I Probably Won’t Be Invited Back by ULI

Last Week This Morning

- 10 Year Treasury had a volatile week, plunging to 1.67%

- German bund mostly flat on the week at -0.38%

- Japan 10yr down to -0.19%

- 2 Year Treasury inched up to 1.55%

- LIBOR at 1.79% and SOFR at 1.76%

- GDP came in at 1.9%, stronger than the forecasted 1.6%

- The economy added 128k jobs last month and the previous two months were revised higher by a combined 95k jobs

- The unemployment rate ticked up to 3.6%, but only because the participation rate improved

- Average hourly earnings 0.2% (lack of inflation)

- US manufacturing contracted for the third straight month

- Trump getting booed at a Nats game makes sense, but at a UFC event?

- Speaking of the Nats, congrats on an incredible run. The Phillies will sell Bryce Harper back to you for pennies on the dollar if it means they win the WS next year…

Jobs Report

Friday’s Non-Farm Payrolls, as they call them – I call them jobs. Beautiful jobs. Talented jobs. But what made Friday’s job report all the more impressive was that it came in the midst of a GM strike cost (41k jobs), Beto/Kamala layoffs (14?), and the end of the census (20k). And those census workers. You know, you’d think they’d go to the front door. If you’re a normal person, you say “knock knock may I come in?” But not them. There was a lot of shooting. A lot of blasting. They make holes. Big, beautiful holes and blast their way in to gather your data. And I suspect 2029’s census will just be a daily report sent to the government by your Alexa.

Accounting for those big factors, the 128k gain would have been 189k. And with the GM strike over, that means those will pump up next month’s numbers. This suggests the labor market will remain strong through year and adds credence to the Fed’s suggestion that no more cuts are planned this year.

Keep in mind, however, that 48k of the 128k jobs were restaurant service workers. The theme of quantify vs quality continues, but the data certainly suggests resiliency.

Fed Funds – Soft Landing

The Fed cut rates as expected, with two dissenters (George and Rosengren) calling for no cuts. Because this was an “off” meeting, there was no update to the Fed’s projections for Fed Funds. At the last meeting, the median forecast suggested no change through year end 2020.

Powell hopes the recent cuts allow the Fed to achieve the elusive soft landing. The economy continues to grow without causing speculative bubbles. “We believe monetary policy is in a good place to achieve these outcomes,” Powell said in his Q&A after the rate decision.

Powell is trying to walk a fine line, a lesson learned from last year’s missteps in Q4. You may recall he kicked off a market revolt on 10/3/18 by saying Fed Funds was, “a long way from neutral at this point.” In just three months, financial conditions went from very accommodative to restrictive. Powell backtracked on January 5, 2019 and conditions began easing quickly. Powell wants to avoid a repeat this year.

What Does This Mean for Floating Rate Borrowers?

- The Fed believes LIBOR will go unchanged for the next 12 months

- LIBOR almost certainly will not be higher within the next 12 months

- LIBOR could be lower if the data continues to weaken

- Interest rate cap pricing should look attractive

Because last week’s FOMC meeting was an “off” meeting, the Fed did not update its own projections for Fed Funds. But at the September meeting, the median forecast suggested an unchanged Fed Funds through year end 2020, and then one or two hikes in 2021.

Financings with hold periods of three years or less should have minimal risk of floating rates climbing materially by the end of 2022.

The market has odds of a December cut at just 16%, which feels about right. I just can’t see the Fed cutting against a backdrop of a strong labor market and a trade dispute that has (at least temporarily) stopped escalating.

Economic expansions don’t die of old age. We’ve been hearing about the economy being in the 9th inning for years now, but there’s a reason we use a baseball analogy – innings don’t have a clock. There’s no countdown to when the expansion has to end.

The Fed won’t be the reason this expansion ends this time. Powell realized he had over-hiked. So he eased off the brakes and now hopes it has given the economy room to run. Something else might cause a downturn, but it won’t be monetary policy.

A soft landing.

Fixed Rates

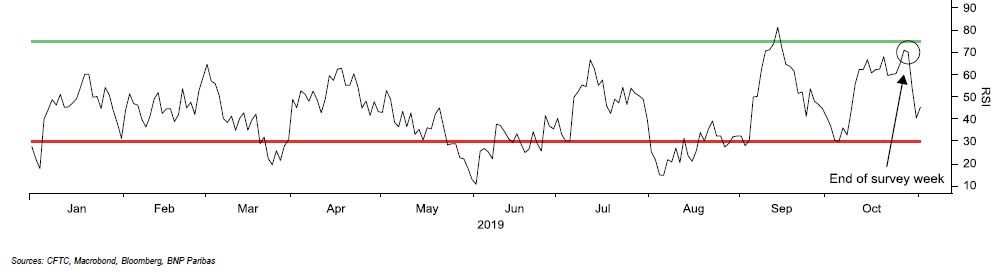

The 10 Year Treasury has settled comfortably in the middle of the 1.50% – 2.00% range. My favorite Relative Strength Index from BNP suggests last week’s drop in rates puts the 10T in a neutral position – not too hot and not too cold. Just about right.

Election

I was the moderator at a Charlotte ULI Capital Markets panel last week. The topic was the transition from LIBOR to SOFR, but the host kicked off the meeting by asking everyone to use three words to describe the impact next year’s election will have on their business. Some variation of “potentially a ton” were the most common response. Mine?

“Afterwards, not much.”

I was literally the only person in the room with that view.

I generally believe the impact of politics are overstated when it comes to the US economy. We treat our political party affiliation with the same fervor as our favorite sports team. It’s us vs them. Right vs wrong. Good vs evil. When we win, we celebrate (and maybe even taunt). When we lose, we sulk and scream, “just wait and see!”

But does our behavior actually change? If my team loses, do I take my ball and go home? I’m just going to sit out the next four years and hope my guy/girl wins next time around? Come on.

I have plenty of commercial real estate clients that proudly wear the GOP pin on their lapel. In 2016, they were telling me how critical it was for Trump to defeat Hillary. My response was something like, “Because your business has been so unprofitable under Obama?”

And with my left-leaning clients, I would hear, “The economy will collapse if Trump wins.” Whoops.

Commercial real estate professionals are deal junkies. If Bernie or Elizabeth win, you’re going to stop doing business? Please. Go sell that ocean front property in Arizona to someone else. This is the same group that found ways to get deals done when rates were 20%.

Real estate firms just want to know what rules to play by, and a presidential election creates uncertainty about the rules.

In 2012 and 2016 I saw the exact same thing. Transaction volume dried up in the months leading up to the election (uncertainty around the rules). Immediately after the election, transactions spiked (rule certainty).

I can’t think of a single thing I agree with Bernie Sanders on. But if he somehow wins and tries to usher in democratic socialism, am I shutting down and moving to Canada? Are you sending your investors’ money back with a note to check back in in 2024? And before you start sending me hate-email, I’m not saying it won’t have any impact, just that it will be much less than our emotional response suggests.

The economy is bigger than any one person or election. But we are so passionate about our team that we assume the worst if our team loses. Maybe it just takes a Philadelphia sports fan jaded by decades of inadequacy to realize that the world doesn’t actually end after a loss.

Had the ULI host instead asked, “In 26 words, describe the impact of the 2020 election on your business”, I would have said:

Transaction volume will slow down in late summer, persist through the election, and then return to normal levels once we know what rules to play by.

But since I was limited to three words, I said, “Afterwards, not much.”

The sounds of crickets chirping reinforced that I was alone in my view. I suspect I will not be invited back.

This Week

Lots of Fed speakers trying to clarify the FOMC message from last week, but pretty light on economic data.

Stocks may set an all-time high now that the Fed has delivered another rate cut and there is optimism on a trade deal with China.