Does Janet Really Even Want the Job and a Look at 2018 Yields

Good luck to those of you in Florida, hopefully you pull through as well as Houston has pulled through. And for those of you with personally painful memories from that day 16 years ago, good luck with the day. Somber start to a newsletter that should be about football, but that’s the reality this week (don’t fret Ohio State, you aren’t off the hook just yet).

Rate Hikes

Markets have the odds of a hike in September at 12%, which is about 13% too high. More importantly, there hasn’t been any Fed-speak lately intended to drive up the odds of a hike. Recall that the Fed likes the odds of a hike to be at least 60% by the time they hike. Leading up to the June meeting (when they did hike), there was a constant stream of Fed members talking about how the market was underpricing the odds of a hike. Those odds climbed to about 85% and voila – the Fed hiked.

With September off the table, that means the Fed has two remaining meetings to squeeze in another hike. The November 1st meeting is unlikely because it is an “off” meeting – no Yellen Q&A and no updated economic projections.

That leaves the December meeting. We continue to believe the Fed will not hike in December, but we were wrong about the June hike. The market is coming back to us, with odds of a December hike now at 33%. If those probabilities hold steady and the Fed intends to hike, we will hear a lot from Fed officials to help drive up market expectations.

In fact, the probabilities of a hike don’t exceed 50% until June 2018, which feels about right to us.

Here’s the thing – does it really even matter? Yellen is trying to get off the zero bound range, not rein in inflation. Whether the Fed hikes in December or June, the growing consensus is that the Fed won’t push floating rates to 3% anytime soon (despite clinging to those projections).

FOMC Changes to Leadership and Composition

Fed Vice Chair Stanley Fisher unexpectedly resigned last week. His term was set to expire in June 2018, so on the surface this isn’t a huge deal. But recall that Tarullo resigned unexpectedly in April and both men are advocates of post-financial crisis regulations. Perhaps the pressure to roll back regulations is wearing on the Fed members?

This leaves four vacancies at the Fed (five if you count the pending confirmation of Quarles). We thought Yellen’s odds of being re-appointed by Trump were far greater than the market was expecting, particularly if the economy was doing well later this year. Trump likes low rates, high stocks, and Yellen is about as non-threatening to him as the second most powerful person in the world can be. But with another resignation, we have to wonder if there’s a shifting sentiment behind closed doors.

What if Janet Yellen doesn’t even want the job? What if she has told those closest to her that she does not plan on serving another term even if the presidents asks her to? Wouldn’t it make sense to spread out the departures to mitigate the market response?

Tarullo resigned in April. Five months later, Fisher resigns. Five months from now, Yellen’s term expires. Coincidence? Happenstance? If Yellen was planning on another term and Fisher wanted out, couldn’t he simply leave next June when his term expires?

With her closest allies departing, it is starting to feel like Yellen won’t be the next Fed Chair even if Trump wants her to stay.

Conventional thinking – the dove/hawk composition could shift significantly over the next twelve months as Trump has the opportunity to appoint more FOMC members than any other president in history. We should take care not to extrapolate current Fed policies too far into the future. A dramatically different Fed may still be restrained by lack of inflation, but could hike anyway out of belief that asset bubbles are lurking. LIBOR may remain low for the next year but risks to the upside beyond 2019 are increasing.

Contrarian thinking – Trump shocks the market by appointing an uber-dove, a la Minneapolis Fed President Neel Kashkari. Kashkari is a Republican dove that has opposed the last two rate hikes because of weak inflation. “It’s very possible that our rate hikes over the past 18 months are leading to slower job growth, leaving more people on the sidelines, leading to lower wage growth, and leading to lower inflation and inflation expectations. These premature rate hikes that we are embarking on, they’re not free, and I think we need to remind ourselves of that.” Trump wants jobs jobs jobs and wants them now and asset bubbles can be dealt with later by the next guy. Appoint several anti-regulation members and a dove chair and let’s see what the economy can do when those two are combined.

Given the USD sell-off and flat forward curve, the market may already be pricing in the likelihood of a Trump appointed dove.

Removal of Global QE – 2018 Yields

Long term fixed rates like the 10 year Treasury have been grinding lower over much of the year. The initial catalyst was the market realizing it had overreacted to Trump’s victory. We believed so strongly that the market’s kneejerk reaction was overdone that in January we made a bold prediction – that the 10T was more likely to finish 2017 below 2.00% than over 3.00%. As Trump’s pro-business agenda stalled, rates steadily fell. More recently, rising geopolitical tensions and back to back hurricanes are also weighing on yields.

We’ve been beating a dead horse about 2.13% being the last technical support level before the 10 year Treasury tests 2.00%. That level finally broke last week with the 10T getting as low as 2.03%. This week could see the 10T finally get a 1-hande, particularly if Irma really slams Florida or if anything happens with North Korea.

Barring an economic slowdown, the biggest driver of rates over the next 12-24 months is likely to be the global removal of accommodation. In the US, we’ve known this was coming for much of the year. Whether the Fed hikes once or twice in the next year pales in comparison to the impact of shrinking the balance sheet. The Fed is likely to use the September 20th meeting to announce plans for passive tightening to begin in October. Yellen is on record as saying that the long end of the curve has 3x the impact on tightening financial conditions that hiking Fed Funds has on tightening financial conditions.

Monetary policy announcements tend to have two distinct impacts:

- Market Kneejerk Reaction – this is what happens in the near term as traders try to figure out the longer term impact of the news. The Taper Tantrum of 2013 is the perfect example – Bernanke used the word “taper” in a press conference and the 10T spiked more than 100bps in a month.

- Long Term Technical Impact – the real impact that policy changes have on yields, much tougher to measure. Rates may jump intermittently during QE following a great job report or strong GDP print, but the general trend is to push yields downward. Think slow, persistent pressure rather than violent swings.

It’s tough to know exactly how much impact QE has had on the long end of the curve, but a reasonable estimate might be 100bps. In other words, absent massive QE, the 10T would be north of 3.00%. It stands to reason that if a large buyer of Treasurys slows the pace of purchases, yields should rise.

Given the Fed plans on unwinding its balance sheet in a predictable and methodical manner, the upward pressure on yields should be slow but persistent. In a vacuum, the 10T might be 25bps higher in a year simply as a result of the Fed’s actions. Slow, persistent grinding higher…

Just as notably, global QE is coming to an end. The other dead horse we’ve been beating this year is that ECB tapering could push up the German Bund, which in turn could push up the UST yields. Capital allocation decisions are more global today than ever before, so the global removal of accommodation may have a bigger impact on US yields than our own Fed’s passive tightening.

The ECB is currently buying bonds at a pace of €60B/month. Draghi punted at last week’s ECB meeting on a formal tapering plan, but is very likely to announce plans at the October ECB meeting. For example, Draghi may suggest a reduction from €60B/month to €30B/month with the intent of monthly reductions until purchases are totally eliminated by mid-year. Just as in the US, think of this more as taking the foot off the gas rather than tightening financial conditions. Rate hikes are probably at least two years out, so this is really about shifting from extremely accommodative to very accommodative.

- Kneejerk Reaction – Draghi will spend the time between today and the October 28th ECB meeting trying to manage expectations (a la Fed-speak about rate hikes) to avoid a dramatic market response. By the time of the announcement, it will be the deviation from expectations that will drive the response, not the announcement itself. If the market is fully prepped for a reduction to €30B/month and that is what the ECB announces, the market reaction should be muted.

- Long Term Technical Impact – there should be persistent upward pressure on Eurozone yields, most importantly German Bunds. This, in turn, gives the 10T room to move higher.

The Fed’s balance sheet reduction program should cumulatively reduce holdings by about $175B over the next year. Persistent, upward pressure on yields…

The ECB’s tapering program should begin in October with no further bond purchases by mid-2018. Persistent, upward pressure on yields…

Japan is slowing the pace of QE and settling in about JPY 60 trillion per month. Persisent, upward pressure on yields…

In total, this sort of reduction in accommodation should represent the equivalent of about $50B per month. That’s a drop of about 35% from current levels. Persistent, upward pressure on yields…

In a vacuum, the removal of accommodation could push the German Bund up towards 1.00% and the 10T up to 2.62% between now and next summer. Throw in some tax reform, stimulus, inflation, etc and it isn’t inconceivable we see a run up to 3.00% on the 10T.

But the Economy Doesn’t Operate in a Vacuum

Weak inflationary pressure, a reversal of GDP, war, etc could all easily offset the technical pressures from central banks withdrawing accommodation.

We’ve never been down this road before. We don’t really know how the global economy (and rates) will respond to this process.

UST’s are still the world’s mattress and we aren’t so sure that just because one buyer withdrawals from the market that there aren’t 10 others ready to step up and buy in its place. We took a look at what happened to the 10T over the last five years while the Fed was gradually removing accommodation.

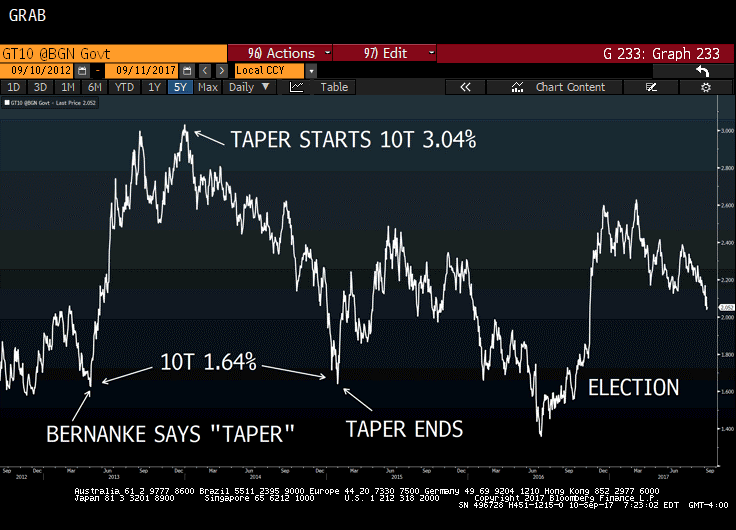

10 Year Treasury

Let’s start with the most basic graph. Here’s the 10yr Treasury over the last five years. Couple of takeaways:

- Bernanke’s suggestions of tapering QE pushed the 10T from 1.64% to 3.00% in about two months (kneejerk market reaction)

- When tapering actually began in December 2013, the 10T was 3.04%.

- When tapering ended in in late 2014 (roughly 12 months later), the 10T was back to 1.64%.

- Persistent, upward pressure on yields…not so much. Tapering had the exact opposite effect as expected as the 10T yield fell throughout 2014.

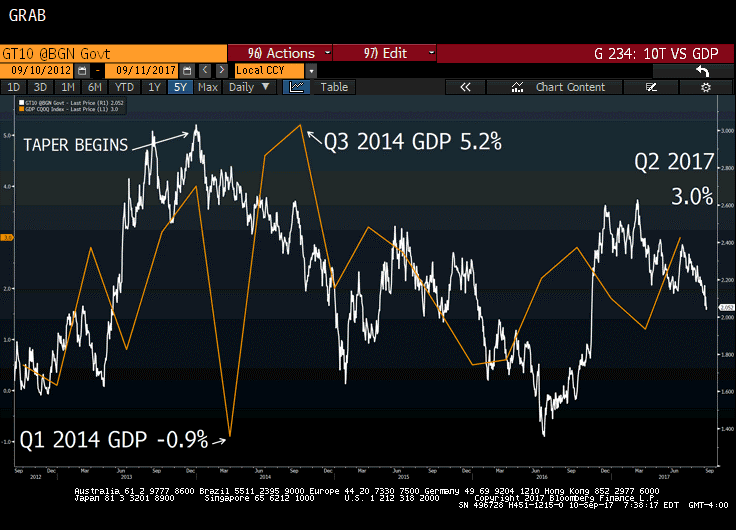

10 Year Treasury and GDP

But maybe the economy is doing much better today than it was during tapering in 2014 and the economy is better prepared for higher rates? Let’s keep the 10T graph exactly the same and overlay GDP.

In 2013 when the Fed was laying the foundation to begin tapering, GDP averaged 2.675%. During 2014 while the Fed was actually tapering, GDP averaged 2.725%. In fact, if you take out the oddball negative Q1 2014 GDP reading, GDP in 2014 averaged 3.933%.

Thus far in 2017, GDP is averaging 2.10% with the highest print at 3.0%.

2017: 2.100% (average Q1 and Q2)

2016: 1.850%

2015: 2.000%

2014: 2.725%

2013: 2.675%

2012: 1.300%

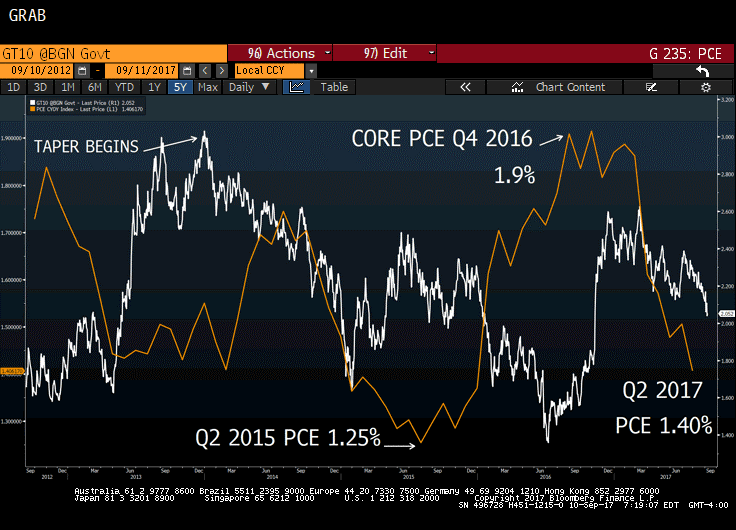

10 Year Treasury and Inflation

Maybe the economy was doing at least as well as it is today, but maybe inflation was lower then? Today’s low unemployment will eventually drive up inflation and give room for rates to push higher, right?

2013 and 2014 never saw inflation as low as the most recent PCE reading (Fed’s preferred measure of inflation).

Persistent, upward pressure on yields…not so much.

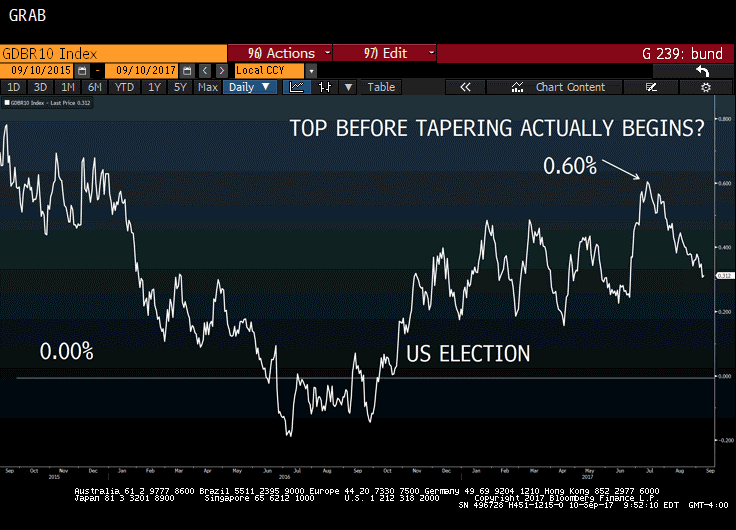

Will the Bund Behave Like the 10T?

Perhaps the Bund will (or has) top out in anticipation of the effects from tapering, but then spend the next year grinding lower.

With the Bund around 0.30%, we suspect it will climb again before grinding lower. We would not be surprised to see the Bund test 0.60% before year end and perhaps even 1.00%.

Takeaways

Intuitively, it makes sense that the removal of accommodation should push yields higher, but that has not proven to be a steadfast rule to live by. Arguments can be made that the global economy is healthier than it was in 2014 (particularly the Eurozone), but arguments could also be made that red flags are going up domestically.

Perhaps the real takeaway is that the removal of accommodation gives global yields room to move higher as long as the global economy is doing well. If the Eurozone continues to expand at a reasonable pace and the US doesn’t stall out, it stands to reason that long term fixed rates could move higher before next summer.

With 10 year Treasury volatility at all-time lows, there is certainly a possibility that we are falling into a complacency trap and long term asset holders may benefit from locking in now, particularly given how flat the yield curve is currently (premium to convert from floating to fixed for 10 years is about 0.75%).

This Week

No scheduled Fed speeches as the members go dark ahead of next week’s meeting, but there is a ton of economic data released this week. Inflation data and retail sales will be the headliners, with all eyes on CPI because it has come in lower than expected five consecutive months.

Hey there Ohio State, how you feeling today? Listen, it’s not your fault the media had created unrealistic expectations for you this season. Last year you didn’t win your own division within the Big 10, let alone the Big 10 itself. In fact, you lost head to head to the team that won both of those. And yet somehow you got voted into the BCS playoffs…which you quickly justified by losing 31-0 to eventual champion Clemson.

Despite Game of Thrones Mountain of evidence suggesting that maybe, just maybe, you weren’t that good, the savvy insiders voted you preseason #2 this season. That wasn’t fair to you. Having your helmets handed to you, at home, was predictable as long as we refused to buy into THE Ohio State media hype machine. I have no doubt you’ll beat PSU at home this year now that I’ve run my mouth and jinxed them, but someone had to say it. How long before Urban Meyer starts getting “sick” again and abandons ship with the cupboard bare?