No, China is Not Dumping Treasurys

I had a better title, but Harbaugh stole it. I thought the only fair thing to do after Harbaugh was suspended from the sidelines Saturday was to do the same and keep Franklin off the sidelines. Good sportsmanship and all. Alas, I don’t make the calls at Happy Valley. And now Michigan interim HC Moore now has exactly the same number of road wins against Top 10 teams as James Franklin, so that’s a fun stat for your next tailgate trivia game.

I’m certain Harbaugh woke up Saturday morning to a text from China the night before, “U up?” Since China is the only one that can match Harbaugh’s self-righteous act, I figured this is the perfect week to dig into both.

Yep, it’s one of those newsletters.

Last Week This Morning

- 10 Year Treasury at 4.65%

- German bund at 2.72%

- 2 Year Treasury at 5.06%

- SOFR at 5.32%

- Term SOFR at 5.32%

- Loan Officer Survey: Tighter lending conditions and weaker demand

- 14 Fed Speeches, here are some highlights

- Fed Chairman Powell: Not confident Fed has done enough to bring inflation down

- Cook: Global tensions could change US economic outlook

- Waller: Q3 growth a “blowout” but new data suggests slowdown

- Barkin: We are still yet to feel the full effects

- Bostic: Rates are “likely sufficiently restrictive”

- To all of my fellow veterans, thank you for your service. Is it weird that Veteran’s Day doesn’t get celebrated if it falls on a holiday or is that exactly the sort of treatment you’d expect of our servicemen and servicewomen?

China Owns Us and the Sky is Falling and Rates to the Moon!

Lots of headlines like this lately, “China sells the most US assets in 4 years, dumping $21 billion of US stock and Treasury bonds”.

I am asked dozens of times a year what would happen if China were to start selling Treasurys. And then this year it started happening! Chaos. Pandemonium. Dogs and cats living together. Mass hysteria. Almost as many “I told you so” emails as the people calling for inflation since 2014.

Like Michigan’s sudden and totally coincidental emergence as a top program the exact same year they started stealing signs, there is more to the story.

Michigan fans – here’s a link to unsubscribe if you don’t feel like this is a safe space for you anymore.

How Big is the US Treasury Market?

About $26T in outstanding securities.

How Big of a Holder of Treasurys is China?

Officially about $805B.

What is $805B Divided by $26T?

3%

If One Tenant Represented 3% of Your Total Portfolio, How Scared Would You Be of Them?

That’s up to you to decide. But if a lender called you claiming your company was about to go under because of that one tenant, would you be like, “Oh my gosh, I had no idea. That’s terrible. How did we miss that!?! Are you guys hiring? How will my kids eat?!?!”

OK Smartass, Is China Selling Treasurys or Not?

Technically yes, but it’s not that easy. Plus, on a net basis they appear to be buying at least as much as they are selling.

First, below is the link to the “official” US stats on foreign holdings of US Treasurys. You’ll see that China is second only to Japan. This is the table all the media headlines reference when screaming about how China is dumping Treasurys. “Here, look at this really formal government table about Treasury holdings. There aren’t even any colors, it must be legit!”

You didn’t click on the link, did you? Don’t worry, if I hadn’t been the one writing this, I wouldn’t have either. That’s why we’re friends. Don’t worry, it just confirms that the “official” US statistics show a decline in Treasury holdings by China. All those media headlines are right.

Wait, Why Do You Keep Putting Air Quotes Around “Official”?

Good catch!

Like Harbaugh, China isn’t known for its transparency and fair play. Michigan’s “official” record the last few years might be a little different if they hadn’t been cheating, right? Same for China’s holdings of Treasurys.

You’re Really Sticking with the Cheating Thing, Huh?

I am a sore loser. I’ve been really honest about that. I’m more mad at myself than anything for falling for the PSU hype this year. But I’ll try to focus better, promise. Let’s examine some common reasons why everyone is so scared of China dumping Treasurys.

Why China Might Sell Treasurys

1. Weaken the yuan to support their exports

2. Deterioration of US credit dampens demand

3. Free up cash when their economy weakens

4. Sell before Treasurys lose value

5. Good old fashion spite…some people just want to mess with the competition

“Well allow me to retort,” totally random quote from Samuel L Jackson as Jules Winnfield in Pulp Fiction. Seriously, there’s no other connection in the newsletter, it just popped into my head and I love that movie.

Why China Wouldn’t Sell Treasurys

1. Selling negatively impacts the value of the rest of their Treasury holdings

2. Even if they sold, those proceeds have to go somewhere. You guys know that better than anyone when you consider selling a property. Where are they reinvesting that matches the profile of a US Treasury?

3. Destabilizing currency markets likely punishes them more than us

4. Putting upward pressure on US rates leads to outflows from China to US as investors chase yield, causing China to raise their own rates and buy the yuan. Higher rates slow their economy, while a stronger yuan offsets the benefit of a weaker currency

5. My personal favorite and the one no one ever seems to mention…the Fed can simply step in and replace China as a buyer, negating the desired effect

Turns out geopolitical monetary policy is tricky business, like winning football games without knowing the other team’s plays. That’s why I keep putting air quotes around “official”. Like Harbaugh, China needs to pull funny business to keep up with the Wangs.

PBOC readers – here’s a link to unsubscribe if you don’t feel like this is a safe space for you anymore.

The Chairman of Everything Except Transparency

Are You an Expert on This?

No, but since when has that stopped me from offering up my thoughts from a Chicago hotel at 3am? More importantly, there are experts out there. What follows borrows heavily from Brad Setser, a Whitney Shepardson Senior Fellow at the Council on Foreign Relations. Funny little story, I almost went with that exact title for the podcast before landing on The Rate Guy. Small world.

“Why Are You Giving Him Credit? You Can Just Steal His Stuff If You Want.” – Jim Harbaugh

I like your brother better than you.

OK, Let’s Get On With It

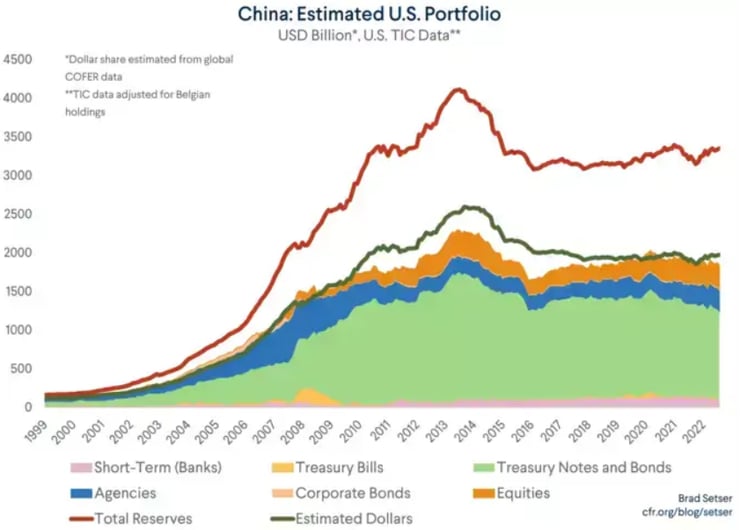

Last month, Brad wrote an article “China Isn’t Shifting Away From the Dollar or Dollar Bonds.” I’m sure you read it, but just in case you didn’t he opened with, “China's reserves have shifted its dollar reserves from Treasurys to Agencies and made increased use of offshore custodians. The available evidence suggests that it still holds about 50 percent of its reserves in dollar bonds.”

This article suggests China’s overall holdings haven’t really changed over the last 8 years, they’ve just gotten better at hiding their holdings ever since one of their central bankers got busted taking iPhone videos of a Ben Bernanke press conference.

Brad also wrote a great piece last year, “How To Hide Your Foreign Exchange Reserves User Guide.”

(The most surprising thing about Brad has to be that he doesn’t go by Bradley, right? He’s got Harvard and Oxford in his bio, that screams for Bradley or maybe even Bradford. I respect him for staying grounded)

How Do They Conceal Their Holdings?

Glad you asked, let’s dig in.

Method 1 – Custodial Accounts

Just buy and sell Treasurys out of accounts that can’t be traced back to you. This is old school Chicago mafia style stuff.

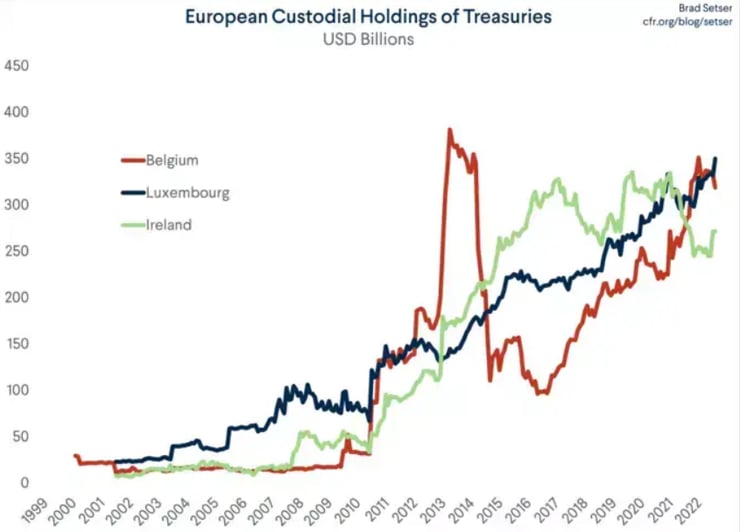

Look how use of European custodial accounts spiked after the financial crisis when the US implemented much more stringent reporting requirements. That’s about as coincidental as Michigan’s emergence as a top program at the exact same time Stallions started stealing signs.

In the graph below of three of the most prominent enablers, Treasury holdings are larger than their entire GDP by many multiples. It should be noted that other countries like Russia likely use this method as well, so it’s not entirely China.

Method 2 – Chinese “Private” Banks

“Now that you’ve explained your use of air quotes, I detect a hint of sarcasm, right?”

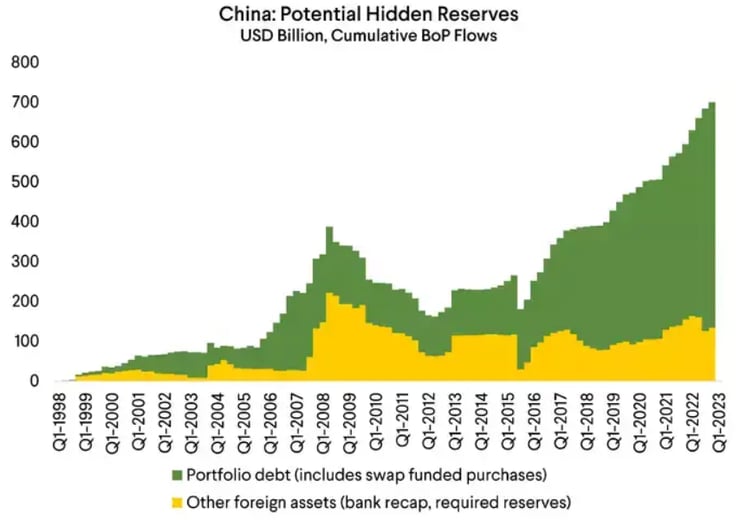

Not only can China use these custodial accounts to obscure US holdings, but their own banks are just arms for the government. But it gets tricky because these entities are under no obligation to be honest with us. So our crafty buddy Brad uses China’s Balance of Payments (BoP) to track asset holdings on behalf of the state.

Regardless of whether the purchaser is a government entity or a private institution, the acquisition of foreign assets like U.S. Treasurys by Chinese entities is recorded in the BoP. This is true even if the purchases are made indirectly through intermediaries or in foreign markets.

Note how the BoP has surged over the last five years.

Method 3 - Openly Run State Owned Banks

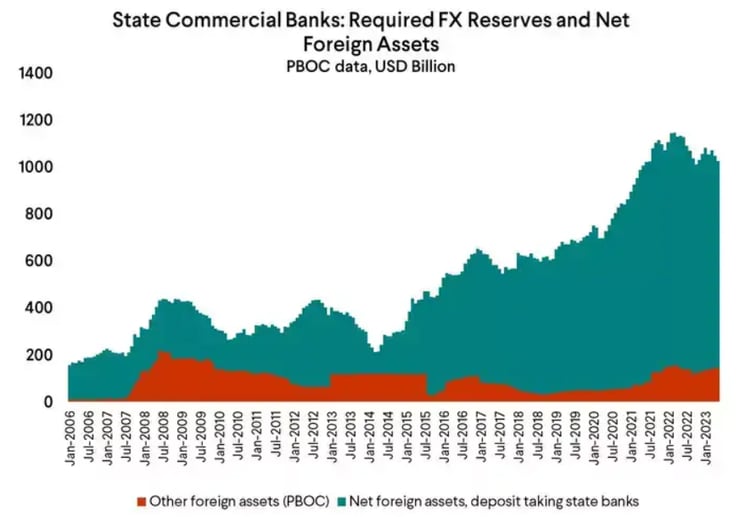

From the Department of Why Even Bother, let’s look at the banks China doesn’t even bother to pretend are private. Same story – surge.

Method 4 – The Export Import Bank of China

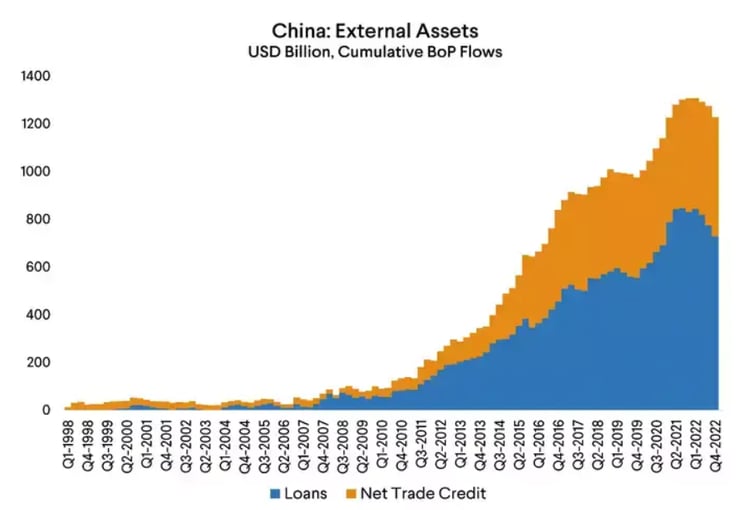

According to Brad, this is the big one.

“The Export Import Bank of China and the China Development Bank were global minnows back in 2009. Total “loans” in the balance of payments at that time were something like $50 billion and net trade financing was $30 billion. Now they are whales. Each individually has a larger commercial external loan book than the non-concessional loan book of the World Bank.”

All Those Graphs Go Up and to the Right, So It Feels Like You’re Trying to Tell Me Something?

All those scary headlines about China dumping Treasurys are more about selling clicks than facts.

China holdings of US assets has remained largely stable since 2015, somewhere in the neighborhood of $1.9T. They have shifted asset allocation (from Treasurys to Agencies) and obscured the purchases through the mechanisms we covered, but they haven’t started dumping Treasurys en masse.

One last graph from Brad where he estimates actual (instead of “official”) US holdings by China.

So, while China is selling Treasurys in the data the US government reports, it is offsetting that in more opaque transactions. The big fear of mass Chinese selling is overblown.

But When a Headline Confirms What I’ve Been Saying for Years, I Want it to be True so I Can Tell People I Was Right.

If my answers frighten you, then you should cease asking scary questions.

Wait…What is $1.9T Divided by $26T?

7.3% and I like where you’re head is at. China is a substantial holder of Treasurys, more so than the official stats would suggest. But they are an unlikely seller in any volume that would hurt us long term, particularly when you consider the Fed could jump in and buy to provide stability.

Hey, Did You Sneak In Another Jules Quote From Pulp Fiction Back There?

Just like Harbaugh, you caught me.

If Harbaugh Was a Character from Pulp Fiction, Who Would He Be?

The Gimp, obviously.

You’re Just Forcing It Now

“The path of the righteous man is beset on all sides by the inequities of the selfish and the tyranny of evil men. Blessed is he who, in the name of charity and good will, shepherds the weak through the valley of darkness for he is truly his brother’s keeper and the finder of lost children. And I will strike down upon thee with great vengeance and furious anger those who attempt to poison and destroy my brothers.

And you will know my name is The Harbaugh when I lay my vengeance upon thee.”

Week Ahead

Fed members continue their press tour, but this week’s highlight will be the CPI and PPI reports to be released on Tuesday and Wednesday.

Oh, and Biden and Xi meet this week in San Francisco.