Fixed Rates Down: Lock In Or Risk Rates Changing?

Since their peak on June 14, rates are down 0.50-0.60% across the curve on the back of eco data, Fed speak, and mounting recession fears. If you’re locking a fixed rate in the near future and want to avoid rates potentially spiking, you could cross your fingers… or consider executing a swaption.

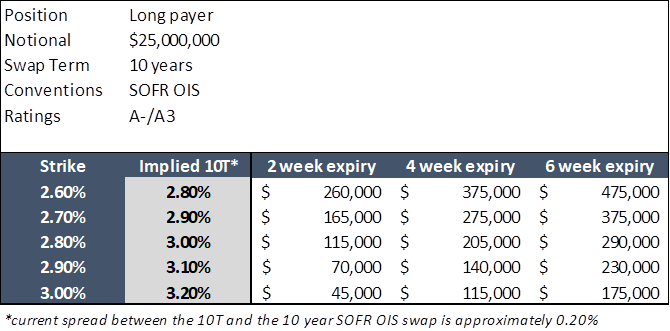

Since swaptions are options on swap rates (and not US Treasurys) they’re effective but not always a perfect hedge. Since the beginning of 2022, the spread between the two has varied from 0.16%-0.24%, and at the time of writing, was ~0.20%. In other words, there could be a couple bps of mismatch but swaptions otherwise perform well for efficiently putting a ceiling on rates.

Here’s some generic pricing on a variety of structures. By way of example, if you wanted to put a ceiling on the 10 year Treasury at ~3.00% for a rate lock occurring in 4 weeks, you would execute the 2.80% strike at a cost of $205,000.

Frequent readers are likely familiar with the mechanics of swaptions at this point, but if not, here’s a quick refresher:

- An upfront premium is paid for the option, which puts a ceiling on the 10 year swap

- If at the expiry the swap rate > strike, the bank pays the borrower the present value difference between the swap rate and the strike

- Borrower rate locks with their lender and the swaption payment can be used to offset the increased rate.

- On a $25mm 10 year deal, a swaption in-the-money 10 bps pays out ~$220,000

- If at the expiry the swap rate < strike, the option expires worthless, and borrower still rate locks with their lender

- More here

If you’d like to see pricing for your deal or discuss in greater detail, please reach out to the team at pensfordteam@pensford.com or 704-887-9880.