Premature Pivot

A newsletter unlike any other…

I was watching the Masters just like you and wanted to incorporate that somehow. I do have an office wager with a colleague where I got Scheffler/Rahm/Rory and he got the field. That wager forced me to learn that Scotty is actually spelled Scottie. Let’s hope his wife doesn’t go into labor before 7pm Sunday!

Last week, I of course heard from JMo .39 seconds after the CPI data was released.

“What was the CPI report today? My Internet’s a little fuzzy and I can’t download it.”

I can’t believe I am taking sh*t from a guy that capitalizes the word “Internet”…

For my Core PCE Wager with JMo, I am betting on Core PCE < 3.0% for 2024 in large part because of the shelter component from 2023 dragging down the reading in the first half of the year. I actually believe rents have bottomed and are starting to rebound, which means they will start showing up later in the year.

I probably need a cushion at the halfway point in order for Core PCE to average < 3.0% this year. Next week will be the next print and an average thus far of 2.85%.

Last Week This Morning

- 10 Year Treasury at 4.52%

- German bund at 2.37%

- 2 Year Treasury at 4.89%

- SOFR at 5.31%

- Term SOFR at 5.32%

- CPI - All measures .1% higher than expected

- PPI - As expected or slightly below expectations

- U Mich Sentiment printed at 77.9 vs 79 expected

- Fed Speeches

- Fed Williams – Believes the central bank has made “tremendous progress” fighting inflation, it was also stated “There’s no clear need to adjust monetary policy in the very near term” and the recent “bumps” in inflation readings have not been unexpected.

- Fed Collins – Still expects it to be appropriate to begin cutting rates later this year, but believes the recent data suggests it will take more time than initially thought.

- Fed Daly – Believes there is still “a lot of work to do” to make sure inflation is on track, and there is “absolutely’ no urgency to cut rates.

- Iran launched a retaliatory attack against Israel, escalating tensions and increasing the odds of a broader conflict (part flight to safety, part inflationary)

Inflation

I get asked a lot when I am going to abandon my projection of five cuts this year. I am notoriously stubborn, so not quite yet. While Q1 could best be summarized as “Stalling Disinflation”, how much of that is attributable to changing the way inflation is measured vs actual reacceleration? How much is from seasonal effects we generally see in Q1? How much is from confirmation bias?

What is starting to hit me is that even if I am right about cooling inflation and not-so-gangbusters labor market, that doesn’t mean the people making the decisions feel the same way. It’s hard not to feel influenced by the headlines even when I poke holes in them month after month.

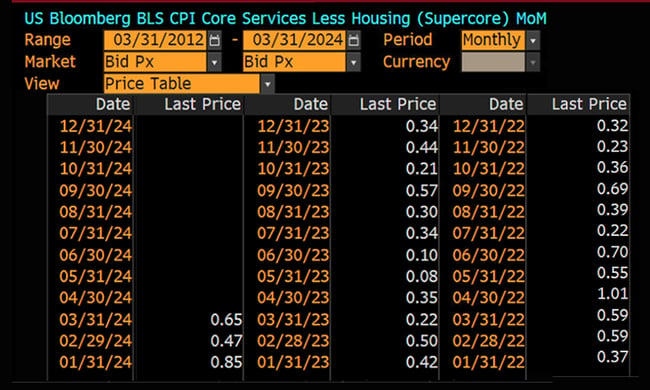

The one thing keeping up the most? Supercore inflation.

This is the measure Powell repeatedly cited last year but has gone conspicuously quiet on as it has started to surge. Through Q1 this year, we are annualizing at 7.88%. Last year was just 3.84%. Yowza.

This is largely a reflection of wages/commissions, which surged with equities following Powell’s premature pivot in December. I think he really regrets the messaging at that meeting – it was just too soon. There was no reason to signal a pivot and the market overreacted.

Supercore also accounts for things like home/auto insurance and property taxes, which are less impacted by monetary policy. This puts the Fed in a tricky spot. Is your insurance bill high because the Fed hasn’t hiked enough?

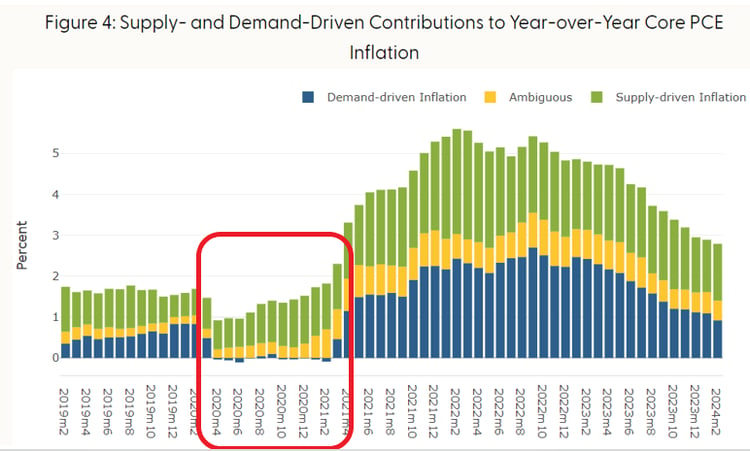

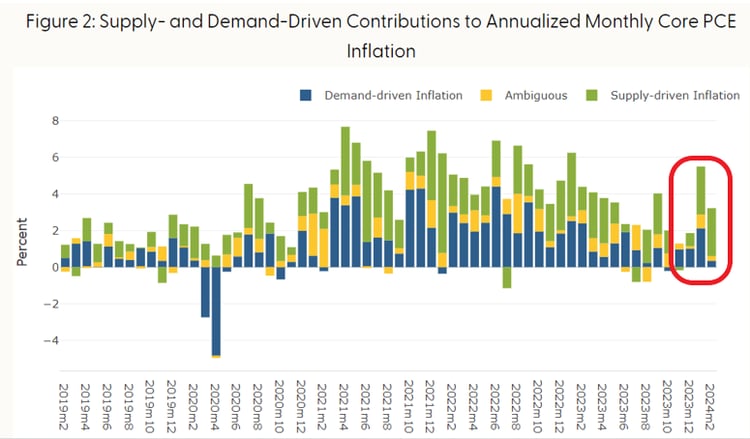

SF Fed official Adam Shapiro has this great graph illustrating demand vs supply components of inflation. I’ve highlighted 2020 to illustrate how supply side (green) dominated inflation that year.

These two components have come more into balance over the last two years. Even more interesting is the monthly data. The monthly numbers, annualized, show that supply side factors make up nearly all of the recent surge in Core PCE. Demand (blue) has fallen off a cliff.

For those of you screaming for the Fed to hike more, just remember: monetary policy primarily affects demand, not supply.

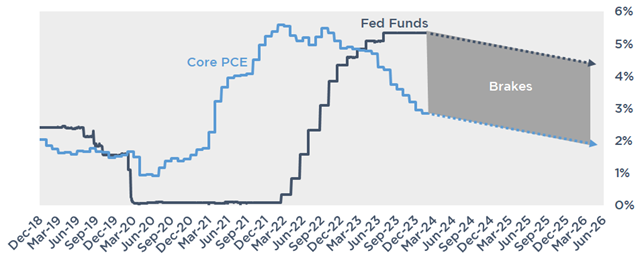

Monetary policy has done a good job of cooling off demand. More hiking won’t fix supply side issues. And if they hold off too long without easing off the brakes, they run the risk of breaking the economy.

In order for a soft landing to be achieved, Powell needs to gently let off the brakes. The current braking action got CPI from 9% to 3%. Do we really need the same amount of brakes to get from 3% to 2%?

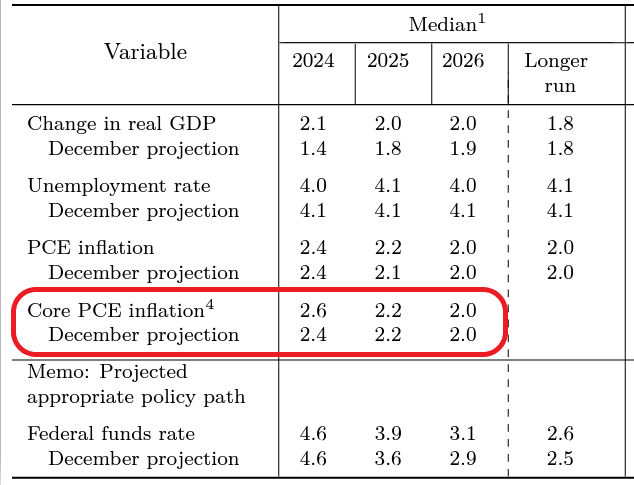

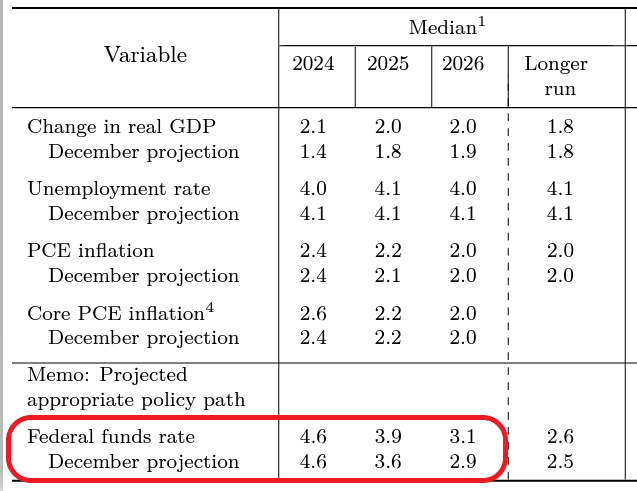

Don’t forget - the Fed doesn’t expect inflation to hit 2% until 2026. Rate cuts this year aren’t dependent on hitting 2% inflation this year. Here’s the Summary of Economic Projections (SEP) from the most recent FOMC meeting.

Here’s the projections for Fed Funds ending this year at 4.6% - three cuts.

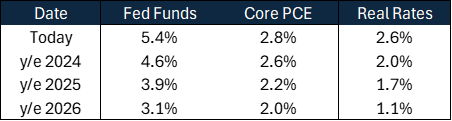

Now look at the delta between the two. Remember, Fed Funds - Core PCE = Real Rates.

That’s the braking action I’ve been talking about. Notice how the Fed wants to gradually apply less braking action (lower real real rates) over time to avoid slamming the brakes on the economy.

My belief the Fed is cutting this year is based on maintaining a consistent level of braking action. If inflation doesn’t fall, they don’t need to cut. But if it falls like they expect it to, they will cut just to prevent the braking action from increasing. In other words, peg Fed Funds to some amount over Core PCE.

The first three months of the year show disinflation has slowed, which probably means a shallower trajectory this year for rate cuts. I’ll wait until Core PCE next week to determine if the number of projected cuts needs to be reduced.

My call for five cuts was predicated on starting in June. If the Fed doesn’t cut by sometime this summer, it makes it harder and harder to cut at all before the election. Here are the remaining meetings.

May 1

June 12

July 31

September 18

November 7

December 18

Because of the election, not doing five cuts doesn’t mean they do four instead. It could mean just one. If they don’t start by July, they may have to wait until after the election. If they plan on 3 cuts starting with September 18th, they probably need to be signaling that by the summer so they can claim they aren’t trying to influence the election. Heck, they might cut once this summer and then let the market deal with the fallout and wait to resume until after the election.

If I’m wrong, it could be by more than usual and there are way fewer than 5 cuts. That would likely mean 2025 brings the more aggressive cuts and we end up at the same spot y/e 2025. I will have to console myself with JMo’s money…

Astute readers may wonder, “hey JP, if you think inflation might actually tick back up in the second half of the year, and you think the Fed is pegging FF to some spread over inflation, why do you still think they’ll be cutting?”

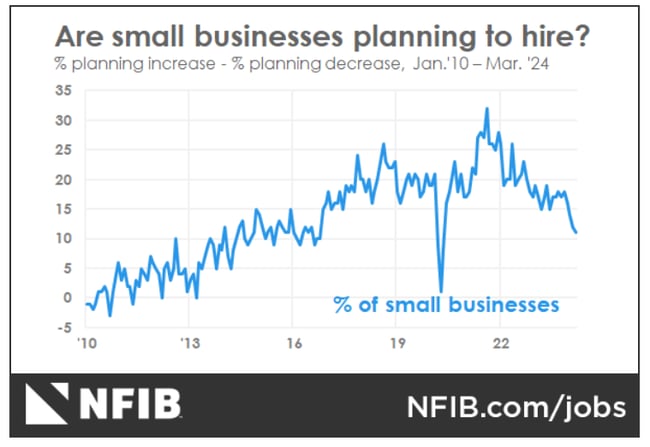

Because unemployment is going to be climbing and more people are going to agree with me later this year that the economy/labor market has cooled substantially. Small business hiring intentions are at the lowest levels since 2017 (not counting covid).

Rates

Odds of a June cut are down to just 28%. I think that’s too low because Core PCE should be around 2.6% by then, pushing real rates towards 3%.

December odds put FF < 5% at north of 60%.

The 10T is hovering around 4.50% with not a lot of technical resistance before 4.75%.

The Week Ahead

Quiet week ahead with retail sales data Monday and Fed speeches throughout the week.

And hopefully Scotty Scottie Scheffler pulling a dub out for me!