Powellmageddon – October 3, 2018

Once in a lifetime storm. Generational. One to two feet of snow. Snowmageddon. Just a few ways the weather forecasters were describing the storm that was headed to Charlotte this weekend.

We got some rain, but not even a lot of rain. It basically drizzled all weekend. So here’s to the only guys worse at forecasting than me…meteorologists….and Fed officials.

Last Week This Morning

- 10 Year Treasury plunged to 2.82% before closing the week at 2.85%

- German bund drifted lower to 0.25%

- 2 Year Treasury also plunged to 2.72%

- LIBOR up to 2.40%

- Odds of a December hike still at 67%

- St Louis Fed President James Bullard said on Friday the Fed should hold off this month

- There is no Fed meeting in 2019 with a 50% probability of a hike

- LIBOR forward curve collapsed

- 12/31/18 – 2.52%

- 12/31/19 – 2.58%

- 12/31/20 – 2.66%

- Yield curve initially flattened to less than 10bps as the front end refused to blink while the long end collapsed.

- Once the front end threw in the towel, the yield curve steepened back out to 0.13%

- 2’s/5’s part of the curve actually inverted

- John Kelly is stepping down as Chief of Staff at the end of the month

- NFP at 155k vs 198k forecast

- UR still at 3.7%

- With each new conviction or guilty plea, I am more convinced than ever that this whole Mueller thing is just fake news. Somebody needs to rein this guy in with all his false convictions. And for crying out loud where is his report on Hillary’s emails!?

Job Report

The economy added 155k jobs last month, missing the forecasted 198k while also revising down last month’s report. The miss couldn’t have come at a worse time, with markets on edge all week.

Despite the apparent weakness, the BLS indicated that bad weather played a significant role. “Workers unable to work due to bad weather” came in at 129k. With this week’s storm, that trend may not reverse entirely next month but at some point we may see a report “catch up” and the overall trend not be as negative as it currently looks.

Average hourly earnings rose 3.1% as forecasted, but the month over month was a bit softer than expected.

The job market was reasonably strong, but the market wasn’t in the mood for any kind of miss.

Powellmageddon – October 3, 2018

At the risk of beating a dead horse, Powell may have broken markets on October 3rd.

That was the day he spooked markets by saying, “we’re a long way from neutral.” He then maintained his hawkish stance right up until two weeks ago when he changed course and said current interest rates were just below neutral.

So why does this matter? Because the Fed historically hikes us into a recession, preceded by an inverted yield curve.

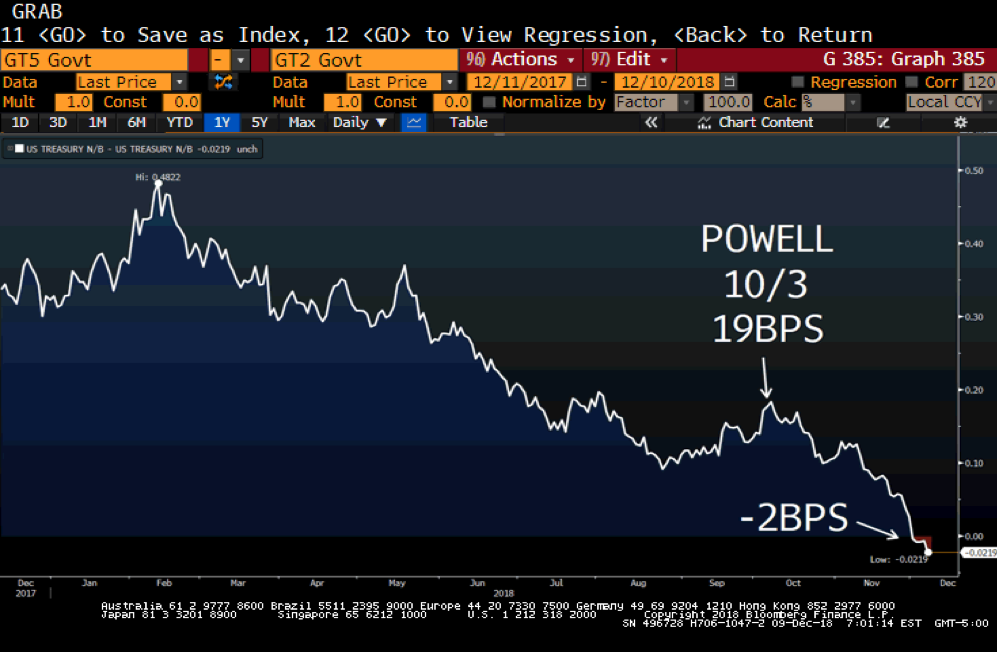

Yield Curve Steepness

The 5 Year Treasury is now yielding less than the 2 Year Treasury, meaning the 2’s/5’s part of the curve is inverted. While not considered the traditional recession indicator, it could certainly be a precursor to a potential 2’s/10’s inversion.

5 Year Treasury Minus 2 Year Treasury – Negative Now

10 Year Treasury Minus 2 Year Treasury Just 13bps Now

The more traditional measure of yield curve steepness now stands at just 13bps, but actually got as low as 9bps last week before rebounding.

The only reason the yield curve did not invert last week was because the market lowered expectations for future rates hikes. The Fed hasn’t formally changed its tune, so the market is betting the Fed will have to hold off.

If Powell & Co reiterate more hikes for 2019, the yield curve could invert. Powell needs to be very careful right now.

While I would normally expect the Fed to tread lightly, Powell has consistently dismissed the threat of an inverted yield curve…so while I do expect a dovish Fed hike next week, I can’t completely write off the possibility that Powell missteps.

But it isn’t just the yield curve that has responded negatively to Powell’s 10/3 statement. Let’s see how other markets have fared since October 3, 2018 and you tell me if Powell’s words matter.

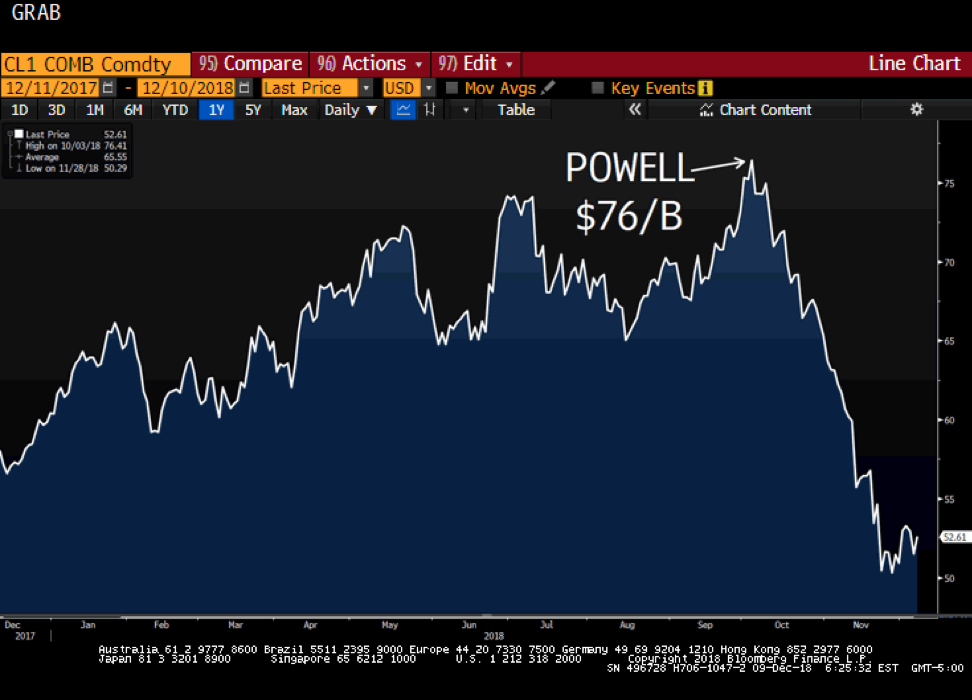

Oil Since 10/3

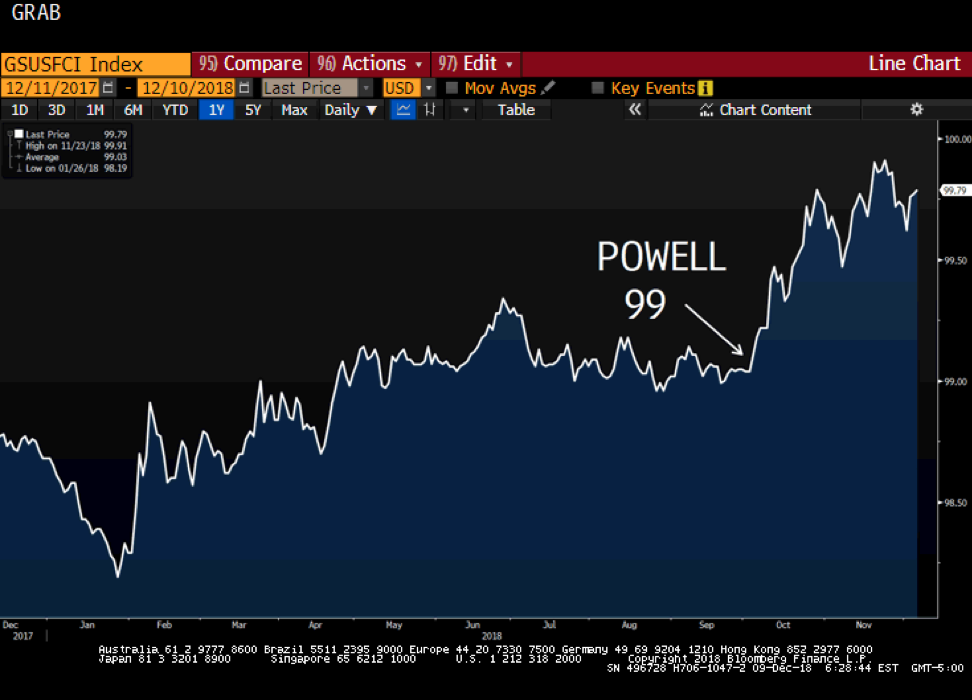

Financial Conditions Since 10/3

Financial conditions are an often overlooked, but very critical, measure of the economy. This reflects easy vs tight monetary conditions. In general, when the Fed hikes interest rates, financial conditions tighten and the line on the graph moves higher.

The higher this index climbs, the tighter financial conditions are. This generally leads to a cooling economy – exactly what the Fed wants when it is hiking rates.

But if the Fed overdoes it, then conditions can tighten too much. The spike in financial conditions since October 3rd suggest a much slower Q1 2018.

S&P Index since 10/3

Pretty self-explanatory, but just in case you weren’t sure check out how the bottom fell out in equities after Powell’s comments.

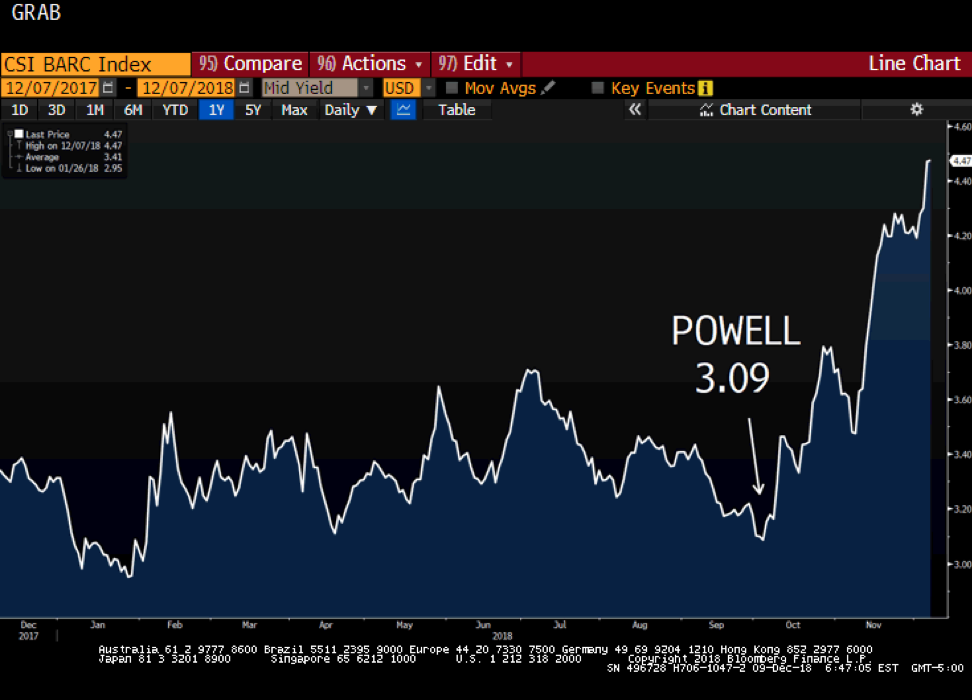

Credit Spreads Since 10/3

Takeaway?

The Fed is on the verge of hiking us into another recession and Powell’s dismissal of an inverted yield curve is a significant concern. One simple statement on October 3rd has sent markets into a tailspin. If Powell doesn’t acknowledge the impact of his words and Fed policy, the downward spiral could continue.

Maybe Powell can send enough dovish signals to ease market concerns, but he will need to do so quickly. I still think he hikes next week, but also believe he will lower the trajectory of hikes in order to calm markets.

And then in 2019 we will spend a lot of time talking about how the Fed is being too slow to cut interest rates…

This Week

Brexit vote in Parliament and developments on China will be the headline risks.

PPI and CPI inflationary data, as well as some retail and manufacturing data. The Fed goes mostly silent ahead of next week’s meeting, but Powell may be forced to send some signals if we kick off the week with further pain.