Markets Take a Mulligan

I spent New Year’s Even sipping on Theraflu like Snoop Dogg on gin and juice, unsuccessfully fending off strep and bronchitis. My wife was icing her recently torn ACL. Two teens laid up with wisdom teeth out. Yeah, it was pretty much a South Beach rap video in our household that night. Then Penn State sh*t the bed on January 1, with Franklin finding a way to blow a game late in the 4th again. Walked into the office on January 2nd and two other employees called out sick with similar symptoms, one threw out a back, and another’s flight home from Wisconsin the night before had been cancelled.

So on Thursday we collectively decided to we needed a mulligan on New Year’s. Take all the hope and optimism that normally accompanies December 31 and stuff it back into Friday January 4th. A do-over. Hit the reset button.

Turns out we weren’t the only ones. Markets started off the week plunging into the abyss, only to rebound following Friday’s job number and closing the week back at the same level it started. Powell comments, rumors of a US delegation headed to Beijing to resolve the trade war, and a very strong job report all conspired to bring the markets back up.

Last Week This Morning

- 10 Year Treasury started at 2.70%, plunged to 2.57%, and then rebounded to 2.70% on Friday’s mulligan

- German bund drifted lower to 0.20%

- 2 Year Treasury started at 2.65%, plunged to 2.52%, and rebounded to 2.65% on Friday’s mulligan

- LIBOR leveling off around 2.52%

- Powell finally jumped in and offered some reassurances to the market

- 312k jobs were added last month vs forecasted 184k

- Unemployment ticked up to 3.9%

- Average hourly earnings increased from 3.0% to 3.2%

- Government shut down enters it’s who caresth day, with Congress still getting paid and rank and file federal employees not getting paid. And cabinet appointees and Pence actually got raises.

- A US trade delegation headed to China for discussions on Monday and Tuesday

Jobs Report

Man, the market needed that. Sixty seconds before the report, I said “If the report shows a gain of only 50k, the market will tank further. If it shows actual job losses, the 10yr Treasury is going to 2.00%.” But in our office pool, I selected 300k and won for the first time in a very long time. The mulligan is working!

My rational was this – last month’s report was surprisingly weak due to the weather, with the BLS noting at that time, “Workers unable to work due to bad weather” were 129k. So I took the consensus forecast of 184k this month, added 129k bad weather misses from last month, and came up with 313k. The actual number was 312k. The job market took its mulligan (this is going to be a heavy handed theme, so settle in).

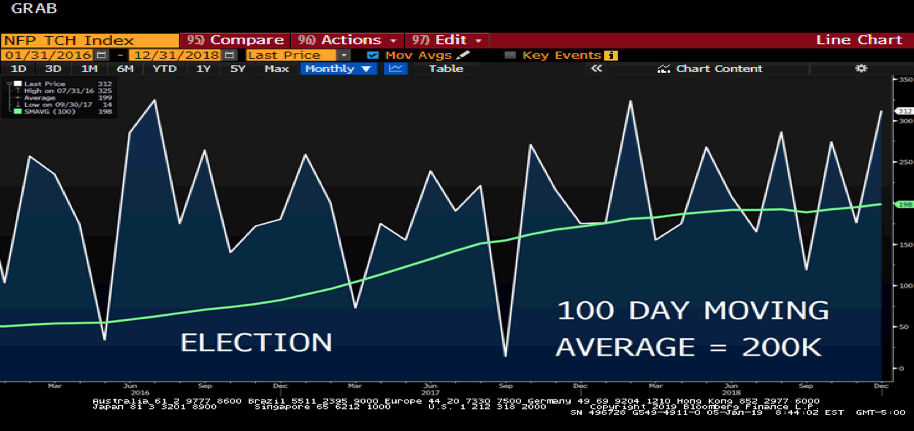

That means the 155k from last month was artificially low and this month’s 312k is artificially high. The truth is probably somewhere in between, maybe 200k-ish. In fact, here’s a graph of Non-Farm Payrolls over the last two years with a 100 day moving average of 200k jobs/month. This does not feel recessionary.

We’ve been beating the drum about an inverted yield curve signaling a recession in 18-24 months, so we went back to the two years leading up to the 2008 crisis to see how the job market performed. As you can see, the 100 day moving average was 86k/mo, vs the current 200k/mo.

But once the downturn began, jobs were negative quickly and sharply. If we see job growth slow to 50k-ish jobs per month and the talking heads reassure us by saying that is what happens when you approach full employment, just keep in mind we could be teetering on the brink. But for now, the economy seems much stronger than the market is giving it credit for.

LIBOR vs SOFR

On Friday 12/28, SOFR set at 2.46% – about what could be expected.

On December 31st, it spiked to 3.00%.

It opened January 2nd at 3.15%.

The very next day, it was back down to 2.70%. A mulligan if you will.

SOFR is intended to replace LIBOR, ideally in 2021. But do so, the market needs to have confidence in the index. This sort of volatility will make that more challenging. What in the world is going on with SOFR?

SOFR is a type of repo rate. Repos are just loans backed by collateral, in this case Treasurys.

Notice in the graph below how SOFR spikes at quarter end. That’s because banks don’t want to make loans at quarter end for regulatory purposes. It doesn’t matter if it’s an unsecured loan or a loan backed by Treasurys, they simply don’t want to make loans. Compounding this issue is that Treasurys are the world’s mattress, so they have supply and demand tendencies that have nothing to do with price or yield.

In a round about way, the spike in SOFR also reminds us why regulators want to move away from LIBOR.

If banks don’t want to lend money at quarter or year end, shouldn’t LIBOR spike, too? If LIBOR is the rate at which banks lend to one another, why doesn’t it climb at quarter and year end?

The answer is…it used to. I can remember before the crisis when LIBOR would typically climb about 0.10%-0.15% in December, only to settle back down in January.

But post-crisis, banks balance sheets have bloated and they have much higher capital requirements, meaning they don’t borrow from other banks nearly as much as they used to. They kept submitting LIBOR surveys as required and just gave best estimates at where they think they would borrow.

This too-big-to-fail index imbedded in trillions of dollars of contracts doesn’t really have any underlying transactions to support it.

Cue SOFR. A market driven index. Based on real transactions instead of best guesses.

But if you want a market-driven index, you have to live with the market driven ups and downs…but the regulators are going to have to figure out a way to smooth out the volatility because most borrowers we work with would be pretty upset to see their monthly invoice spike from 2.50% to 3.15%.

Thank you Jay Powell

Finally. Powell finally sent some much needed dovish signals to the market. This was exactly the sort of thing we have been hoping for. While we’ve been expecting him to change his tune, with each passing month he just refused to budge. I was worried he was going to hawkishly march us into the next recession.

I can appreciate his conundrum. If we separate “market” from “economy” and only look at the economy, most signs are strong. GDP, unemployment, inflation, etc. But markets are forward looking. Trade wars. Geo-political risk. Oil. Earnings have been disappointing. You know all the stuff.

That’s why stocks have been getting crushed, rates plunged, and the yield curve was on the verge of inverting. Panic was setting in. Throw in fears that the Fed is tone-deaf and will keep hiking and it was classic flight to safety time. In fact, Powell’s infamous 10/3 statement about being a “long way” from neutral and then the less-dovish-than-hoped December FOMC meeting, the signs were negative.

Then Powell took his mulligan on Friday, “We’re listening carefully with – sensitivity to the message that the markets are sending and we’ll be taking those downside risks into account as we make policy going forward.”

He also added that the Fed would not hesitate to change its stance on balance sheet normalization if they believe it is causing issues. This is also a huge change in position – as recently as December he described this as being on “autopilot”. Markets rejoiced and the rally was on.

We don’t think this should be taken to mean the Fed is now paused. But it is reassuring that the hikes are not on autopilot and the Fed will only hike if the data supports it. The Fed is once again data-dependent.

The odds of a hike at anytime in 2019 are now at just 5%, whereas the odds of a cut are at 30%. The forward curve has 1 month LIBOR at 2.49% at year end (vs 2.52% today). But we think it will be financial conditions that really dictate hikes.

Financial conditions typically tighten when the Fed hikes, but until recently this cycle has been different. With conditions easing as the Fed hiked, Powell probably felt like he had to keep hiking to get the desired result. Now that financial conditions are responding, Powell can ease off the hikes.

If you missed last week’s newsletter on bowl games, we suggested that financial conditions will be one of the most critical data points in 2019. As conditions tighten, GDP slows. It’s a very direct relationship, albeit with a slight lag. If financial conditions remain restrictive (above 100 in the graph), expect GDP to push lower.

Fixed Rates

The 10T is down 0.70% in under two months.

On Thursday, you could lock in a 10 year swap below LIBOR.

Despite Friday’s jump, 10yr swaps are still just 4bps higher than 2yr swaps. Five year swaps are below both.

We were flooded with calls and emails this week with clients asking if they should hedge now. We are putting out a white paper this week on this very topic, so we won’t spoil it here. Instead, let me tell you a story about my time on the trading floor in the second half of 2007 when the curve inverted.

Selling swaps was like shooting fish in a barrel. You could lock in a fixed rate and immediately save money – no brainer. You could go from floating at 5.32% to locking in at 5.00%. And once rates started falling and swaps fell faster than LIBOR, the same relationship held true. We kept selling swaps as everyone figured the Fed would stop cutting eventually.

Next thing you know, LIBOR was at 0.32% and that 5.00% fixed rate that felt so good when you locked it in was 5.00% above market in just 18 months…at the exact same moment that the economy was tanking and borrowers needed the most cashflow relief.

I have no idea if LIBOR is headed back to 0%, but be certain you can live with missing out on that scenario if you choose to lock right now.

This Week

Tons of important economic data, with manufacturing data, durable goods, inflation data, and FOMC minutes.

Headlines out of China will likely dominate market movements, followed closely by numerous Fed speakers.