Labor Day Labor Update

On Tuesday, the JOLTs job opening survey came in 700k lower than expected and the lowest point since April 2021. On Wednesday, GDP came in weaker than expected (2.1%). On Thursday, Core PCE m/m came in at just 0.2%, with the 3 month average annualizing at 2.7%. Then on Friday, the economy added the fewest jobs in two years while the prior two months were revised down by 110k.

Rates were down, volatility was down, pressure on cap prices was relieved…and then Cleveland Fed President Mester gave a speech and said the job market is still very strong and inflation too high.

“Although there has been some progress, inflation remains too high,” she said. “The monetary policy questions are whether the current level of the federal funds rate is sufficiently restrictive and how long policy will need to remain restrictive to keep inflation moving down in a sustainable and timely way to our goal of 2%.”

Rates reversed course and vol picked up again. Sonofa!

You sure you guys are data dependent?

Last Week This Morning

- 10 Year Treasury at 4.18%

- German bund at 2.54%

- 2 Year Treasury at 4.87%

- SOFR at 5.31%

- Term SOFR at 5.33%

- JOLTS Job Openings 8.827M vs. 9.465M expected

- Consumer Confidence 106.1 vs. 116 expected

- GDP 2.1% vs. 2.4 expected

- Core PCE y/y 4.2% vs. 4.2% expected

- Core PCE m/m 0.2% vs. 0.2% expected

- Unemployment rate 3.8% vs. 3.5% expected

- NFP 187k vs. 170K expected

Labor Day Labor Update

Every single month this year has revised the prior month’s job report lower.

Every. Single. Month.

So we get a “resilient” headline and celebrate the strongest labor market in the history of the universe while quietly revising the last report lower. Last month’s 187k was revised down to 157k. If we could go back in time, would the headlines have been so positive if the report had said 157k right from the start? Doubtful.

Friday’s report will be no different. Next month, the headline gain of 187k will be revised to something lower, but none of us will notice because we’ll be distracted by another soft landing resilient jobs headline.

Over the last two months, we’ve lost 670k full time jobs while adding just over 1mm part time jobs.

The only reason we haven’t seen job losses over the last two months is because part-time jobs surged so dramatically. Does that sound like the most resilient labor market in the history of the universe?

And that’s on top of last week’s report that revised the prior year’s gains down by 300k. JOLTs survey came in 700k fewer openings than expected!

I feel like I’m screaming into the abyss.

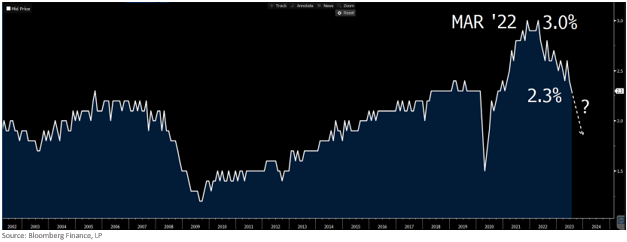

Quits are generally considered a leading indicator and a good gauge of labor sentiment. The more confident you are that you can land another job, the more likely you are to quit the one you have. Quits have dropped from 3% at the first hike to pre-pandemic levels. More importantly, it appears as though we will continue barreling lower.

Why is the Fed still talking up hikes?

1. Because they are overdoing it just like they always do

2. It’s easier to talk tough and not hike than to say you’re pausing and have to hike

3. They are driving inflation to 2% to avoid repeating the mistakes of the 1970s

4. Financial conditions have tightened but aren’t in deeply restrictive territory

5. They want to make sure inflation expectations are pounded into the ground

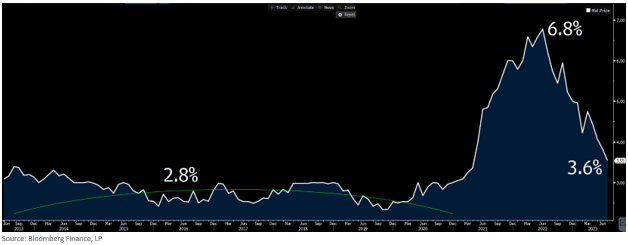

Since the first hike, one year forward inflation expectations have plunged from 6.8% to 3.6%. It’s important to note that prior to covid, this averaged 2.8% (instead of 2%). We aren’t that far from pre-pandemic levels.

Rates

Markets have just a 6% probability of a hike on September 20th, but a 35% probability of a hike in November. This is down quite a bit from just two weeks ago when those odds were north of 60%.

I would like to think that if the data continues to come out like it has, the Fed will hold. That Mester’s comments are more about keeping a lid on expectations. But I’m not convinced the Fed is data dependent and the odds of overdoing just keep going up.

The 10T had pushed to 4.10% before rebounding to 4.19%. The range is 3.92% - 4.25%.

Week Ahead

Much calmer week ahead (hopefully) so we can focus on football. I assume PSU won 100-0 enroute to the CFB and a Drew Allar Heisman campaign, so I will turn my sights to the NFL.

The Cowboys will win the NFC east, but then choke in the playoffs. It was hard for me to type that.

Cardinals HC (and Eagles ex-DC) Jonathan Gannon will be fired by the end of the season. “Thanks for landing us the #1 overall pick” – Cards. We succeed despite Gannon, not because of him.

The Niners will miss the playoffs. After the Eagles curb stomped them in the NFC Championship, they whined. A lot. Mostly about how lucky the Birds were that Purdy got hurt. Um, ok, sure, but allow me to retort.

- Didn’t he get knocked out because you couldn’t block the Eagles defense?

- What’s that gotta do with your alleged #1 defense giving up 31?

The Niners got no heart. They are terribly overrated and lack the intestinal fortitude to take it to the next level. They choke worse than the Cowboys, which is tough to do.

The Birds start 8-0 before hitting a brutal stretch. Cowboys/Chiefs/Bills/Niners/Cowboys/Seahawks. Obviously, the Niners game is a gimme (because of the whole spineless gutless heartless whiner thing) but the rest are tough matchups. They could be 10-4 after that stretch, ultimately costing them the NFC East title. It also costs Jalen Hurts the MVP.

They end up traveling to Dallas, with the giant chip on Jalen’s shoulder traveling first class. There, they knock out the Cowboys after Dallas HC whatshisface makes another terrible in-game decision.

The Eagles march on to the Super Bowl against the Bills, where good turf allows them to avenge last year’s loss and the Bills become the third team to rack up 5 SB L’s.

Eagles 31

Bills 17

Lead pipe lock guarantee - sure to be just as accurate as my interest rate observations.