Is LIBOR Still Going Away in 2021?

Intro

In the summer of 2017, Andrew Bailey made headlines by putting an actual timetable on the replacement of LIBOR – by the end of 2021. Regulators currently require participating banks to submit a LIBOR survey each day, but after 2021 they will not. The concern is that the banks will stop submitting to this survey and there will be no LIBOR. Imagine the possible disruption. If you want a more detailed backstory, click here (https://www.pensford.com/resources/libor-vs-sofr/). Today, we will focus on developments over the last year, including a surprise announcement on Thursday by ICE.

Please keep in mind that there is no mandate that LIBOR has to go away by the end of 2021. The Alternative Rate Reference Committee, or ARRC (https://www.newyorkfed.org/arrc) has been hard at work since 2014 to identify a suitable replacement, well before the 2017 headlines we all remember.

“The ARRC believes that long term liquidity and confidence in the markets that currently reference USD LIBOR will be strengthened considerably to the benefit of all market participants if such markets are able to identify and actively trade a robust alternative…the ARRC believes that a transition to alternative rates is in market participants’ own long term interest, despite the complications that it may pose in the short term.”

The goal is to improve market liquidity and transparency, not to disrupt it. We do not believe there will be a mandated cessation of LIBOR unless the replacement index is fully adopted. “The ARRC has considered and rejected plans that call for a quicker and potentially more disruptive transition.”

SOFR – Secured Overnight Funding Rate

The Secured Overnight Financing Rate, or SOFR, is the current front runner as the replacement index for LIBOR. SOFR is a repo rate, meaning it is an overnight loan secured by Treasurys. This is one of the critical differences between SOFR and LIBOR. LIBOR is the rate a bank would expect to pay on an unsecured loan from another bank, while SOFR is effectively a risk free rate.

Some other differences between SOFR and LIBOR

- LIBOR is a response to a survey, while SOFR is based on actual overnight transactions

- Basing the index on actual transactions should make it less susceptible to manipulation

- LIBOR is a bank’s estimate at what its unsecured borrowing cost would be that day, while SOFR is backward looking at what the bank actually paid overnight

The New York Fed began publishing SOFR on April 3, 2018. It plans on running SOFR in parallel to LIBOR for three years to establish a correlation and encourage market adoption over time.

There has been material progress made over the last year

- May 7, 2018 – CME launched 1 month and 3 month SOFR futures

- July 18, 2018 – LCH began clearing of SOFR OIS and basis swaps

- October 1, 2018 – CME began clearing OTC SOFR swaps

These developments are critical for the adoption of SOFR in derivative markets, where traders need a forward curve to adequately hedge an index over a given tenor.

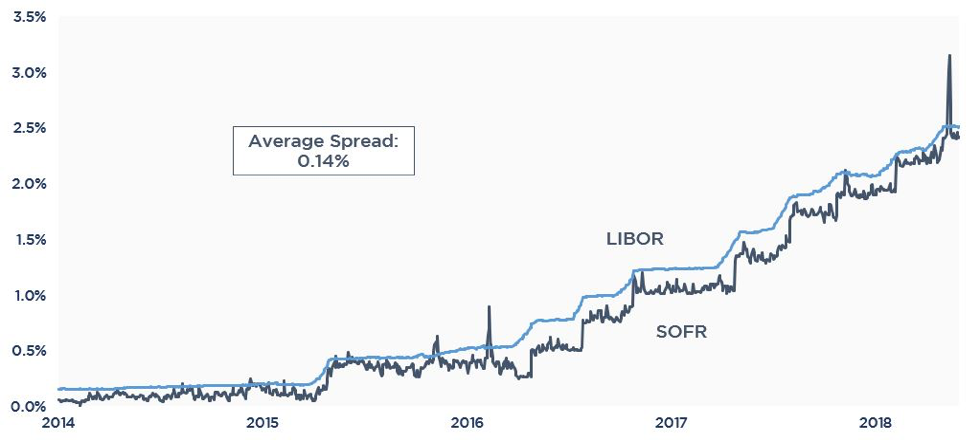

The New York Fed has also run historical analysis to 2014 to track how SOFR would have compared to LIBOR. As you can see in the graph below, SOFR would have set an average of 0.14% below LIBOR. This makes sense given that SOFR is essentially a risk free rate.

But also note how SOFR is susceptible to spikes at quarter and year end when banks are reluctant to lend cash in preparation for regulatory/accounting balance sheet snapshots. Expect an averaging to smooth that out.

Notable developments regarding adoption include

- 17 institutions have issued a total of $46.3B notional in floating rate instruments tied to SOFR, including a monthly high of $9.95 billion in December 2018

- 1st Issuance: Fannie Mae issued $6 billion in bonds tied to SOFR on July 30th, 2018 (0.5, 1, & 1.5 year tenors)

- World Bank issued $1 billion in bonds tied to SOFR on August 21st, 2018 (2 year tenor)

- MetLife issued $1 billion in bonds tied to SOFR on September 7th, 2018 (2 year tenor)

- Freddie Mac has issued ~$6 billion in bonds tied to SOFR

- S&P Global Ratings has recognized SOFR as an “anchor money market reference rate”

- FASB added SOFR to the list of approved rates for hedge accounting

In the derivative space, the CME has executed over $200B in notional open interest (60k+ contracts) with terms out to three years.

The final step in the Paced Transition Plan calls for the creation of a forward-looking term rate based on SOFR-linked derivative markets. Availability of a forward-looking term structure for SOFR may be necessary to transition some cash products from LIBOR to SOFR to ensure certainty of cash flows for retail and corporate end users. With the availability of SOFR term rates and liquid derivative markets, it is expected it will be possible to use SOFR for cash products before the end of 2021.

Transition from LIBOR to SOFR

For our clients, there are generally two primary concerns regarding the transition to SOFR

- What is the impact on my loan?

- What is the impact on my hedges?

Q: What is the impact on my loan?

Fallback Language – most of the attention over the impact a change to SOFR would have on loans focuses on the fallback language within the loan documents. The is the section that describes what happens if LIBOR is no longer available at some point over the term of the loan.

The ARCC has spent a considerable amount of time on this topic in 2018, seeking comments and feedback from market participants. They even extended the deadline for comments because they were so flooded with responses.

Because there is no guarantee that SOFR will be the ultimate replacement for LIBOR, lenders are reluctant to reference in the fallback language section. They don’t want to be held to an index that doesn’t exist.

Instead, most lenders have adopted an approach that will rely on the market accepted replacement for LIBOR. If that ends up being SOFR, great. But it allows for flexibility in the event that a different index ultimately becomes the replacement.

The ARRC hopes lenders will begin to adopt universal language, likely in incremental steps, between today and 2021. The more consistent the language across loans and asset types, the smoother the potential transition.

Two common issues we see in loan documents

- “at the sole discretion of the lender”

- “Prime + %” or “greater of alternative rate or Prime + %”

While lenders may not agree to specific language referencing SOFR, they should be open to using the industry-accepted replacement for LIBOR.

We do not believe lenders will use this as an opportunity to increase a borrower’s rate. There is a very big spotlight on this transition and regulators are focused on improving market transparency, not disrupting it.

Additionally, floating rate typically do not have prepayment penalties and borrowers may refinance the loan in order to avoid a sudden spike in their rate.

Bottom Line – incorporate language that would capture the market accepted replacement for LIBOR, not Prime or some other index at the sole discretion of the lender.

Q: What is the impact on my hedge?

Unlike the lending market, the derivative market has one industry group that oversees all contracts – ISDA.

The International Swap and Derivatives Association is a trade organization comprised of market participants that governs derivative contracts. If you’ve executed a derivative contract, you’ve signed a document with the ISDA written across the top.

This means ISDA can apply changes universally across all derivative contracts. LIBOR can be replaced with SOFR quickly, although they would likely provide significant lead time.

Given the intense focus by the ARRC to limit market disruption, we believe the impact on hedges will be as minimal as possible. For example, a LIBOR based contract won’t suddenly be worthless. If that were going to be the case, they simply wouldn’t make the change.

The two most direct impacts will be on the MtM and the monthly cashflows.

Hedge Value (MtM)

SOFR will not be able to match up with LIBOR precisely, particularly over a set amount of time via a forward curve. Therefore, we would expect some mismatch that would cause the MtM to change. While it is impossible to predict the impact, we suspect it will be manageable. In other words, if you terminate the hedge, the value for/against you may change based on the change to the forward curve or discounting factor, but given the high correlation between the LIBOR and SOFR the impact will be mitigated.

Monthly Cashflow

If all loans and all hedges changed to SOFR at the exact same time, the impact to borrowers should be limited. That also seems unlikely, so here are some possible outcomes each month.

- Loan changes to SOFR, but hedge remains on LIBOR

- Hedge is still highly effective, but borrower is exposed to spread between the two indices

- This increase today would be 0.09%

- Loan stays on LIBOR, but hedge moves to SOFR

- Hedge is still highly effective, but borrower is exposed to spread between the two indices

- This would actually benefit the borrower by 0.09% today

- Hedge is still highly effective, but borrower is exposed to spread between the two indices

- Hedge is still highly effective, but borrower is exposed to spread between the two indices

Those with the biggest risk are those with loan language that will move to something other than SOFR.

- If your fallback language is Prime and the hedge is on LIBOR, your rate will still increase in the same way that moving from LIBOR to Prime would increase your rate without a hedge

- In other words, if a lender changed your floating rate from LIBOR + 2.00% to Prime + 0% today, your rate would increase by 1.00%

- If you have a 5.00% fixed rate swap based on LIBOR + 2.00%, the fixed rate in this scenario would increase to 6.00%

- The issue arises out of the loan, not the hedge. Address the loan issue first and the hedge should largely move in step with it

Conclusion

There is a very intense, concerted effort to establish a suitable replacement for LIBOR – ideally by the end of 2021. But we put the odds of full market adoption by then below 50%.

Thus far, SOFR has tracked nicely with LIBOR; however, there have been hiccups – most notably at quarter and year end.

The derivatives market has not adopted SOFR yet, and this will be crucial before the market will transition fully to SOFR.

While disruptions are to be expected with a transition of this magnitude, these will be minimized as much as possible. The purpose of this change is to improve markets, not to disrupt them. The ARRC does not want to yank the rug out from under markets.

The most important aspect to address right now is the fallback language in the loan agreement. If your financing extends beyond 2021, this is more critical.

There is no guarantee that LIBOR will be gone by the end of 2021. One trader we spoke with said, “No one is using it. Liquidity is brutal. Zero options.”

Doesn’t exactly sound like ringing endorsement…

But Wait, There’s More!

We have suggested that ICE, the company that publishes LIBOR daily, has incentive to keep LIBOR alive. On Thursday, ICE announced their own potential replacement for LIBOR – the ICE Bank Yield Index.

https://ir.theice.com/press/press-releases/all-categories/2019/01-24-2019-135606523

https://www.theice.com/publicdocs/futures/Bank_Yield_Index_WP.pdf

At first glance, it appears to address some of the deficiencies with SOFR, namely that they are already publishing it with 1 month, 3 month, and 6 month maturities.

The pdf link includes graphs of how this new index has tracked LIBOR so far this year and the 1 month reset is within 1 basis point, which compares favorably to the 14bps spread SOFR is experiencing.

So maybe everything you just read about SOFR will be thrown out the window…