 2023 forecasts down to -2% to -4%.

Maersk CEO Søren Skou said there is a “looming global recession” and “dark clouds on the horizon.”

Housing activity has plunged with 30yr mortgage rates exceeding 7%.

The Phillies hit 0.92% since the 7-0 home run derby in Game 3.

Although headline CPI is likely to show accelerating, monthly core data might finally show a minor improvement on Thursday. Last month, Core CPI m/m came in at 0.6%. This month, it is forecasted to fall to 0.5%. Obviously, still much too high but at least it isn’t still climbing.

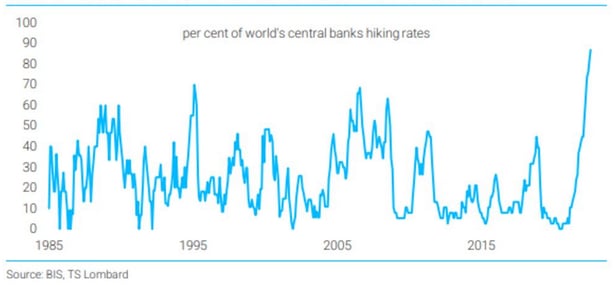

This cycle has experienced greater central bank coordination than previous cycles. This is why economists expect a global recession next year.

As the Fed hikes, it forces other countries to follow suit because:

- they want to avoid an outflow of investments chasing safer, higher yields in the US

- many emerging markets borrow and repay debt in USD, so a weaker currency would mean much more challenging debt service

- oil and other imports are traded in USD, so a weaker currency makes it more challenging to buy necessities

This comes with consequences, however, as those economies weren’t starting from a position of strength the way the US was. Higher rates cripple their economies.

Heck, it’s not just emerging markets. Even the Bank of England signaled a need for a slowdown in hikes to avoid deepening the inevitable recession.

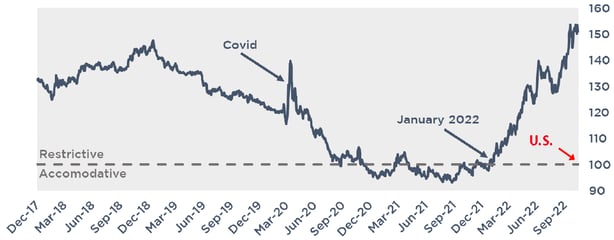

You know how much I love the US Financial Conditions Index, but Goldman also tracks the same for Global Financial Conditions. They don’t publish it publicly, so we called in a favor to get it. But notice how much tighter global financial conditions are than domestic. This is not going to end well.

I suspect a key theme in 2023 will be the impact of US monetary policy on the global economy. Powell will face growing pressure from abroad to slow/stop rate hikes.

10 Year Treasury

Continued upward pressure here. As the Fed keeps hiking, it will drag the 10T up with it.

If Fed Funds is headed towards 5.0%, I think a 4.50% 10T is firmly in play. This would basically keep the current level of inversion intact.

Week Ahead

Another big week, with inflation data and small business optimism. The Fed will also use the time to massage the message from last week’s meeting.

The one benefit of the ‘Stros beating the Phillies? Maybe, just maybe, we can avoid a recession. If you’ve been reading the news lately, you know that a Philadelphia title is highly correlated with a US recession. (Phillies vs Astros Recession)

But we aren’t out of the woods yet because the Eagles are going to win the Super Bowl suckas!

See you Arizona @kateupton!