Hope is a Horrible Hedge

Last Week This Morning

- The 10T started the week at 2.90% and fell to 2.86% on continued trade war fears

- German bund closed at 0.30%

- 2 year Treasury opened at 2.55% and closed at 2.53%

- Yield curve steepness is now just 0.33%

- Am I the only one worried about this?

- LIBOR at 2.10%

- SOFR at 1.93%

- Core PCE, the Fed’s preferred measure of inflation hit the targeted 2.0% for the first time in six years

- Harley Davidson and GM don’t understand how tariffs work – these are going to bring back jobs you guys!

- Rumors swirling that Chief of Staff John Kelly is likely to be replaced in the coming weeks

- Draghi indicted the earliest the ECB would hike rates would be September 2019

Is the Fed Almost Done Hiking?

Our June 4th newsletter theorized that we are closer to the end of the tightening cycle than the beginning. With inflation finally at 2.0%, will the Fed need to hike more than expected?

Probably not.

Inflation is sticky. It doesn’t generally move sharply month to month. It’s more of a long play type of data point.

The Fed has started using the word “symmetric” to describe its approach to monetary policy with respect to inflation. Basically, because inflation has lagged for six years, the Fed is comfortable letting it overshoot 2.0% for some time without intervening aggressively.

Now, if inflation starts looking like it’s headed to 2.50%, I think the Fed will ramp up rate hike talk. But that isn’t a base case outcome. Here’s a snapshot of the Bloomberg Survey of Economists for Core PCE over the next few years.

Year Mean High

2018 2.0% 2.1%

2019 2.1% 3.3%

2020 2.2% 2.8%

That high forecast of 3.3% is a bit worrisome, so I dug in. It’s a forecast made by Guerrilla Capital Management, who somehow doesn’t even have a website (which is maybe the ultimate level of cool). The next highest “high” forecast is 2.7% by the CME group. Setting those two outliers aside, no other “high” forecasts exceed 2.5%. That obviously doesn’t mean Guerrilla’s projections won’t come to pass, but its important to put them into context.

How about GDP?

Year Mean High

2018 2.9% 3.9%

2019 2.5% 3.9%

2020 1.9% 3.6%

Much to my surprise, it wasn’t Guerrilla forecasting the highs this time around. But it is interesting to note that only two firms project GDP above 3.0% in 2019.

2017 actual GPD was 2.3%. That means we are probably at the peak right now. A lot of economists are suggesting Q2 GDP will hit/exceed 4.0%…before gradually declining.

- inflation inching higher, but not spiking

- GDP peaking and declining

- flattening yield curve

I think the Fed will find it increasing hard to hike rates over the next year. While Fed Funds may eventually get to 3.00%, I don’t think it will be as fast as the FOMC is currently projecting. And I think it’s more likely FF ends up 2.50%-2.75%.

The first step will be to start backing down on rate hike talks, possibly even lowering projections gradually. Perhaps a pause here or there.

And at what point will the Fed start to acknowledge the flattening yield curve?

Hope is a Horrible Hedge

The Fed has done a pretty good job of gradually withdrawing accommodation over the last two years without shocking the market.

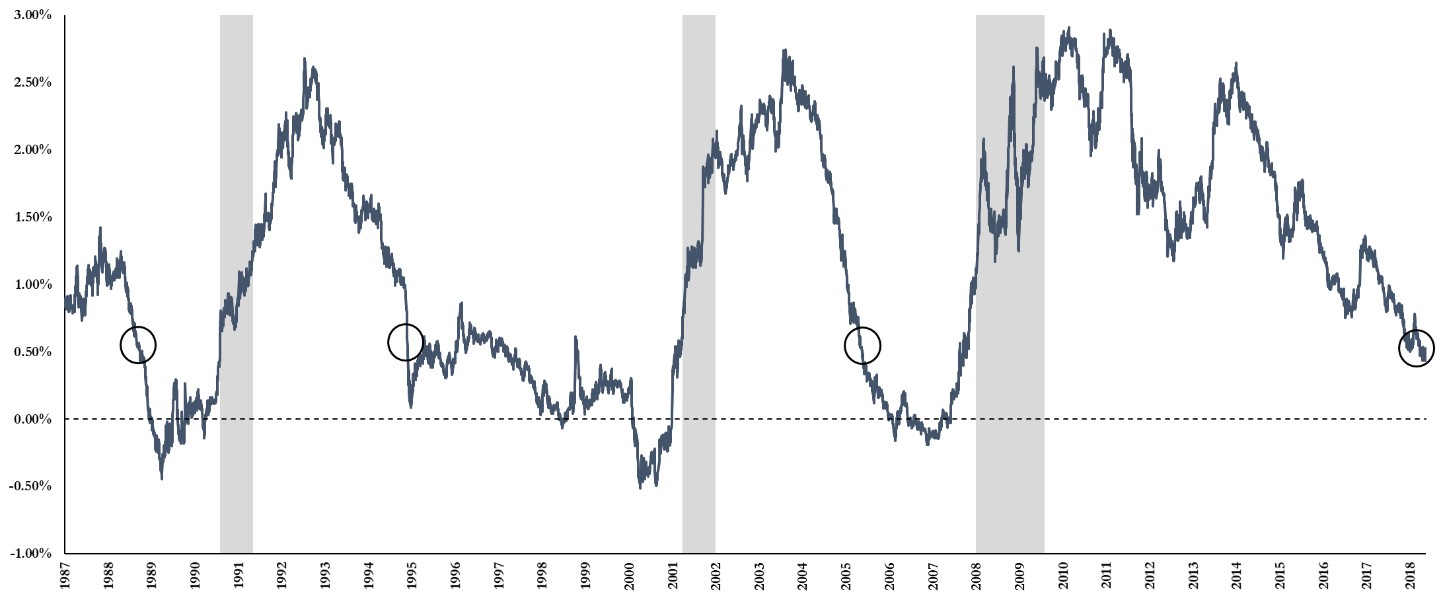

But its total lack of respect for an inverted yield curve is worrisome. Minutes from the March FOMC meeting revealed Fed officials “generally agreed that the current degree of flatness of the yield curve was not unusual by historical standards.”

More commentary:

“I don’t think it’s likely the inversion of the yield curve is a reflection of a recession to come.”

– Randal Quarles

“The flattening of the yield curve that we’ve seen is so far a normal part of the process, as the Fed is raising interest rates, long rates have gone up somewhat.”

– San Francisco Fed President Williams.

“I am actually not as worried about it”

– Boston Fed President Rosengren

“It’s true that yield curves have tended to predict recessions if you look back over many cycles. A lot of that was just situations in which inflation was allowed to get out of control and the Fed had to tighten and put the economy into recession. That’s not really the situation we’re in now.”

– Fed Chairman Jay Powell

This is as shocking as it is disappointing. Heck, the San Francisco Fed itself released a study in March that showed every recession over the last 60 years was preceded by an inverted yield curve. And per Powell’s point that this time is different? That same research paper concluded:

“While the current environment appears unique compared with recent economic history, statistical evidence suggests that the signal in the term spread is not diminished.”

In only one instance has the yield curve been this flat and not inverted – the mid 1990’s. The Fed had hiked 3.00% in twelve months in 1993 and 1994, flattening the yield curve dramatically. But the yield curve didn’t invert? Why? Because the Fed cut rates three times in 1995, pushing Fed Funds back down from 6.00% to 5.25%. Those cuts help avoid an inversion and presumably a recession.

The Fed shouldn’t have to cut rates in order to stave off an inversion – just stop hiking for a bit. Or lower the eventual landing point or extend the timeline. Or hike to 2.50% and then pause. Lots of ways to avoid an inversion without needing to cut rates a la 1995.

The hikes in 2017 were unusual in that financial conditions loosened despite the hikes. But in 2018, hikes are tightening financial conditions once again. The Fed should be paying attention.

While the Fed has been dismissive of an inverted curve, there’s been quite a bit of talk about the new neutral rate being 2.50%-3.00%. The Fed will be challenged to keep hiking above neutral if financial conditions keep tightening and tax cut impacts fade.

I hope the Fed’s position is rooted more in wishful thinking than blatant disregard for precedent. I hope the Fed says it isn’t worried so as not to cause even more concerns. I hope the Fed isn’t concerned because it really expects the T10 should move higher (massive Treasury issuance, balance sheet normalization, etc), but will be flexible should that fail to happen.

I hope the Fed hikes two or three more times, pushing FF to 2.50%-2.75%. And then stops.

Since I’m a silver lining kind of guy, I am hopeful the Fed will change its position as the yield curve flattens.

But I also hope Trump eases his position on tariffs.

But as one of my mentors used to tell me, “Hope is a horrible hedge.”

This Week

Markets close early on Tuesday (2pm) and liquidity will start to dry up around lunch time as traders head off to the Hamptons for the 4th. Markets obviously closed all day Wednesday.

Lots of data in a holiday shortened week, headlined by Friday’s job reports.

Also, Thursday’s FOMC minutes from the June meeting have some dovish surprise potential. That meeting, the statement, and the subsequent Q&A with Powell were so overwhelmingly hawkish that it’s tough to envision a scenario where markets could interpret the minutes as surprisingly hawkish.