Just 84 Days

Powell said the Committee discussed timing of rate cuts at today’s meeting. The bottom has fallen out of rates. T10 touched 4.01%. The T2 is down 26bps, which is great news for interest rate caps.

It’s been 84 days since the Fed’s last “on” meeting, where it provides a Summary of Economic Projections (SEP).

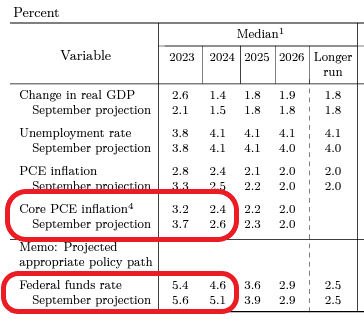

In just 84 days, the Fed has changed its tune quite a bit. Inflation is already lower than they thought it would be at year end, so they were forced to revise Core PCE lower by 0.5%.

84 days ago the Fed was projecting a hike today. Not only did they not hike, they are now projecting three cuts next year.

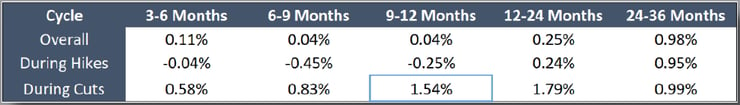

The Fed is now projecting Fed Funds to finish next year at 4.60%. If they are wrong by the historical average, Fed Funds will finish next year at 3.06%.

In 84 days, the number of FOMC members expecting 3 cuts or more next year has grown from three to eleven.

In 84 days, we went from one FOMC member expecting Fed Funds to exceed 6% next year to one FOMC member expecting Fed Funds to be below 4% next year.

The odds of a rate cut within the next 84 days is 74%. The market is pricing in six cuts next year.

In 84 days, the Eagles have gone from runaway Super Bowl favorites to has beens.

84 days ago, Powell reminded everyone that the Fed would cut before inflation actually got to 2% because of the lag effect.

Today he said, “The full effect of tightening has yet to be felt.”

What has the Fed seen to make them pivot so hard in just 84 days?