FOMC Primer (and an NFL Draft Spite Site)

The NFL draft is Thursday and I have no doubt my Philadelphia Eagles will blow it again this year. Sometimes, my sports teams cause me so much anger I need an outlet. A few years ago, I started buying up website domains just to constructively vent my frustration.

My wife calls them “spite URL’s”. I own about a dozen of them, mostly centered around the Eagles and Penn State football. Until now, I haven’t actually built a website on any of them, mostly because my hatred was shared by decision makers (dougpedersonisajoke.com and rickyrahnemustgo.com) and they were pushed out before I could build a site.

Heading into last year’s draft, we needed WR’s and CB’s. Somehow, Justin Jefferson fell into our laps. It was perfect – run to the podium and turn that card in! But when the name was announced, it wasn’t Jefferson (who went on to set all sorts of rookie records). Heck, I had never even heard of this guy – Jalen Reagor. I watched the highlights of this guy who was supposedly being picked for his quickness and elusiveness. I know less about football than I do about interest rates, but nothing about this guy said he was the next DeSean Jackson. He wasn’t quick or elusive. He got run down from behind in most highlights. I was livid.

Day 2 and it can’t go any worse, right? We still needed help in the secondary…and then we picked Jalen Hurts! We had just signed Carson Wentz to a massive contract and we waste a second round pick on a guy we hope never sees the field?! We have one of the oldest rosters in the league and we’re grabbing guys that won’t contribute?

You know how the season played out. The Eagles were a clown show, Doug Pederson was fired, and surely GM Howie Roseman would be sent packing, too, right?

But Howie Roseman must have dirt on Jeffrey Lurie. He’s a special kind of survivor. Fortunately for me, last year I bought a Howie-inspired spite URL to vent my frustrations. I figured there’s no way he survives the year if these picks don’t pan out and I’ll never get to make a site, but I was wrong. The picks (and the team) did worse than I could have imagined and yet Howie is still making the calls this week. And our new head coach is evaluating competitiveness by asking prospects to play rock/paper/scissors. True story.

This year, with the help of some colleagues, I put some effort into building out a spite website in honor of Howie. If you’re looking to express your own frustrations vicariously through me, check out the site. It’s even got a hidden easter egg with a conspiracy theory buried in there.

If you’re like my wife, you might be asking why I keep watching the Eagles if I hate them so much? “Because no one likes a quitter, Sarah!”

I did, however, make the following deal with her – if Devonta Smith is available at 12 and we don’t take him, I won’t watch another Eagles game until Howie is gone.

I suspect she spent the weekend creating “hype URL’s” to artificially drive up the value of other players to encourage Howie to pick them instead. It’s not hard. Just pick a player everyone agrees is a third-round talent and leak some advance metrics about him. Howie will outsmart himself.

Last Week This Morning

- 10 Year Treasury fell further to 1.55%

- German bund unch at -0.26%

- 2 Year Treasury unch at 0.16%

- LIBOR at 0.11%

- SOFR at 0.01%

- New home sales jumped more than 20%

- MIT researchers concluded 6 feet of social distancing is no better than 60 feet and the CDC recommended J&J benefits outweigh risks

- The CDC is also looking at whether masks outdoors are necessary

- Why are on-location reporters, standing alone, wearing masks during their airtime?

Don’t Fight the Fed

Recently, markets got ahead of themselves by pricing in almost two hikes by year-end 2023. We were skeptical all along, believing Powell et al were committed to 0% interest rates and would tolerate an overly hot 2021.

Over the last two weeks, the market has backed out some of those expectations. If you’ve been pricing caps, you’ve probably seen the cost come down for this reason. Here’s where the market put 1mL:

Reset Today April 1

Dec 2023 0.81% 1.03%

I still think the market is overestimating the path of LIBOR, which will probably be below 0.25% and definitely below 0.50% in December 2023.

This week’s FOMC meeting is another opportunity to remind markets that the Fed won’t be hiking in 2023. The more Powell reiterates the Fed isn’t hiking despite spiking inflation and GDP (Q1 GDP comes out Thursday and is forecasted at 6.9%), the more likely the market will have to throw in the towel. We expect the Fed to acknowledge the improving economic outlook while reiterating patience.

The lesson, as always, is don’t fight the Fed. Also, is Jay Money Powell available to be GM of the Eagles?

Fed Funds

Obviously, I expect the market to continue backing out rate hike expectations. The market is pricing in a 10% chance of a hike this year and a 45% chance of a hike in 2022. These are absurd.

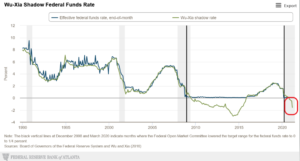

A few months ago, we reminded everyone that the “real” Fed Funds rate was headed negative. That has finally started showing up in the data, particularly the Wu-Xia Shadow Fed Funds rate, which is now about -1.50%.

This model suggests that when the published Fed Funds is below 0.25%, the real Fed Funds can continue below the zero bound. That’s about halfway to the all-time low of -3.0% in late 2014.

This is contributing to incredibly accommodative financial conditions, which are now at an all-time accommodative position. Things are going to be running hot for a while.

10 Year Treasury

As the US emerges from COVID, keep in mind other countries will trail us. We can’t fully detach from the global economy, and that will keep a lid on yields here.

The spread between the 10T (1.55%) and the German Bund (-0.26%) ran up dramatically over the last year, but actually has begun retracing over the last two weeks.

Keep an eye on this spread in the months ahead.

- if the bund stays at current levels, it becomes harder and harder for the 10T to push incrementally higher

- if the bund moves up (towards 0% or above 0%), it gives the 10T rope to move higher

- if the bund moves lower (towards -0.50%), it could drag the 10T down with it

Week Ahead

Obviously, the Fed meeting is the headline act, but we also have a ton of economic data. Durable goods, consumer confidence, Case-Shiller Home Price Index.

Most importantly, GDP could come in around 7%.

Buckle up.