Five Reasons Why The Fed Won’t Hike June 14th

Last Week This Morning

- 10 Year Treasury at 3.81%

- German bund at 2.53%

- 2 Year Treasury at 4.57%

- LIBOR at 5.15%

- SOFR at 5.06%

- Term SOFR at 5.15%

- Core PCE came in slightly higher than forecasted

- y/y came in at 5.0% vs 4.9% expected

- m/m 0.4% vs 0.3% expected

- I hate the Celtics with a white-hot passion

- I don’t have anything clever to say, just reiterating that

Five Reasons Why the Fed May Not Hike on June 14th

Core PCE, the Fed’s preferred measure of inflation, came in a bit higher than expected Friday. Some interpreted this as a lead pipe lock for a hike on June 14th. That thinking is stale. Sure, three months ago that sort of Core PCE print would have had the market debating between 25bps and 50bps, but that was before three of the four biggest bank failures in history transpired.

I think it increased the odds of a hike, but it’s still not a certainty. Inflation and unemployment are the Fed’s dual mandate, but the super-mandate is financial stability. We’re all totally ready to give the all clear on the financial system?

The Fed has been unanimous in rate decisions for the last two years, but that may change in the coming meetings. And I think the “pause” camp is being led by Powell. He has had a lot of opportunities to suggest more tightening and has not done so.

We all know the reasons why the Fed might hike again, no matter how much I might disagree with them. But let’s spend a few moments discussing why a hike isn’t a total certainty even after Friday’s inflation report.

Reason #1 – The Banking System is Fine, Pinky Swear Promise

Powell & Co have spent a lot of energy reiterating the banking system is sound and resilient. If we take them at their word, that must mean the emergency measures enacted at the height of the contagion in March have subsided, right? If I pull a graph of the Bank Term Funding Program outstanding balance, it should either have dropped significantly or even been terminated entirely, right?

Whoops.

Any chance the Fed is keeping these emergency measures open so regional banks can figure out how to handle their own MtM issues while they keep losing deposits to the Big 4 banks?

Reason #2 – Some Measures of GDP Suggest Recession Already

Q1 GDP was revised up from 1.1% to 1.3% (annualized). Yay?

Interestingly enough, the Fed uses a couple of different measures for economic growth. Obviously, we all know about GDP (which was GNP when I was growing up). But there are a few other measures.

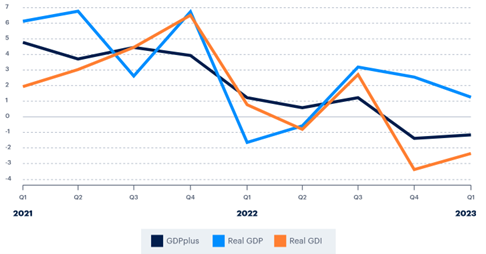

GDI, or Gross Domestic Income, attempts to measure the same thing as GDP but using a different basket of inputs. GDI is generated by the same government agency as GDP, so this isn’t some random data series from the far corners of the internet.

Q1 GDI came in at -2.3%. And that was after Q4 GDI came in at -3.4%.

And the Philly Fed has its own GDP Plus index, which came in at -1.2% after finishing Q4 at -1.4%.

Although these two indices fit the generally accepted definition of a recession (two consecutive quarters of contraction), the Fed does not believe the US was in a recession given the labor market resiliency. That being said, it would be impossible to argue the economy hasn’t slowed tremendously since the Fed started hiking.

If you’re Jay Money, aren’t you a little nervous about hiking again when clearly the signs are signaling a dramatic slowdown?

Reason #3 – Inflation Expectations Are Relatively Low

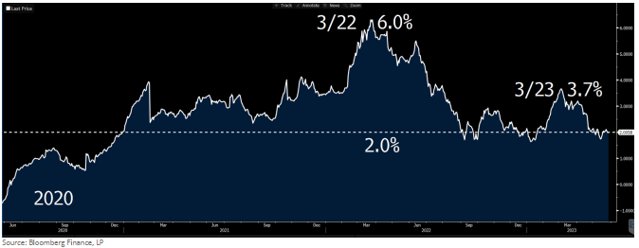

Since the Fed first hiked, one year ahead inflation expectations have fallen from 6% to 2%. That buys Powell some time.

If expectations were surging again, Powell would be more likely to hike (even if he didn’t want to) just to rein those in.

Reason #4 – Rents Are Falling

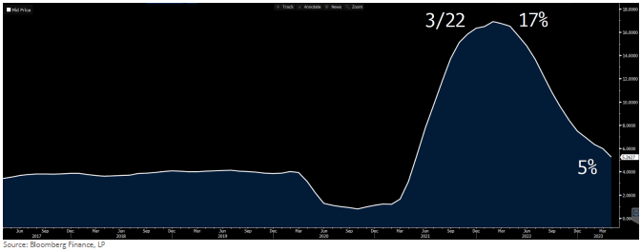

By now, even my grandmother knows the shelter component of the inflation readings have an enormous lag, but what if we looked at more timely data…like that provided by Zillow. Zillow’s index shows that rent inflation has fallen from 17% at the first hike to 5% today.

If CPI/PCE captured data on a more timely basis, how much lower would inflation readings be?

Reason #5 – Real Rates Are Positive (aka Restrictive)

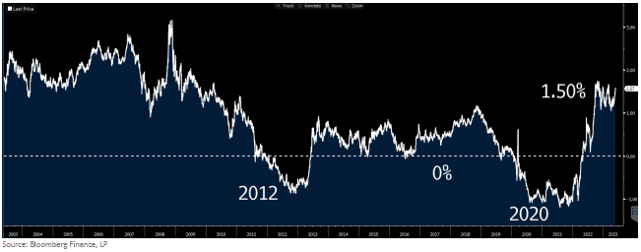

At the last meeting, Powell said real rates are around 2% and well into restrictive territory. He doesn’t need real rates to be higher, he needs them to stay here for a while so they can sufficiently slow the economy.

Hiking more now may just cause more damage without a corresponding benefit in inflation.

Takeaway

The minutes from the most recent FOMC meeting showed a divided Fed. Some expect to pause, some believe there is more work to be done. I believe both are correct, but that another 25bps hike doesn’t help.

If the Fed pauses, they will likely try to convince markets that future hikes are still firmly on the table. This is a stall tactic to buy more time to see how incoming data looks…or if more banks implode.

We get the next jobs report this Friday and another CPI print before the next meeting. Plus, who knows if Congress actually passes a debt ceiling agreement.

Right now, the June 14th meeting is a 50/50 proposition, but markets have a 70% chance of a hike between now and the July 26th meeting. But what does Jay think?

“We’ve come a long way in policy tightening, and the stance of policy is restrictive, and we face uncertainty about the lagged effects of our tightening so far and about the extent of credit tightening from recent banking stresses,” Powell said Friday in Washington. “Having come this far, we can afford to look at the data and the evolving outlook to make careful assessments.”

That doesn’t sound like a man hellbent on hiking in 3 weeks.

- If market odds of a hike surge through 60% in the coming weeks, the Fed is hiking

- If not, I think they are on pause with a signal they are keeping their options open for July

Rates and Caps

The 10T has run back up to the highest yield since SVB. With a top end of the range of 3.90%, I don’t expect to break through that. This is a temporary sell-off.

Caps got whacked with last week’s 30bps move higher in the front end of the curve. Even if the Fed pauses, short term caps (eg 1yr caps) are likely to experience the least amount of relief because the Fed is certain to stress a pause does not mean there are cuts coming. This will be exacerbated if the Fed successfully convinces markets a pause could be temporary and a July hike is on the table.

Longer term caps will still benefit from a downward sloping forward curve, but year one will be expensive.

Week Ahead

Will the debt ceiling pass through Congress? Will jobs again exceed the 180k forecasted gain? Will Kendall be the next CEO of Waystar?