FOMC Primer – Will the Fed Call for Hikes Next Year?

On Friday, my wife and I had the following conversation following the 8:30am data release.

Me: “CPI just came out, 6.8%.”

Wife: “Is that the highest ever?”

Me: “No, but the highest in 40 years.”

Wife: “So the highest in modern history.”

Me: “Are you saying we were born before modern history?”

Wife: ………

Me: “Well my knees agree with you.”

Last Week This Morning

- 10 Year Treasury recovered 15bps, finishing at 1.49%

- German bund up 4bps -0.35%

- 2 Year Treasury reached a high of 0.725% leading up the CPI release before falling to 0.66%

- LIBOR at 0.10%

- SOFR at 0.05%

- CPI Inflation notched a historic 6.8% YoY, the highest since 1982

- Core CPI at 4.9%, another 30-year peak

- Both inflation readings matched expectations, which comes as a relief to markets that were bracing for yet another surprise to the upside

- Job Openings hit an all-time high of 11 million

- Consumer Sentiment improved to 70.4 off a 10-year low of 67.4

- Whether this is a temporary boost from Michigan making the college playoffs remains to be seen

- Early reports describe the Omicron variant as no more harmful than Delta, helping ease market anxieties entering the Winter.

- Pfizer/BioNTech report their vaccine is effective at neutralizing Omicron in early lab tests

- If you can lose five games a year, you too can sign a 10 year $100mm contract

Shipping Update

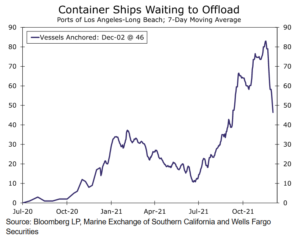

I included this graphic in last week’s newsletter to highlight the improving LA port situation.

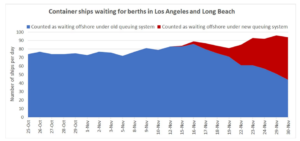

On Monday, a reader emailed me to point out that the government had simply told ships to dock farther off the coast, thereby dropping out of the count! In the graph below, the blue is what is being most commonly reported, while the red is the # of ships that simply anchored further offshore but are in the queue. Add them together, and the situation is worse than ever!

A record 97 ships are now waiting to dock at SoCal ports, with over half of those anchored outside of the old counting radius. Sneaky!

Inflation

My favorite economist of all time is Julia Coranado, who I started following when she headed up BNP’s research team a decade ago. She left in 2017 to form her own research company, Macro Policy Perspectives (https://www.macropolicyperspectives.com/), which is heavily used by traders, hedge funds, economists, and other people far smarter than me. Seriously, you should quit reading this and read hers (I don’t have any affiliation with her, and she’s never heard of me, I’m just a raving fan). They conduct a shadow survey quarterly with about 50 questions and I’m going to rely heavily upon those results today rather than regurgitating typical inflation stories.

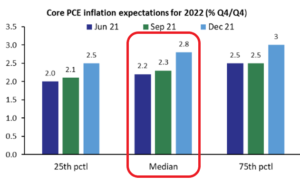

From the 117 respondents, Core PCE inflation expectations for 2022 have risen from 2.3% to 2.8% in just three months.

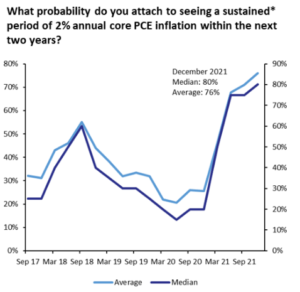

80% of respondents believe inflation will average at least 2% for the next two years. At this time last year, that number was less than 20%.

From the spring through the summer, every single discussion about inflation was about stimulus and government spending. No one, not one single conversation, cited supply chain dislocations.

I think the sudden spike in inflation expectations is the realization that supply chain dislocations will continue for the foreseeable future. Before recently, the discussion has been a philosophical one about stimulus vs no stimulus. QE vs tapering. Enhanced unemployment.

But answer me this – if inflation peaks in January, starts dropping, and then falls off a cliff in April, is the Fed still going to feel pressure to hike rates next summer?

FOMC Primer – The Dots Will be the Main Event

Previously, the Fed’s biggest concern was managing inflation expectations going into next year. Now it’s facing a much bigger concern – managing its credibility. Tapering will be the undercard as the meeting will likely result in a policy shift from Powell and crew. Markets are fully expecting the Fed to upshift and complete bond purchase tapering faster than originally planned.

More importantly, what does that imply for rate hikes? “A month ago, the Fed said tapering would take 6 months. Now they’ve doubled that pace. If we can’t trust them on tapering, how can we trust them on hiking rates?”

Obviously, the Fed’s updated projection for Fed Funds will be the main event. Even though not all dots are created equal, if a majority of FOMC voters line up with multiple hikes next year, it won’t matter what Powell’s dot suggests.

Although the Fed insists that tapering and interest rate takeoff are entirely different animals, an acceleration in tapering will naturally lead to questions about the timing of interest rate hikes. Markets are already predicting more rate hikes than the Fed’s dot plot suggests and will be watching to see if Powell shifts course on hikes like he did on tapering.

I think Powell is trying to ride out the inflation storm. The fact that Friday’s number didn’t shock to the upside probably allowed him to exhale just a bit. He knows next month will probably be over 7%, but as long as it isn’t a shockingly high number, he can ride it out. If he starts talking about hikes in June and inflation in April is 3.0%, what does he do? If the trend is heading down in the spring, is it really time to hike?

But if inflation doesn’t level off after the next print, he’ll probably throw in the towel. Markets are already pricing in a much more aggressive Fed next year. From that Macro Policy’s shadow survey:

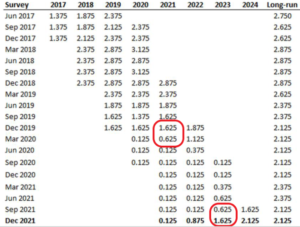

“Our median respondent expects the Fed to raise rates in June, September, and December of 2022 which would leave the fed funds rate at 0.875% at year-end. They then expect 3 hikes in 2023 to 1.625% and two hikes in 2024 to 2.125%, which is also their estimate of the long-run neutral rate.”

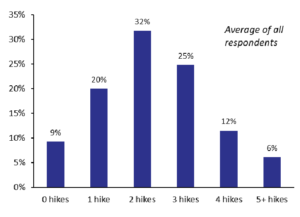

Q: What probability do you put on the following rate hike scenarios in 2022?

75% of respondents expect at least 2 hikes

More respondents expect 4 hikes than no hikes

I am among the lowly 9% that still expects no hikes (gulp)

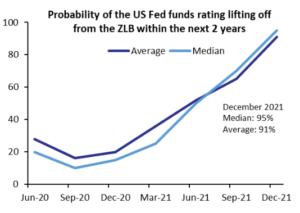

A full 95% of respondents expect at least one hike over the next 24 months.

Look below to see how dramatically expectations have changed since their last survey in September. In just three months, the median expectation for 2023 is a full 1.00% higher! In fact, the only other comparable shift was when Covid began and the respondents concluded FF would plunge by 1.00% more than in the prior survey. Covid gets to claim the biggest shift in expectations both up and down.

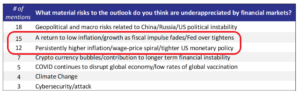

Paradoxically, when asked what risk is most underappreciated by markets, an overly aggressive Fed actually beat out inflation.

“The Fed is behind the curve but they will also overdo it,” – market sounding about as balanced as me complaining about my football teams.

Then again, they both trailed geopolitical risks.

Week Ahead

FOMC meeting. That’s it.

Retail Sales data and Manufacturing/Services data will serve to bookend the Fed press conference.

Omicron developments.

But let’s be real – FOMC dot plot.

Next week we get to revisit my predictions from last year. Here’s a little teaser for you: “Leadpipe Lock #3 – Inflation Will Not Be a Problem in 2021.”

Should be a blast.