Fed Starts Applying the Brakes

The Results

Leading up to this month’s FOMC meeting, markets had at least a 75bp hike locked in with a 20% chance of 100bps. The official decision matched expectations at 75bps for the third consecutive meeting, bringing the target Fed Funds range to 3.00%-3.25%, the highest level in 15 years.

In their official press release, the Committee acknowledged the recent retracement higher in the latest round of inflation data, noting that “recent indicators point to modest growth in spending and production,” a reversal in their stance from the previous meeting.

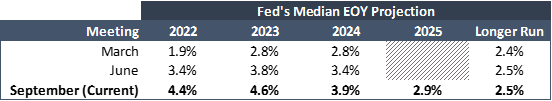

Today, markets are also digesting updated economic projections. The FOMC’s Dot Plot, their projections for the path of Fed Funds, shifted notably higher with the expectation for floating rates to remain above 4% through at least 2023.

This month’s higher-than-expected inflation print had many questioning whether we’re actually at the peak. This is the Fed’s signal that they’re going to make sure it is.

The above projections reflect the Committee’s median expectations but two, especially hawkish, members suggested Fed Funds would remain as high as 4.63% through 2024 and one member suggested that level would carry as far out as 2025.

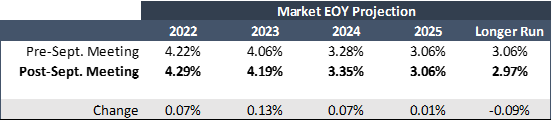

Markets had already shifted their rate expectations higher leading into the meeting, but not quite high enough.

In response, the 2-year Treasury surged back above 4.00%, climbing 17bps and briefly touching 4.10%.

After whipsawing briefly, the 10-year yield settled 5bps lower at 3.51%, nodding to the increased likelihood of recession on the back of tighter monetary policy.

In equities, the initial reaction was red with all indices down over 1.50% but bounced back strongly ahead of Powell’s conference. Daily highs didn’t hold for long, though, as Powell’s tone during his speech blessed the idea of stock markets testing yearly lows.

The yield curve inversion also reached its steepest level since the 2001 recession, reaching -54bps.

Post-Meeting Conference

In his speech post-meeting, Powell remarked early on that the Fed continues to be strongly committed to re-establishing price stability by “moving our policy stance purposefully to a level that is sufficiently restrictive.”

The Chairman highlighted two things he believed the Fed would need to see in order for inflation pressures to ease:

- A period of below-trend growth

- A softer labor market

The Fed still believes the economy remains strong, again pointing to the strength of the current labor market despite signs of slowing in other sectors. When asked how deeply or how long below-trend, Powell avoided any definitive answer but made clear that American would experience some “pain.” He defended the stance by noting that from their view, failing to achieve price stability and forcing the Fed to tighten in a weaker economy would have a far worse outcome.

Backing the sentiment, for the first time, the Fed’s economic projections acknowledged a higher unemployment rate, suggesting it’d reach 4.4% in 2023 and remain there for a couple years.

Unlike previous appearances, Powell also tackled the recession question head-on. He acknowledged that he doesn’t know whether this will lead to recession or how substantial that recession might be, but the probability of a soft landing would continue to decrease as their policy becomes more restrictive.

Although he continued to pound the hawkish drum as loud as ever, the Fed Chair made sure to note that they’ve seen some positive response to tightening policy:

- Some cooling in the housing market

- Hints of signs of the labor market beginning to soften

- Inflation expectations remain at lower levels

Now that we’re finally crossing into restrictive territory, we’ll really start seeing results from tighter policy, right?

Applying the Brakes

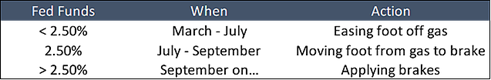

If you caught our Monday newsletter, you might recall that the Fed believes the neutral rate to be around 2.50%. Today’s hike means that from their perspective, they’ve just started applying the brakes.

Financial conditions have also just recently begun to cross into restrictive territory and, although the current trajectory suggests we could cross the recession threshold by the end of the year, that could still leave a couple more meetings before that point.

Remember, the Fed wants to get policy to at a least a moderately restrictive level and Powell’s consistently illuded to the Fed’s willingness to do whatever it takes to rein in inflation. If the Fed’s really just now started toeing the brake pedal and they’re willing to steer us towards a recession, then the rate projections in their latest materials could be on the table.

Takeaways

Markets are now expecting floating rates to hit 4.25% by the end of the year, implying two more 50bp hikes in 2022. Further, the peak has been moved up to 4.50% in March.

More importantly, higher rates are now expected to stick around for longer, with the market and the Fed in agreement that we’ll be above 4.00% at least into 2024. With Powell’s resolve to achieve price stability at all costs, the likelihood of rate cuts as recession signals to pile up continues to wane.

Although inflation data will still be the primary driver of changes in Fed policy, be sure to also keep an eye on signs of further slowing in labor markets.