If You Can Dodge a Wrench, You Can Dodge a Rate Question

The Fed hiked 0.25% to 5.25% - 5.50%. Powell wrangled another unanimous decision out of the Committee, making John Roberts green with envy.

It also reinforces what I pointed out at the last meeting – backroom deals were made. Powell on June 14th: "I’ll give you a hike in six weeks if you give me a pause today.” It’s the only way I can explain a pause in June and a hike today when inflation fell by more than expected in between.

For the first time in a long time, there was no forward guidance provided. Powell spent the entire 30 minutes avoiding a commitment of any kind. Instead of a scarf, I see the spirit of Patches O’Houlihan tossing Powell a purple tie, “If you can dodge a wrench, you can dodge a rate question.”

Without an update to the Summary of Economic Projections (every other meeting), let’s jump into the Q&A.

QA Highlights

- We haven’t made any decisions about hiking every other meeting going forward. We are going meeting by meeting.

- June CPI was welcome but it’s only one month of data.

- We will be looking for moderating growth. Supply and demand coming into balance, particularly labor.

- Two more jobs, two more CPIs between now and the next meeting

- It is certainly possible we would raise rates in September, and it’s certainly possible we hold steady.

- We’re not targeting wage inflation.

- Labor markets are cooling. The historical record suggests a softening in the labor market is very likely.

- SLOOS will come out early next week. It’s broadly what you would expect. Pretty tight credit conditions in the economy. Credit conditions are tight and tightening.

- Fed won’t be cutting rates this year… probably.

- There is a lot of debate about the lag effect monetary policy has on the economy. Markets are forward looking, so the clock started ticking earlier.

- The real fed funds rate very restrictive… is well above long term neutral rate, and more so after today’s decision.

- My base case is a soft landing. The Fed staff is no longer forecasting a recession.

- We won’t keep hiking until inflation gets to 2%. The FF is at a restrictive level and if we see inflation coming down sustainably, we can cut rates. We will stop raising long before we get to 2% inflation because we don’t see that until about 2025.

- Banking turmoil – things have settled down. Of course, we are still watching the situation carefully.

- Some meetings are less certain than others.

- Cutting rates while still actively pursuing QT? “That could happen.”

- Monetary policy has not been restrictive enough for long enough.

- Is the bigger risk doing too much or doing too little? “We are coming to a place where the risks are balanced to each.”

Market Reaction

Rates down 3-5bps across the curve.

Cap pricing is down just a touch, but not enough to write home about.

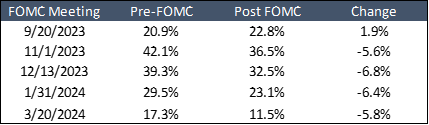

Market Odds of Another 25bps Hike

Here’s how odds of another hike changed since 2pm. The next meeting ticked up a bit, but the rest of the meetings came down.

Odds of a cut don’t exceed 50% until March 20 of next year.

Takeaway

I think they are done hiking, but I thought that after the last meeting, too. Inflation dropped more than expected since the last meeting, but they hiked… so how data dependent are they? How will data over the next six weeks really impact their decision?

The September meeting could be messy. Opinions are likely to continue to diverge. The data to be conflicting.

Perhaps most importantly, the Fed will update its economic projections at that meeting - how will those jive with the actual decision?

GDP tomorrow, inflation Friday, and SLOOS early next week… buckle up.