January Data a Trend Does Not Make

Did you know leap years aren’t actually every four years? I didn’t until last week when our team that is rebuilding our cashflow models was pointing out how hard date logic is to code.

Every 4 years, February gets an extra day—except when the year is divisible by 100 but not 400. In other words, every century year is potentially an oddball. The last time we should have had a leap year but didn’t was 1900 and the next time is 2100.

It’s not just leap years that have a quirk, things like the jobs report do as well. Even though it’s typically the first Friday of every month, the exception is if that Friday falls on the 1st calendar day of the month. For example, this Friday is March 1, so NFP will not be released on Friday. Instead, it will come out on Friday March 8th. Quirky.

Unlike those quirky releases, do you know what follows a shockingly regular schedule? JMo’s smack talk. I got a call Friday while he was driving to one of his eight vacation homes just so he could chirp at me again about the hot CPI report…from a week ago. He was preemptively popping off about this Friday’s Core PCE data, since Dr. Wong from Bloomberg believes the monthly number will come in at 0.4%.

“I’m just a very privileged kid that went to an excellent private school you could never get into, so my math might be fuzzy, but that’s 4.8% annualized, right?”

“Yep,” I conceded. He continued…

“I’m feeling pretty good about this wager in all ways but one...”

“What’s that?” I asked, thinking maybe he had finally bothered to do even a two minutes worth of research outside his industrial sunbelt echo chamber.

“With my winnings, what will I buy for the man that already has everything?”

Ugh.

“Humility?” I offered.

I tried to point out that January is always noisy. Annual December 2022 Core PCE m/m came in at 0.39% and then January was 0.6%. For the year, Core PCE still fell from 4.9% to 2.9%.

Next week I will unveil the JMo Core PCE Wager Tracker so we can all root against him.

The old saying goes, “the market can stay irrational longer than you can stay solvent”, but it’s clear to me that no one can stay irrational longer than JMo.

Last Week This Morning

- 10 Year Treasury at 4.26%

- German bund at 2.37%

- 2 Year Treasury at 4.69%

- SOFR at 5.30%

- Term SOFR at 5.32%

- Fed Speeches:

- Fed Bowman, Jefferson, Cook, Waller: Fed will remain cautious when approaching rate cuts; needs more data before cutting

- Fed Harker: First cut may be close but cautious on when the Fed may be able to do it

- FOMC Minutes - Showed the Fed’s hesitancy to cut rates and reaffirmed their position that they will need more data to confidently cut rates

- Congrats to Nikkie Haley for securing the 2028 GOP nomination

- If Warren Buffet put all his cash in Treasurys, he’d be the 16th largest holder of Treasurys in the world, right behind France and ahead of Saudi Arabia

Core PCE

We get the next Core PCE report on Friday. After the recent CPI report, it’s clear that inflation is surging again. Inflation to the moon! Reacceleration! The Fed is never going to cut again and in fact should be considering more hikes!

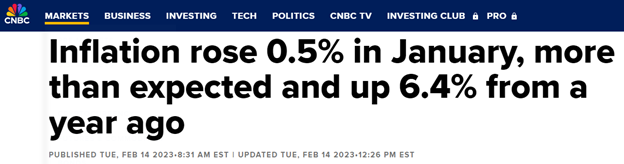

I can already see the headlines screaming, “Key Fed inflation measure rose 0.6% in January, more than expected”! Pandemonium! The inflation sky is falling! Prices will never fall ever again ever ever ever!

Oh wait, that’s an actual headline from last year after January’s inflation data came out.

The article continued, “The numbers suggest inflation accelerated to start the new year, putting the Fed in a position where it likely will continue to raise interest rates.” It was right about the Fed continuing to hike, but wrong about inflation reaccelerating.

After last year’s hotter than expected January PCE data, the 10T popped 13bps for the week. I was a little surprised it wasn’t more, so I did a little digging. The move was muted because the 10T had already popped more than 20bps in the prior two weeks. What caused the February spike?

The January 2023 CPI data was released 10 days earlier!

Are you detecting a pattern here? That article continued, “Across-the-board increases in shelter, food and energy boosted the index after inflation had shown signs of receding in recent months.”

Six weeks later, the T10 was 0.70% lower.

Maybe inflation is reaccelerating (it isn’t), but we will need more evidence than the January inflation data.

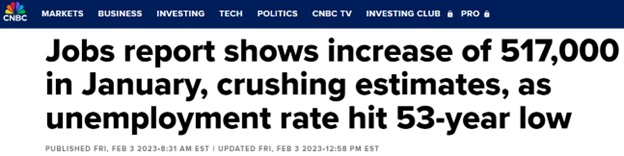

It’s not just inflation. The same is true with jobs.

- December 2022 job gains: 136k

- January 2023 job gains: 517k

Monthly job gains for the year came in at 255k, about half of the January print.

January data a trend does not make.

Don’t freak out if this week’s inflation data comes in hotter than expected. Let the dope rope a dope and send the smack talk.

If you give me three more months of similar data, maybe I’ll concede inflation is reaccelerating.

More likely, I’ll just invent new reasons why I am skeptical. I can be just as stubbornly irrational as JMo.

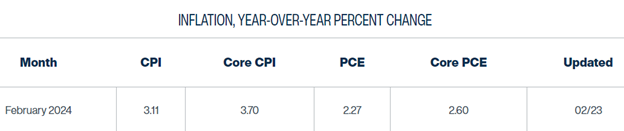

PS – here’s the Cleveland Fed’s InflationNow forecast – 2.6%.

The Week Ahead

In addition to Core PCE, we also get GDP and roughly 7 million Fed speeches.