Lies, Damned Lies, and Jobs

So much of what I write about each week is inspired by conversations with clients. Obviously, there’s the JMO Core PCE Wager™, but a lot of times the newsletter writes itself after hearing directly from people closer to the action than us.

I was speaking in Dallas two weeks ago and discussing my favorite topic – the overstated strength of the Cowboys labor market. One of the attendees, Nathan, pointed out that a lot of the job gains were part time jobs. I knew he was right, but I didn’t know the exact number off the top of my head. Our discussion prompted me to dig in.

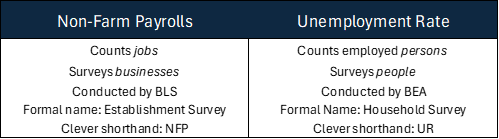

Here’s the first thing to know about the Non-Farm Payrolls (NFP) jobs report. Part time jobs carry just as much weight as full time jobs.

Here’s the second thing to know about the monthly Non-Farm Payrolls (NFP) job report. It counts jobs, not people.

If you have more than one job, each job counts. Oh…and they don’t break out full time vs part time in the NFP number.

Since we just got another “red hot labor market means no rate cuts until 2037” report on Friday, I thought we should spend a little time debunking the headline labor numbers.

I believe this matters now more than ever. Consumers are running out of cash and shifting to credit cards and everything is still ok because people aren’t being laid off. The overstated strength of the labor market is masking the risk that the wheels fall off faster than expected.

This soft landing everyone is so confident about could turn into a United landing quickly if the job market turns.

Summary (only the true nerds are going to want the full newsletter…don’t say I never do anything for you)

- The BLS has revised lower the monthly job print in 12 out of the last 14 months

- The NFP report measures jobs, while the unemployment rate measures people

- Of the 2.75mm headline jobs gained in the past year:

- Some number of those jobs gained are part time and/or multiple jobs

- 1.4mm came from birth/death estimates

- 629k came from government

- 993k came from healthcare

- When we instead measure unemployed persons gaining employment:

- Just 637k added for the year

- 921k were part timers, which means

- We actually have 284k fewer full timers

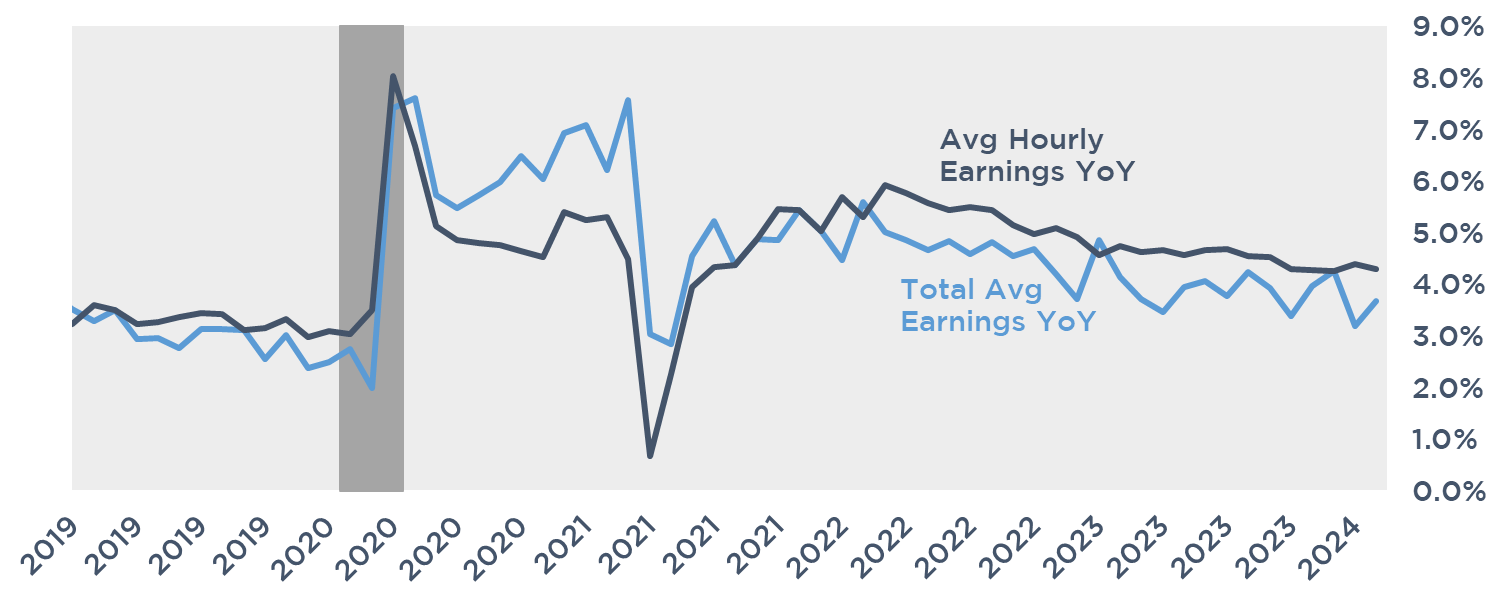

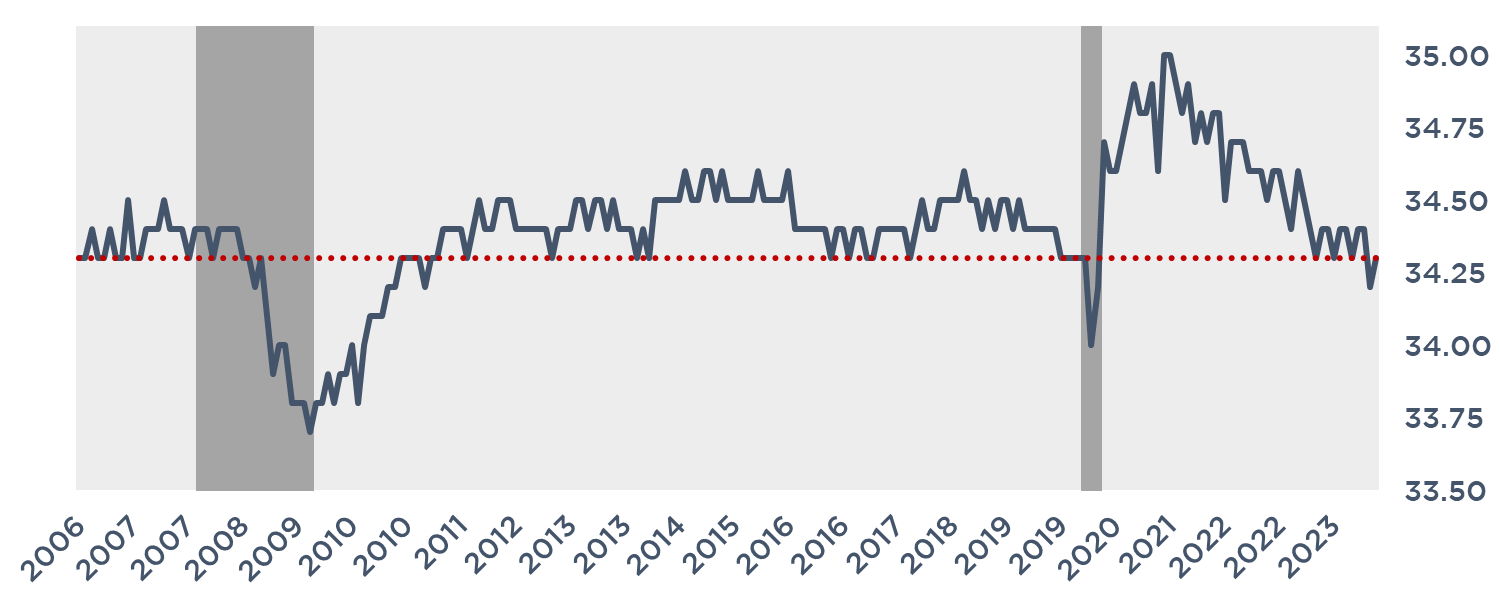

- Average hourly earnings are up, but total compensation is at 20 year lows as employers offset higher wages with shorter work weeks

- Response rates have fallen from 65% to 42%, making it tougher for government statisticians to provide accurate estimates. I blame us, not them, for falling for the same thing over and over again.

Last Week This Morning

- 10 Year Treasury at 4.09%

- German bund at 2.27%

- 2 Year Treasury at 4.48%

- SOFR at 5.31%

- Term SOFR at 5.32%

- Greatest job market in history continues to defy expectations

- ECB hinted that rate cuts are coming

- Powell said the Fed is “not far” from being able to cut rates

- Various Fed speeches still suggest cuts are coming

- Fed Daly - U.S. central bank is committed to "finishing the job" on attaining price stability, particularly with rising housing costs a key driver of higher inflation.

- Fed Kashkari - Reiterated he believed 2 cuts would happen as of December, is now uncertain if 2 cuts or fewer

- Fed Mester - There is no rush to cut as more evidence is gathered that inflation is heading toward 2%, but believes the central bank should be able to start cutting later this year

Lies, Damn Lies, and Jobs

Last year’s 3mm jobs gained was the third highest ever. No wonder every headline is battling over new unique ways to describe this unprecedented labor market.

“January jobs report shows the labor market is hot hot hot”

“Jobs Growth of 353,000 Blasts Past Expectations as Labor Market Stays Hot”

“January Was Scorching Hot For Hiring And Raises—Maybe Too Hot For The Fed”

Those were a few of the headlines a month ago when NFP showed a gain of 355k jobs. I wonder what they would have said if instead the number was 229k?

Because that’s what it was just revised down to. That’s right, the BLS did it again…and we fell for it again! They revised January’s jobs down by 124k! The last two months were revised down by a combined 167k.

A gain of 229k is still a solid showing, so it’s not like Dak Prescott in the playoffs. Before we dig into the details, here’s a cheat sheet for the two main components of the jobs report each month. We should open a Pensford Merch Shop. I’ll find an influencer to peddle it.

Jobs vs People

Let’s come out swinging. The NFP report measures jobs. If you have a job, and pick up a second job this month, that new job counts.

Remember – they are calling businesses. From a business’s perspective, it doesn’t matter if you also have other jobs. If I started paying you this month, that gets reported as a new job.

If you pick up 3 part time jobs this month, each one counts. The economy added 2.75mm jobs in the past year, and at least some of them were just people picking up second or third gigs.

Conversely, the fun folks at the BEA count unemployed/employed persons. The only way you count as gaining employment is if you were unemployed last month.

I’m sure the two numbers are similar, right?

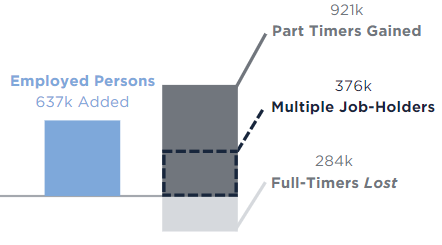

Jobs added in the past year: 2.75mm

Employed persons: 637k

That’s not a typo. The difference between the two measures is 2.1mm.

An argument can be made for each approach, but it’s important to understand that a huge number of the jobs added in the past year weren’t simply unemployed people finding jobs. It was second and third jobs.

And that doesn’t account for Nathan’s point about part timers. Segue alert…

Part Time vs Full Time (Trigger Warning: The Following Contains Sensitive Information That Will Make You Question Media Headlines)

At least some of those 2.75mm jobs gained were part time, which we can all agree carry less significance than full time jobs, right? Conveniently, Unfortunately, the BLS does not break out full time vs part time…but the BEA unemployment report does.

Buckle up…921k of the 637k employed persons were part time. You read that right – on a net basis, we actually have fewer full time employed persons today than a year ago.

I wonder if the part timers agree with all the news headlines about the red hot labor market?

Birth/Death Adjustments

I wrote about this a few months ago, but I’m going to repeat it again now that we have 2023 in the books.

The NFP report we get each month includes an estimated number of jobs gained/lost based on projected business openings/closings. But instead of saying that, they call it “Birth/Death Adjustments”, as in the birth or death of a business. Dark.

So the BLS estimates the number of businesses that opened or closed and the corresponding impact to jobs. They then include this estimate in the number we read in the headlines. Last week’s gain of 275k included some amount of birth/death adjustment.

For the past year, guess what % the birth/death adjustment comprised of the overall jobs gained?

50%.

That means 1.4mm of the 2.75mm jobs gained in the past year were just birth/death estimates, leaving 1.35mm to less speculative measures (but still comprised heavily of part timers and multiple job holders). That’s 114k per month, not the headline 250k we averaged.

Heck, maybe their forecasts are spot on. Then again, given those NFP revisions…

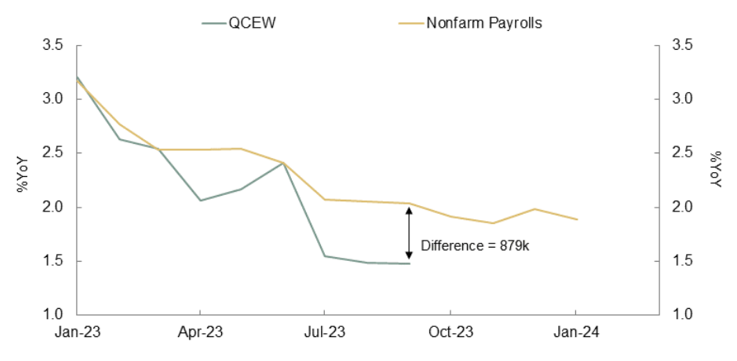

SMBC’s research team attempted to resolve the potential discrepancy by comparing Quarterly Census of Employment and Wages to the birth/death adjustment. This shouldn’t shock you at this point, but the QCEW has a large lag, so the last measure is through Q3 2023. At that time, the delta was 879k jobs, meaning nearly 900k of last year’s 3mm jobs gains may be phantom gains.

“Yeah, what he said!” – BEA, relieved someone finally paid attention

Simma down BEA, you aren’t off the hook yet. I have issues with your participation rate.

If you don’t look for work, you don’t count in the unemployment rate. Since covid, people have just stopped looking. Maybe they eventually run out of the helicopter money or maybe this is just the new normal.

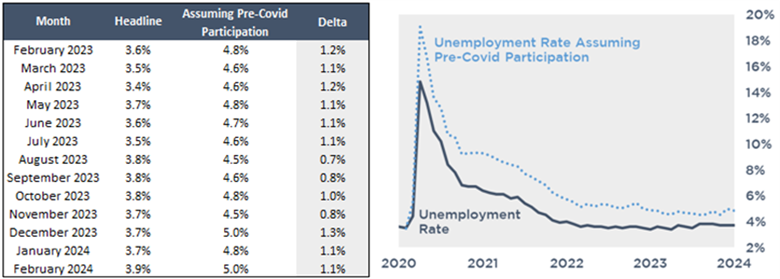

But if we use the participation rate from February 2020, the unemployment rate today is 5.0%.

That’s still full employment! But it’s not “greatest labor market of all time” scorching red hot.

Confirmation Bias

According to Wikipedia, confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one's prior beliefs or values.

Wrong newsletter. Let’s move on…

Private vs Government

Despite everything we’ve covered, let’s assume that all of the 2.75mm jobs gained are totally legit and high quality.

Of those 2.75mm jobs gained, 629k were government jobs (21%).

But if we view healthcare as an extension of the government, it gets even more questionable. Healthcare accounted for 993k of the 2.75mm.

About half of the jobs gained in the past year were government or healthcare.

Average Hourly Earnings

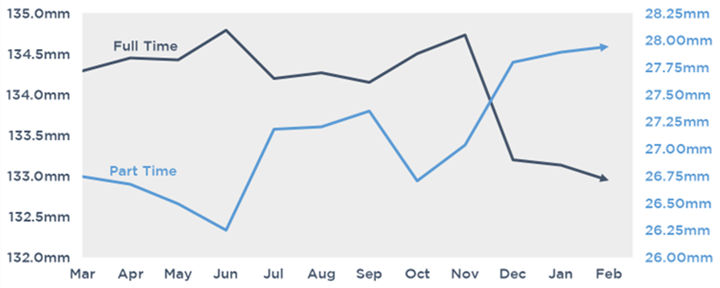

This is the part of the BLS report that inflation hawks like JMO point to for “wage pressure!” But if wage pressures are so high, how come average compensation is down (and no, it’s not because of inflation)?

It’s because the number of hours worked per week is at the lowest level in 20 years. Average hourly earnings are up, but employers are compensating by reducing hours.

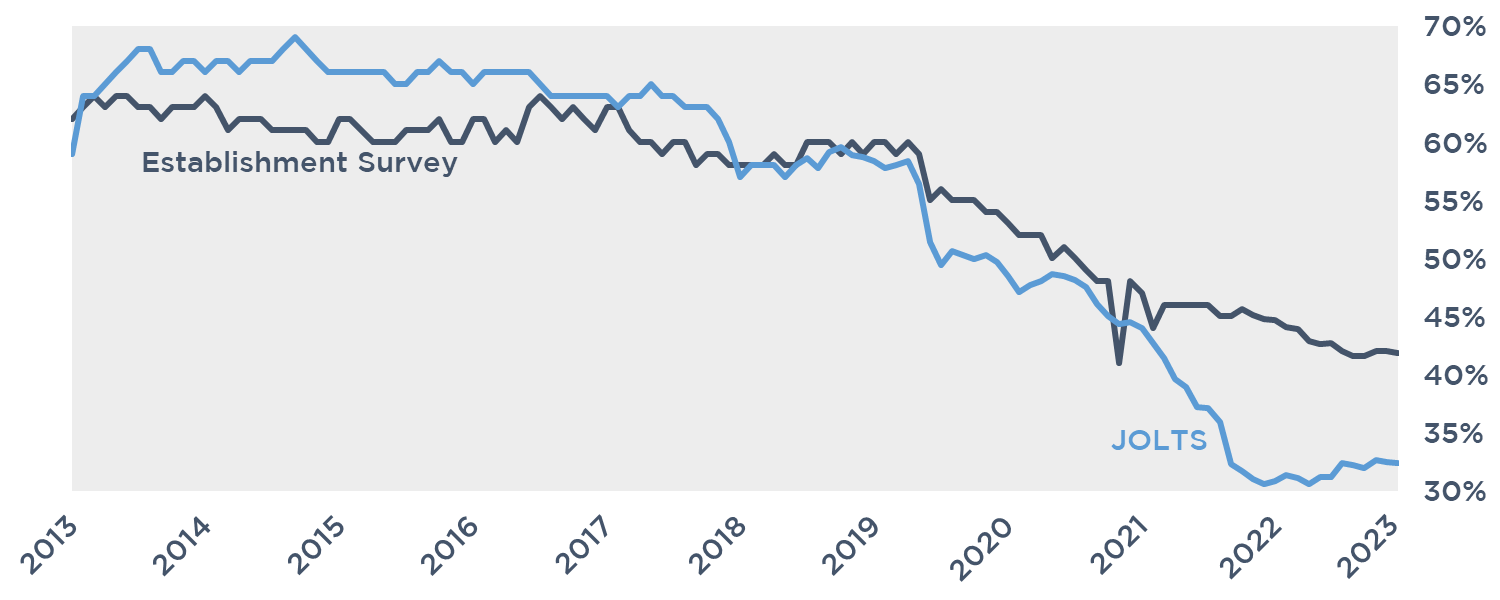

Response Rates

I don’t believe anyone at the BLS/BEA is intentionally trying to mislead us, but I think we are trying to draw conclusions from data that is worse than usual.

Response rates to these surveys have plunged, only marginally better than the JOLTS survey I hate so much. No wonder revisions are bigger than usual.

Whew…that was a lot

The labor market isn’t weak, but it’s not as strong as the headlines suggest. I’m worried that we are overly confident in the soft landing because we keep believing the headlines.

Consumers haven’t changed spending habits, they’ve just shifted to credit cards as their stimulus money ran out. They feel comfortable running up debt because they haven’t been fired…yet.

If the labor market turns, unemployment will surge and delinquencies will surge.

Or…

Everyone will just keep picking up second and third jobs and the economy will never slow.

The Week Ahead

CPI!!!

The Fed goes dark ahead of next week’s meeting.