Premature Pivot 2.0?

Last week’s “Premature Pivot” was in reference to the December meeting, but can I just claim I was predicting Tuesday’s hawkish pivot by Powell? I could use a win!

Powell said it will take longer for the Fed to gain confidence that inflation is moving to 2%, strongly suggesting cuts will be later this year. Rates spiked and talk of rate hikes started back up again.

Powell giveth and Powell taketh away.

Until Tuesday, I still believed the Fed would start cutting in June. After Powell’s comments, I have to concede they are pushing back the timeline. Unlike the market, I’m not throwing in the towel on at least 3 cuts this year, but the people making the decisions are seemingly more swayed by wonky CPI data than I am.

TLDR:

- Inflationary pressures have been whittled down to a few items

- Some of those items are based on questionable data (cough cough shelter)

- Some of those items aren’t really impacted by monetary policy (how does higher for longer bring down my car insurance bill?)

- I’m still going to beat JMo

I think Powell has done a very good job all things considered, but I think Tuesday was a misstep. We get Core PCE this week - why not just wait another week? What if Core PCE surprises to the downside? Then what does he say?

Why doesn’t he instead say, “We’ve gone from 9% to 3%, let’s keep some perspective as we move towards 2%”? If we could roll back the clock to when Core PCE was approaching 6% and ask, “Hey, two years from now inflation will be sub-3% and still falling .1% per month. Do you think the market freaking out?” the general consensus would have been no.

The only logical conclusion for last week’s pivot is that Powell was trying to massage expectations ahead of the next meeting. If he wants the market response at 4pm on May 1 to be a nothingburger, and he expects his comments to be interpreted as hawkish, then he needed to start sending signals last week.

The Fed has trained us to focus on the data. With labor doing well, that means inflation is the focal point. We’ve essentially become inflation traders, beholden to every minor shift in the inflationary winds and to hang on every last Jay$ word.

Before we jump in, here are some of the main reasons why I could be wrong:

- Corporate profits remain strong

- GDP is strong

- Energy prices are rising

- Financial conditions measures signal the economy can withstand current rates

- Supercore inflation looks rough

- If inflation really does reaccelerate, my braking action thesis argues for hikes

- I’ve been wrong a lot

Progress, Not Perfection

Just 30 days ago, I said the Q&A Powell conducted post-meeting was his best ever. He did a great job of acknowledging higher than anticipated CPI data, while indicating they were alert to the possibility of seasonal factors temporarily inflating the data. Basically wait and see. Perfect.

The CPI data is distorted by the increased weighting to shelter component. OER was 25% of CPI before the adjustment, so now because of that BLS superuser email snafu we know it’s at least higher than that. Do you know what you would rent your house out for? I certainly don’t. But that’s >25% of CPI? That’s weird. The wait and see approach made total sense.

The ECB is expected to cut rates in June because inflation is considered well on the way to 2%. The ECB doesn’t have a wonky shelter component like we do. Interestingly enough, if you calculate US inflation the way the ECB calculates Eurozone inflation, the US is in an eerily similar spot and much closer to 2% than headlines suggest. The red line is the headline CPI, while the other two lines are the adjusted-for-shelter readings.

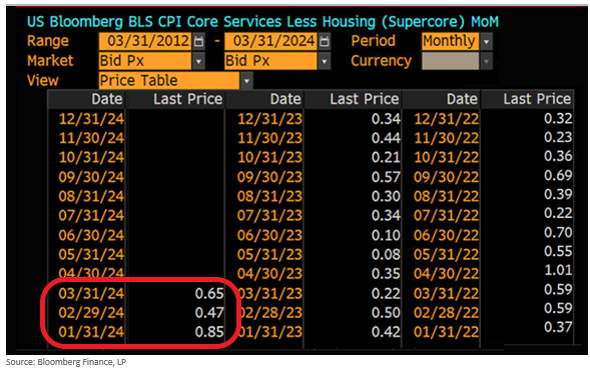

But supercore inflation, which removes shelter, is not good. I highlighted this last week as my #1 concern. Here’s the m/m numbers, with Q1 highlighted.

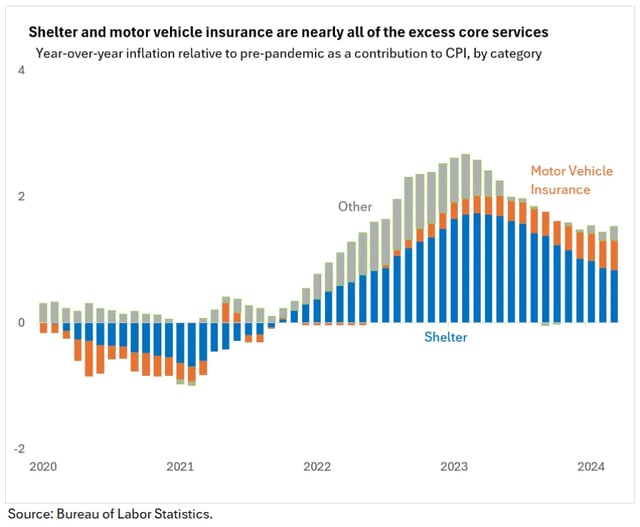

Dr. Claudia Sahm pointed out in a post this week that most of that is attributable to transportation. “The contribution of excess inflation (3-month change, annualized) in transportation increased notably from December to March. Motor vehicle insurance, repair and maintenance, and airfares were key contributors. Transportation alone explains 70% of the pickup in super core.” (added emphasis mine…also go subscribe to her stuff it’s way better than mine).

More importantly, she also points out that “There are fewer enemies in the fight against inflation.” This is probably the best news we are seeing on the inflation front. “Within core services, excess inflation contributions to CPI are down to a handful of categories. With the year-over-year inflation, the two big contributors are shelter and motor vehicle insurance. The latter's weight in CPI is under 3%, underscoring how massive the price increases for motor vehicle insurance have been.” (added emphasis mine).

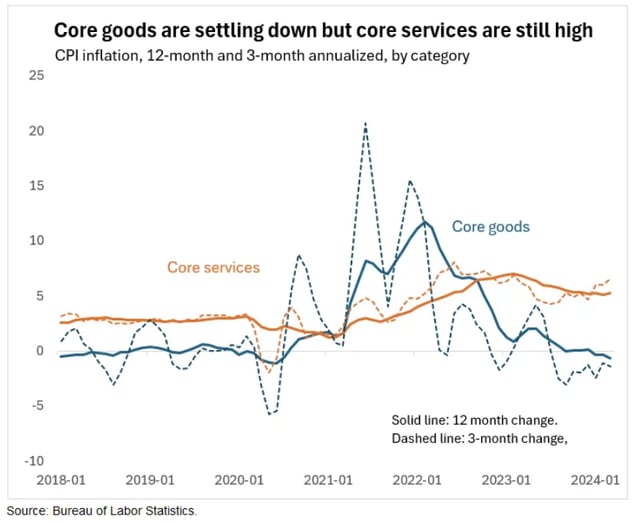

This is usually when the “sure, Goods inflation is down but what about Services!” crowd comes out of the woodwork. And to be fair, Sahm highlights that risk as well.

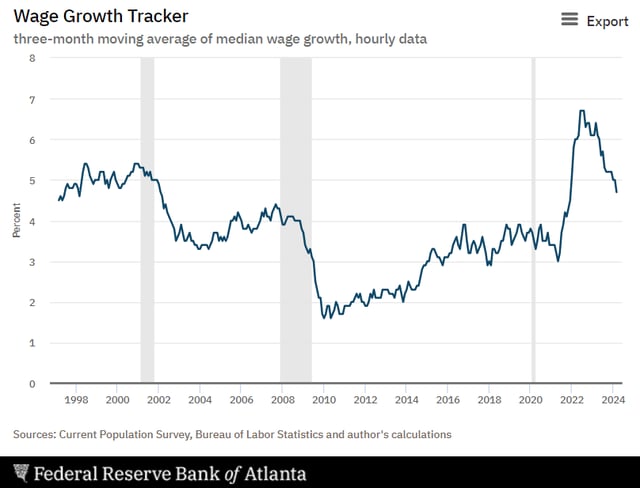

But a lot of progress is being made on the wages front. Here’s the Atlanta Fed’s wage growth tracker.

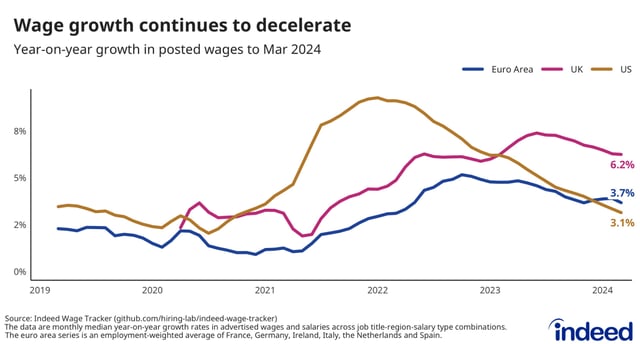

And Indeed’s wage tracker shows US wage pressures are well below the UK’s at 3.1%. It was 10% two years ago!

This should continue to at least help keep a lid on services inflation and more likely even push it lower. That, coupled with Goods inflation down, should continue the momentum lower.

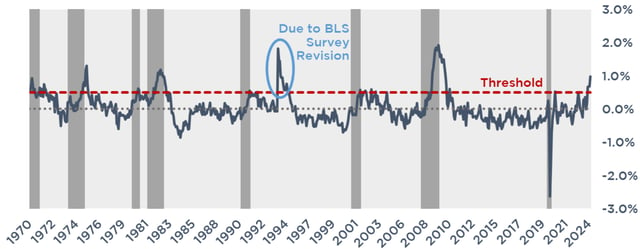

And while some argue that the choice of part time work is a signal of labor market strength, I remain so skeptical that we went out and created our own index. We call this the Pensford Part Time Momentum Index (yo, you down with PTT, yeah you know me!). This compares part time jobs vs the 24 month moving average.

There’s only been one time when we were at current levels and avoided a recession: 1994-1995. That time period is notable for two reasons:

- The Fed had just concluded a tightening cycle and quickly cut 75bps to let off the brakes a little bit, thus leading to arguably the only soft landing in history

- They changed the methodology

Inflation progress, albeit not perfect, has been substantial thus far. Let’s keep some perspective as we move from 3% to 2%.

The Only Question That Matters - Am I Going to Lose to JMo?

No way. Unfortunately, my rope-a-dope strategy of burying smack talk at the bottom of the newsletter isn’t working because it turns out:

- He is literate, which frankly came as a bit of a surprise to me

- He is paying way more attention now that there is money on the line

JMo wants me to be clear that he is not rooting for hikes, nor does he want to see hikes. But he believes there has been a structural shift and inflation/rates will be higher going forward. Too bad for him our wager involves a precise number rather than an ambiguous theory he can massage over time…

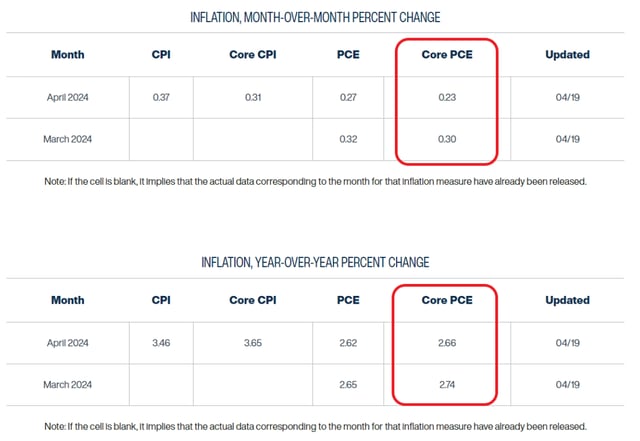

Anyway, I’m not losing to this guy. Here’s the Cleveland Fed Inflation Nowcast. The top section is m/m, the bottom section is y/y. I’ve highlighted Core PCE in each. Note how they are both lower than last month’s readings.

If we only read the headlines, it feels like inflation is reaccelerating. But if you are willing to dig in just a bit, it’s less alarming. And don’t forget two years ago Core PCE was almost 6%, CPI was >9%, and PPI was >18%! Are we really haggling over a tenth of a percentage point here or there?

Is the same amount of braking action that was required for past progress really still required for future progress?

Back to my original question of why Powell should have waited a week to make those comments. If the Cleveland Fed is right, a 2.66% Core PCE reading will be rounded up to 2.7% and we will see headlines that Core PCE showed some positive signs, albeit slower than the second half of last year.

But what if instead of 2.66% it comes in at 2.64% and gets rounded down to 2.6%? That would mean we are already at the FOMC’s SEP y/e projection. That projection was paired with three Fed cuts. What does Powell say then?

On the day of the last hike, Core PCE was 4.2% and the Fed was projecting it would end 2023 at 3.9%. Core PCE instead ended the year at 2.9% - a full point lower in just six months.

What if it “only” improves .1%? At that pace, Core PCE will be 2.6% on the June 12th meeting, again matching the FOMC’s projections for year end.

July 31st is both an FOMC meeting and a Core PCE release. What if Core PCE is “just” 2.4% by the July 31 meeting.

Those that thought I was crazy for calling for five cuts this year…is it really that crazy? Wonky data. Great progress from two years ago. Risk of waiting too long is starting to outweigh the benefits.

And a big chunk of the remaining components causing inflation aren’t impacted by higher interest rates.

The Fed should start cutting rates soon, even if they won’t.

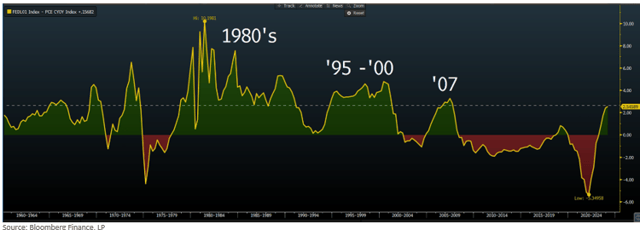

Positive Real Rates

In the last 25 years, we’ve only had 9 months of positive real rates above today’s level. Maybe this is the Great Reset. Maybe the next decade will feel more like the 1980s.

But I can’t shake the feeling that the current economic strength is in large part due to massive government spending post-covid and not organic growth.

The structural shifts that people highlight take a very long time to turn the economic ship. Did the $30 trillion US economy really suddenly start reacting to demographic shifts all at once? Why hadn’t those effects started to show up before the government dropped trillions of dollars on the economy out of a helicopter?

Maybe the AI boom will bail us out.

The Week Ahead

GDP and PCE Data release at the tail end. We also have the NFL draft, where I am sure I will hate our picks. Newer reads may not recall that a few years ago I created a Spite Site to take out my frustrations on Howie Roseman. I haven’t updated it since then, but I revisited it this week with a tinge of pride.

https://howiecantdraft.com/

Also, JJ McCarthy is this year’s Mac Jones. Buyer beware.