Full Effects of Tightening Have Yet to be Felt

The Fed basically changed nothing, which is a relief to markets. No news is good news.

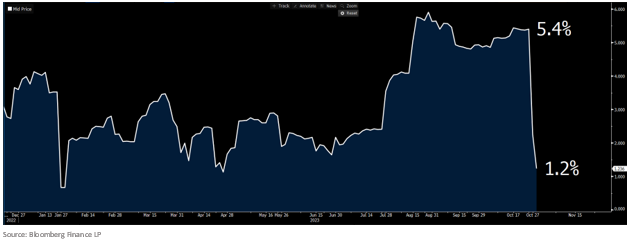

The 10T is down 18bps to 4.75%. Keep in mind that 4.75% is a key level and is serving as a floor. If we break through that, 10Ts could move lower just as quickly as they moved higher.

The 2T is down 17bps to 4.93%, which should help a touch with cap pricing.

Market Reaction

Odds of a hike at the December 13th meeting is just 19%, with the odds of a hike at any time just 25%.

In May 2024, odds of a cut exceed odds of a nothing or a hike.

The forward curve post-meeting:

Y/E 2024: 4.56%

Y/E 2025: 4.04%

Rate Cuts Next?

When asked about the potential for rate cuts, Powell noted, “The fact is the Committee is not talking about rate cuts.” Got it, so no cuts ever. Checks out.

But then I remembered that on June 10, 2020, Powell said, "We're not even thinking about thinking about raising rates." That was 550bps ago.

Just because they aren’t talking about cuts doesn’t mean they aren’t coming.

Proceeding Carefully

Powell also repeatedly said, “the Committee is proceeding carefully”, which is good news because look at the Atlanta Fed GDPNow Forecast for Q4 GDP.

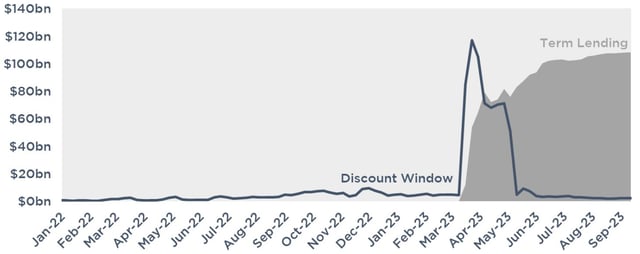

The other reason I think the Fed should be careful is this darn banking system they continue to pinky swear promise is strong and resilient. Someone asked if rates aren’t lower in March will the Fed extend the program, he said, “Good question, we haven’t been thinking about that. We will make that decision in Q1.”

That sounds an awful lot like they might extend that program in March…or lower rates so the unrealized losses on Treasurys aren’t quite so nasty.

Other Interesting Notes

“Efficacy of dot plot decays during the three months between meetings”

- This sounds like we should expect downward revisions in Dec 2023

“We are not confident that we have or haven’t reached a point that is sufficiently restrictive.”

- How is this possible after hiking 5.50% in a little over a year?

“The idea that it would be difficult to hike after having stopped for a meeting or two is not right.”

- He had to say this, but he doesn’t mean it

For the first time that I can ever remember, a Fed Chair admitted a drop in equities could influence future monetary policy decisions. We’ve always known it, but it was one of those things they weren’t supposed to mention.

Takeaway

The lag effects are finally starting catch up to us. The Fed sees the slowdown coming, but will they wait too long to cut like they have historically?

Yes.

The Fed is done hiking and cuts will catch us off guard. I think that next year, the Fed cuts more than the 1% the market is expecting.