Inflation Fatigue

No, I’m not bitter, why do you ask? Because the alleged best defense in the league can get fooled not once, but twice, on simple motion in/out for wide open TDs? Or a terrible field that took away our greatest strength? Or that Hurts outplayed Mahomes. Or that the wrong Kelce brother was dancing at the end?

Going into the game, I felt we were the better team, but they had Mahomes. If we lost because Mahomes just went crazy, so be it. Sometimes Jordan is going to do Jordan things. But Mahomes was largely contained. We got beat on two terrible blown coverages, a terrible punt coverage, a fumble returned for a TD, and a terrible field that negated our greatest strength. About that script…

I am still in mourning. I ask that you respect my privacy during these difficult times.

Last Week This Morning

- 10 Year Treasury up to 3.82% from 3.70% to start the week

- German bund at 2.43%

- 2 Year Treasury at 4.62%

- LIBOR at 4.59%

- SOFR at 4.55%

- Term SOFR at 4.56%

- Tons of inflation data came in as expected or a little higher than expected

- Empire state manufacturing index came in at -5.8 vs expected -18.0

- Philadelphia Fed manufacturing index came in at -24.3 vs expected -7.5

Inflation Fatigue

We got about 90 inflation data points last week, most of which came out as expected or a little higher than expected. This caused the market to push rates up 10bps across the curve. I’m over it.

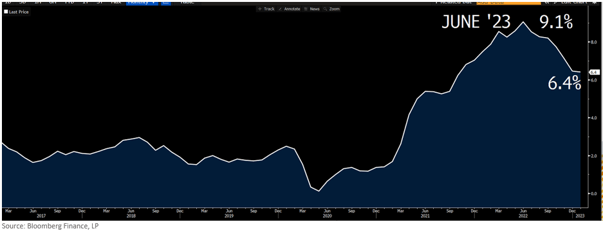

Inflation is down quite a bit in the last 9 months, with CPI down from 9.1% to 6.4%, a 0.4% per month clip - pretty rapidly all things considered. Remember, CPI is typically a little higher than Core PCE, so it isn’t expected to get back to 2%. If the 20 year average is 2.5%, and inflation keeps falling at the same pace (a huge assumption), we’d be back at 2.50% by year end.

I think the market has three primary concerns at this point:

- The first 3% were easier than the next 3%

- It could actually reverse course

- It is missing the forest for the trees

No time to catch our breath because on Friday we get the Fed’s preferred measure of inflation, Core PCE. This could go a long way to soothing markets or causing complete mayhem.

The market reacted to last week’s inflation data by pushing up the odds of a May rate hike, meaning the market now has Fed Funds to 5.25% instead of 5.0%.

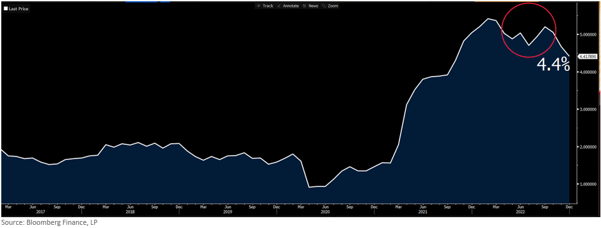

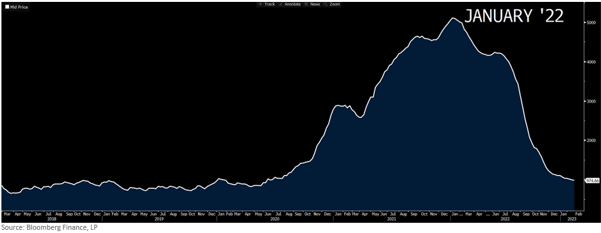

The bigger concern to me right now is that expectations are climbing again. Here are 1yr inflation market expectations. After driving below 2%, they have rebounded to 3%+. A similar pattern emerged in the fall, but hawkish Fed speak coupled with declining inflation caused expectations to eventually relent. Powell may feel like he has to talk up the hikes just to rein in expectations.

Expectations = entrenchment, so Powell will not mess around with reining those in. Expectations are the bigger threat to a pause than spot inflation data prints.

Powell said the disinflation process has begun, and I agree. I trust the JOLTS survey about as much as the State Farm turf and hate that the Phillips Curve is suddenly all the rage again when it was declared dead decades ago. But within that labor bucket, the wage pressure number actually makes sense to me. Higher wages = more spending power = more pricing pressure. Powell keeps citing wage pressure as Exhibit A for an overheated labor market.

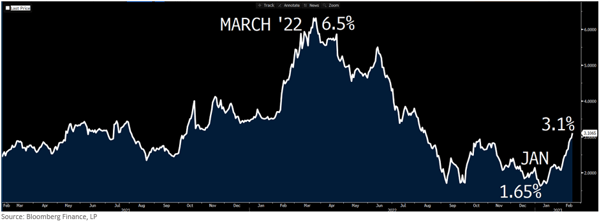

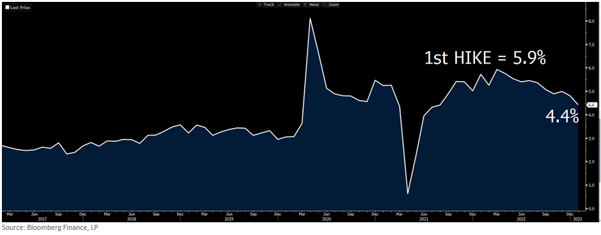

But are we really experiencing rampant wage pressure? Average Hourly Earnings came in m/m at 0.3%, which would annualize at 3.6%. Is that rampant? Heck, even the backward-looking number is down from 5.9% to 4.4% in less than a year.

More importantly, the Fed is relying almost exclusively on backward looking data to steer the monetary policy ship. Traditional forward looking measures signal a rapid cooling off.

Does the Shanghai Shipping Exchange Index scream inflation or potential recession?

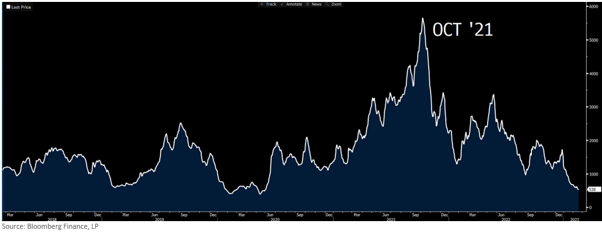

Same story with the Baltic Dry Index, a classic leading indicator.

“You know, I think monetary policy starts to bite on inflation, and on growth, with a lag, of course. And so you would see that more in ’23 and ’24.” Jay Powell March 16, 2022 at the first rate hike.

What if the nice drop in inflation is mostly the result of supply chain issues resolving themselves?

What if tighter monetary policy hasn’t even really started working its way through the system?

Week Ahead

Friday’s Core PCE is the headline, but GDP will also move the meter. The Fed hawks have been out in full force lately and there’s a lot more where that came from this week. I will continue crying myself to sleep for the foreseeable future.