Fed-Speak Helps Avoid a National Emergency

Markets are closed today, but if I’ve told you once I’ve told you a thousand times, the Pensford Letter doesn’t take a holiday!

Last Week This Morning

- 10 Year Treasury had a mild week, closing up slightly at 2.66% (2.62% continues to hold)

- German bund up a touch to 0.10%

- Japan 10yr yielding -0.02%

- 2 Year Treasury up slightly to 2.51%

- LIBOR at 2.48% and SOFR at 2.39%

- Retail sales on Thursday was weakest in nine years

- Atlanta Fed GDPNow forecast for Q4 was revised down to 1.5%

- BofA revised Q4 2018 to 1.5% and is now forecasting the same for Q1 this year

- Online internet sales in December fell 3.9%, the most ever

- PPI (inflation) at 2.0%, the weakest since mid-2017 and forward inflation expectations plunged

- German GDP Q4 came in at 0%, so good luck to the ECB with those rate hikes this year

- I don’t think you get to blame Democrats for not providing enough money to build a wall when your party controlled Congress the first two years of office

- The real national emergency is Ann Coulter saying stuff I agree with

Quantitative Tightening – We Hardly Knew You

Between December 15 and January 30th, the Fed did an about face on interest rate hikes. Following this shift, the market odds of a hike at any point this year now top out at 4%, while the odds of a cut are around 12%.

But perhaps even more surprising was the sudden change in stance on balance sheet normalization. Powell & Co indicated some flexibility on the $50B/mo runoff if they believed it was contributing to financial instability. Since Powell was describing this as being on “autopilot” as recently as two months ago, this was a welcome announcement to the markets.

Then last week Fed Governor Lael Brainard suggested balance sheet normalization will end sooner than expected, “In my view, that balance-sheet normalization process probably should come to an end later this year.”

Keep in mind this doesn’t necessarily mean GDP will suddenly rebound. But it does help relieve the pressure that the Fed will tighten us into a recession.

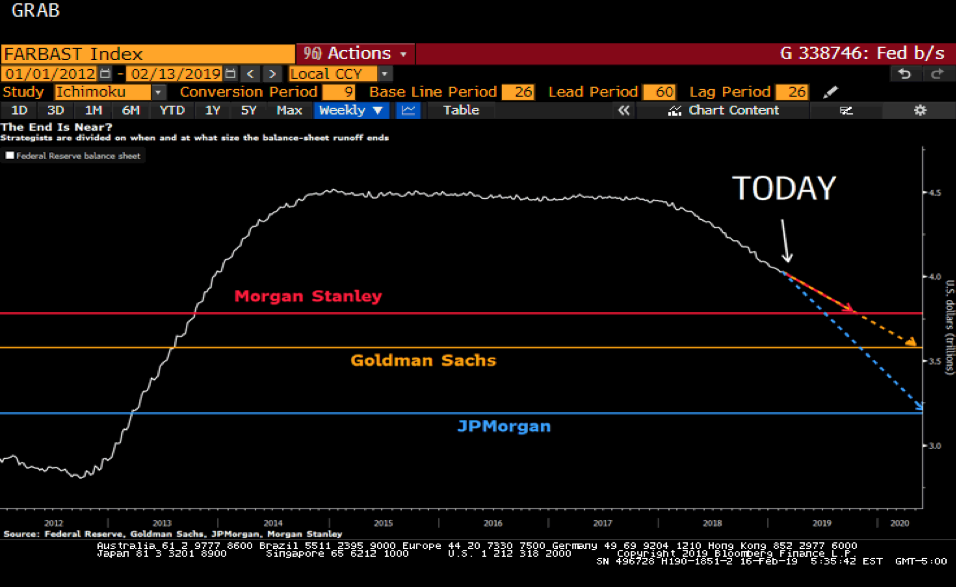

Following the crisis, the Fed’s balance sheet ballooned to $4.5T. Since reverse QE began, it has shrunk back down to $4T. The Fed originally sent signals that it expected to continue this pace of reduction for 5+ years and get the balance sheet back down to $2T-ish.

But following the market’s temper tantrum in Q4, the Fed is reversing course. Or at least sending signals to that effect. Forecasters are revising expectations for this unwinding.

- Morgan Stanley expects the Fed to stop the unwinding at the end of 2019, with the balance sheet around $3.7T

- Goldman and JPM project continued balance sheet normalization into mid-2020 with a final landing spot somewhere between $3T-$3.5T

It’s not a coincidence that stocks have rallied since December. And keep in mind that the rally has come in the face of downgraded GDP forecasts, which theoretically should be reflected in lower share prices. That’s how powerful Fed-speak is.

Fed policy generally impacts the economy relatively slowly. Increase rates today, business slows a year from now.

But Fed policy generally impacts markets very quickly. Simply talk about rate hikes and markets can tank. That’s what happened after the infamous Powell statement on 10/4 about being a “long way” from neutral interest rates.

In this way, Fed policy is really an event risk. It is the sort of ‘event’ that can tip the economy into a recession. Rate hikes, balance sheet normalization, forward guidance, etc all conspire to tighten financial conditions and make markets jittery.

Look at the graph below to see how closely financial conditions have been tied to Fed-speak.

- 10/4 Powell says we are a long way from neutral, conditions begin tightening

- Dec FOMC meeting that was more hawkish than the market wanted, conditions continue tightening

- 1/4/19 Powell reverses course and suggests the Fed may not hike this year and will be flexible about balance sheet normalization, financial conditions ease immediately

Fed balance sheet normalization is just one of many factors that contribute to financial conditions, but if the Fed is going slow the monthly roll-off (Reverse Tapering?) it suggests a more accommodative stance going forward. The markets are happy. Stocks up. Risk on. Higher yields. Steeper curve.

What remains to be seen is whether this recent talk is really just…talk. The financial conditions graph illustrated the impact Fed-speak and forward guidance can have on markets. Powell may just be riding out the storm right now, sending signals about flexibility while really planning on hiking when possible and reducing the balance sheet when possible.

This Week

Very light week for data, but Wednesday brings the minutes from the January FOMC meeting. That meeting was particularly dovish, so I’m not sure how much more dovish the minutes could be. If anything, the real risk is probably that they might be more hawkish than currently priced in.