Loco Like a Fox

Last Week This Morning

- 10 Year Treasury briefly touched 3.25% before falling to 3.16%

- German bund down from 0.57% to 0.49%

- 2 Year Treasury down a touch, but not nearly as much since the Fed is control of the front end of the curve. Monday opened at 2.88% and closed Friday at 2.86%.

- CPI came in softer than expected at 2.2% y/y

- Not enough weakness for the Fed to change its current plan

- Stocks were down 4% on the week even after a strong rally Friday

- Three consecutive weeks of losses

- Two thirds of S&P in correction territory

- No one seems to care about the mess in Italy

Loco Like a Fox

President Trump took some shots at the central bank last week, saying monetary policy is “so tight. I think the Fed has gone crazy.” Of course, the best was when he said the Fed “is going loco.” There is no way this is in any way tied to his personal real estate holdings. I wish he would tell the NFL it’s roughing the passer rules are loco so Clay Matthews can get back to playing defense again.

Fed Chair Jay Powell arguably has a tougher job than his predecessor. Janet Yellen inherited a fragile economy and just had to keep hitting the Accommodate!© button. Powell has to extricate the Fed from emergency monetary measures without pushing the economy into a recession. Thus far, he has done an excellent job (so had Yellen), but has been a bit more hawkish than expected.

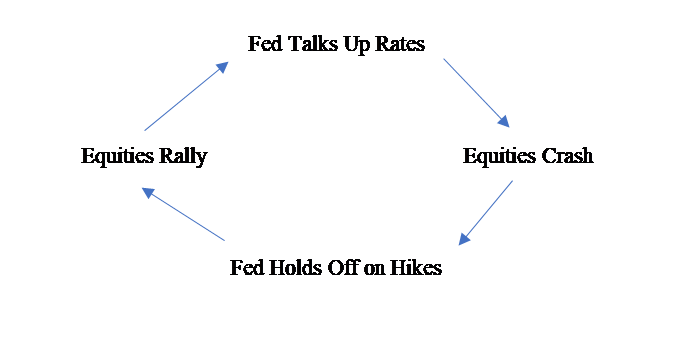

With the sharp equity sell-off, Powell is being truly tested for the first time. You’ve heard of the Greenspan Put, the Bernanke Put, and the Yellen Put. The notion of a Fed put is that the Fed will bail out (insert crashing market instrument here) to avoid dragging the entire economy down. The Fed is the backstop.

Here’s a really complicated graph we put together during Yellen’s tenure to help explain the concept. You’re probably not as smart as us and may need to call so we can explain it to you. Don’t be embarrassed, we’re really smart.

The market shouldn’t assume Powell will swoop in to save the day. He has been consistently hawkish, he constantly talks about how strong the economy is right now, etc. A few bad weeks in equities won’t cause Powell to change course.

Also, Powell has said he is worried about stretched valuations. He probably believes a small stock market correction is a good thing.

Powell likely thinks that the occasional correction in equities and leveraged credit assets is normal during a tightening cycle. It’s healthy for a period of price discovery as markets reassess valuations with higher risk-free returns. Unlike his predecessors, he didn’t come from the ivory towered world of academia. He has lived with risk professionally.

I’ve been a fan of Powell’s since he was nominated. I wish he would pay more attention to a yield curve inversion, the lack of inflationary pressure, and the threat of a trade war, but overall he is doing a good job navigating these waters.

If he still hiking aggressively this time next year, Trump will be proven right. But with asset values already too high, sub-4.00% unemployment, strong GDP, etc…if Powell is loco, he’s loco like a fox.

10 Year Treasury

It’s hard to believe now, but there used to be a time when stocks and bonds were highly correlated. When stocks went up, bond prices went down (and yields went up). As money flowed out of one, it moved into the other. It was so simple even I could follow it.

Then quantitative easing came along. Turns out, when the Fed pumps $4.5 trillion into the economy, all asset prices go up. There is no flow from one to the other because there is just so much money that everything goes up. Stocks and bonds went up. Rates went down. Everyone won. Especially readers of this newsletter.

Then in mid-2017, the Fed announced plans to begin shrinking its bloated balance sheet and initiated reverse QE in October a year ago. The balance sheet has shrunk marginally over the last 12 months.

Last week’s market movements felt like the good ole days. Risk off mentality led to money flowing out of stocks and into bonds. Equities down, bond prices up, and therefore rates down. All made sense again!

Take a look at the graph below. Notice the nice correlation and then the breakdown as this relationship was distorted by the massive Fed accommodation post-2008.

With the Fed reducing its balance sheet, perhaps this relationship is returning to normalcy? If rates continue marching higher, it has to negatively impact stocks, doesn’t it?

So where do yield go from here?

On March 19th, we highlighted an interesting calculation that Doubleline CEO Jeffrey Gundlach uses to ballpark the appropriate 10 Year Treasury yield.

Nominal GDP + German Bund = 10 Year Treasury Yield

2

6.4% + 0.49% = 3.45%

2

Using back of the envelope math, Gundlach would expect the 10T to be trading around 3.45% right now. He would be the first to admit this isn’t a trading strategy, but has been eerily accurate over the last 40 years. Given the sharp equity sell-off and ongoing issues in Italy, I am surprised the 10T only dropped to 3.15% last week. This suggests the bias is still for higher rates.

One of the other issues Gundlach highlighted in March was that he was really more focused on the 30 Year Treasury from a technical standpoint. He felt that if the 30T broke 3.25%, it could push dramatically higher and drag the 10T higher with it.

30 Year Treasury

I don’t agree with Gundlach that the 10T is heading for 6%, but it’s obvious why he believes 4.00% is on the table.

Treasury Correction?

The base case is that the sell-off in equities is just a temporary blip and the Fed will maintain course. As long as Powell maintains a gradual yet nimble approach to hikes, the market will likely take it in stride. Both LIBOR and the 10T climb steadily.

But there is also a real risk that higher rates expose excess leverage and inflated valuations. This leads to sharp asset re-pricing (real estate in 2008, tech stocks in 2000, etc) and could force Powell to change the Fed’s monetary policy…the Powell Put.

There’s a rule of thumb during a tightening cycle that if the S&P falls to its 200 day moving average, the market generally backs out a rate hike. That has not yet happened, as the market still has a hike in December at 76% and Fed Funds at 3.00% by the end of 2019. Perhaps most importantly, the 2 Year Treasury hasn’t flinched.

Given the relatively minor drop in 10yr yields last week despite some pretty negative news, I wonder if the market is failing to sufficiently price in systemic repricing of risk assets. And if Powell is slower than predecessors to waive the white flag on rate hikes, he could exacerbate the problem.

Despite shorts on Italian bonds hitting the highest levels since the May implosion, the US market seems indifferent. Italy’s economy is 10x larger than Greece. Draghi said just last week that if the populist Italian government doesn’t play by the rules, there will be no bailout. But how many tools does Draghi even have at his disposal?

This situation is escalating:

– On Wednesday, Fitch wrote a highly critical report on the expected budget and the disorderly process by the 5 Star Movement. Fitch all but promised that the budget it reviewed would lead to a downgrade on Italy’s credit rating.

– Italy needs to submit its budget proposal to the European Commission today. Yes, today.

– In May, the Italian 10yr was 1.7%. Last week, it clipped 3.7%. Can you imagine the 10T moving from 3% to 5% in a few months?

This isn’t some far off event – this is happening right now!

So…the market is probably right and nothing disastrous will happen. But, like May, it feels like the market is being complacent and we could be caught off guard by a low probability event occurring.

Trying to think through these outcomes is making me loco.

This Week

Relatively light data week, but we will get the FOMC minutes. More importantly, developments out of Italy will drive rates.