Progress Not Perfection

As a math teacher, my mom had very high academic expectations for me and my two siblings. At some point around middle school, she realized that I would be extremely limited in this regard. She kept pushing my brother and sister, both of whom now require I refer to them as Dr. Conklin at family gatherings.

But mom had to pivot with me. While I heard the siblings repeatedly congratulated for 4.0s in AP classes, I instead heard, “Progress, not perfection.” She was happy if I was just moving from one grade to the next, which wasn’t always assured. Like my wife, she lowered the bar just enough to allow me just enough room to clear it. I’m starting to think improvements in inflation could benefit from a similar view.

Before you start thinking she was a softie, keep in mind this is the same woman that just last year sent me a photo of my SAT score to settle a family dispute. And yes, the siblings had each scored much higher than me.

Last Week This Morning

- 10 Year Treasury at 3.83%

- German bund at 2.48%

- 2 Year Treasury at 4.77%

- SOFR at 5.06%

- Term SOFR at 5.23%

- U of Mich Sentiment came in at 72.6 vs 65.5 expected, so soft landing yay!

- If at first you don’t succeed, just even more blatantly buy votes by waving a magic wand and making debt disappear

Nothing to See Here

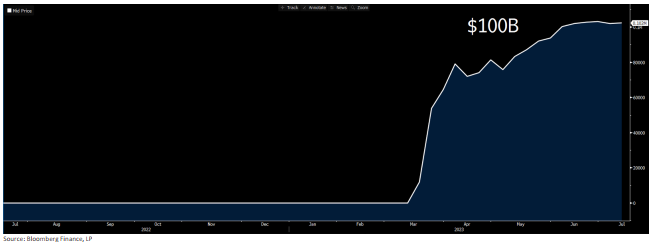

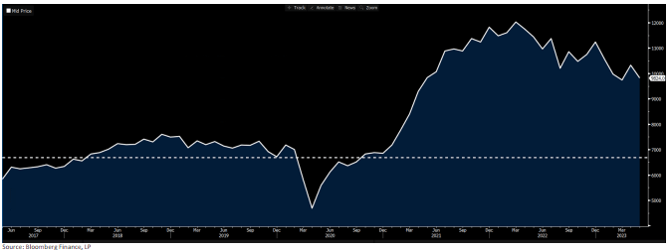

Here’s what lack of progress looks like. The Fed’s emergency term funding program has an outstanding balance of $100B that is still climbing. Inflation falling from 9% to 3% isn’t good enough, but emergency loans to regional banks remaining at $100B is totally fine? I’m so confused. “Nothing to see here folks, just a random $100B placed directly onto regional bank balance sheets even though they don’t need it because the banking system is sound and resilient.”

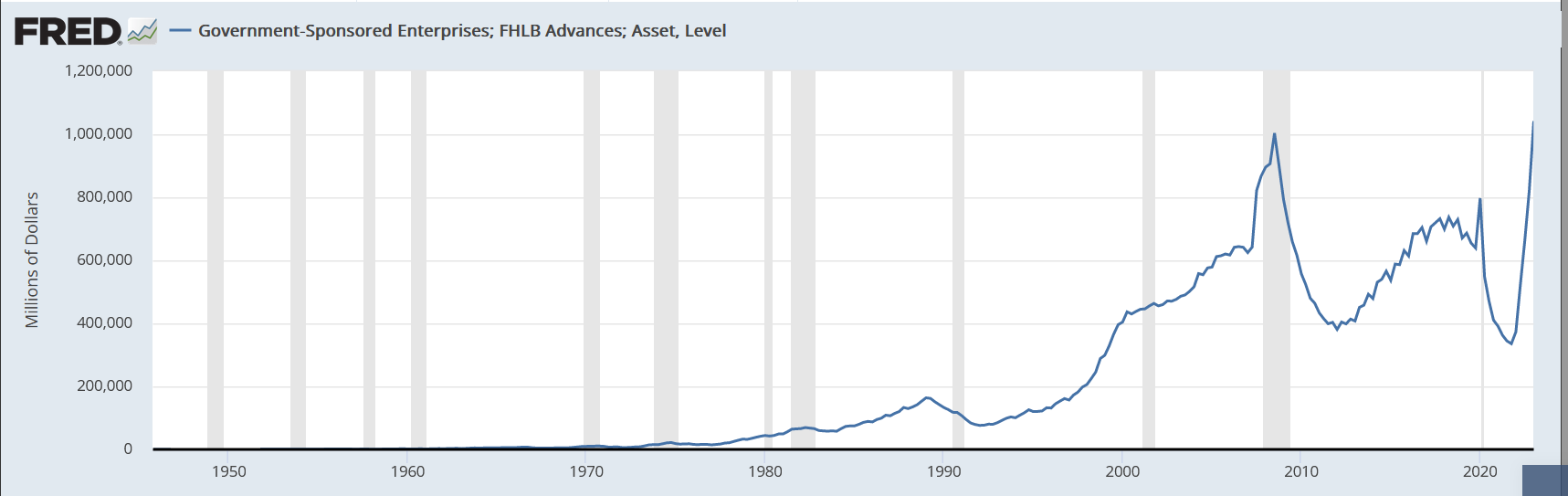

Here’s FHLB advances. Anytime I see a chart that is more extreme than 2008, I get nervous.

What are FHLB advances? Here’s a resource that describes it in a way that my siblings could understand: FHL Banks, but I need a little translation help from exactly the sort of tool I would have abused in school to help survive…ChatGPT.

Me

Describe to me at a high school level what FHLB advances are. Don’t lecture me about ending a sentence in a preposition.

ChatGPT

"FHLB advances" refer to the loans that the Federal Home Loan Banks provide to their member financial institutions. These are typically used by the member institutions to finance home mortgages for their customers, but they can also be used for other purposes like meeting regulatory liquidity requirements, funding asset growth, and financing operations.

While traditional grammar rules often suggest avoiding ending sentences with prepositions, this isn't a hard and fast rule. In fact, sometimes it's more natural and clearer to do so, especially in spoken English or casual writing. The key is to ensure the meaning of your sentences is clear and understandable.

Me

Do FHLB advances provide liquidity to banks that might be experiencing stress from rapidly rising interest rates?

ChatGPT

Yes, FHLB advances can indeed provide liquidity to banks experiencing stress due to rapidly rising interest rates.

FHLB advances can help banks navigate this situation in a few ways. They provide a stable and reliable source of funding which isn't directly impacted by the volatility in the market's interest rates. This means that even when rates are rising rapidly, a bank can secure funding from its FHLB at a relatively predictable cost.

Having access to FHLB advances can help a bank meet its regulatory liquidity requirements even in challenging market conditions. This can be crucial for the bank's operations and stability.

So, while FHLB advances can't prevent the challenges of rising interest rates, they can provide important support and flexibility to banks navigating those conditions.

Me

How many days were there between the initial collapse of the Bear Stearns subprime hedge fund and the agreement for Wachovia to sell itself to Wells Fargo?

ChatGPT

If we consider the collapse of the Bear Stearns subprime hedge funds to have occurred on June 20, 2007, and the Wachovia agreement on October 3, 2008, we would get approximately 470 days.

Me

How many days has it been since March 10th of this year?

ChatGPT

Today's date is July 17, 2023, so if we count the days from March 15, 2023, we get exactly 129 days.

Progress not Perfection

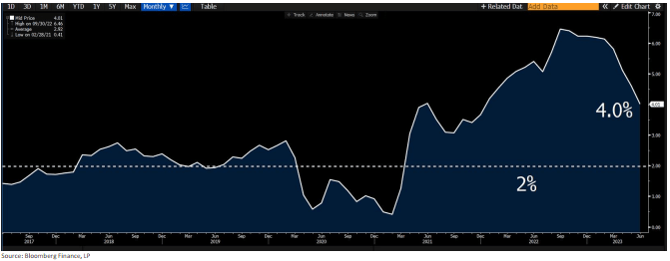

Multiple measures of inflation hit their lowest levels in over two years. Most surprising was the monthly core inflation, which fell to just 0.2% (actually 0.16% before rounding). Annualizing the three-month average puts core at 4.0%. A year ago, the monthly core was 0.6% and the same annualized three-month average was 6.8%.

And yet most commentary revolves around some element of “more work to do.” A common theme is that the next 2% of inflation will be tougher to beat than the last 2%. While that’s fair, keep in mind that inflation has fallen considerably in the face of a “resilient” economy. The next 2% might be easier to tackle if the economic slowdown materializes.

Is inflation back to 2%? No. But I can hear my mom saying, “Progress, not perfection.”

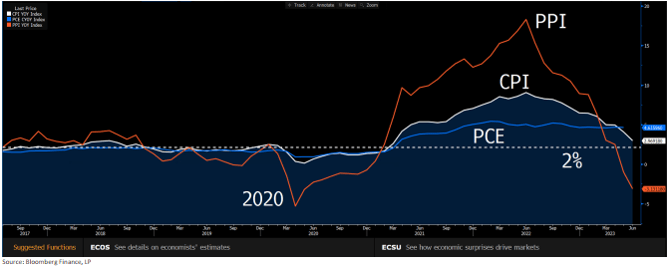

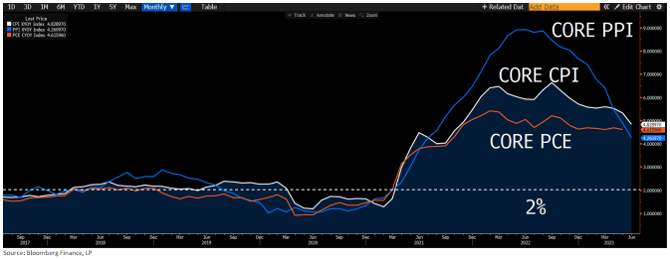

Because I like pictures, here’s a quick recap of how various inflation measures have progressed since the first hike.

Headline Inflation

CPI down from 9.1% to 3.0%. PPI is negative, off a peak of double digits. PCE is down a little bit, proven to be more stubborn. Overall, though, not too bad.

Core Inflation

Definitely more stubborn, but we’ve still seen some improvement. This is more impressive when you consider we are just now in reaching the starting line that Powell highlighted at the first hike.

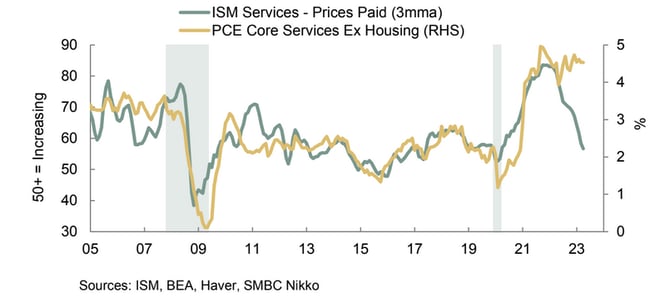

Supercore

By now, everyone knows about the lag in the shelter component. Supercore simply excludes housing and says, “here’s how the other inflation stuff is going.”

Jk, that was a JOLTS graph - just seeing if you’re still awake. Here’s supercore.

SMBC believes supercore will fall rapidly in the months ahead. “In the chart below, we graph the three-month moving average of the prices paid series in the ISM services survey versus the year-over-year change in core PCE services excluding housing. The two series are plotted contemporaneously and have a high 0.80 correlation coefficient.”

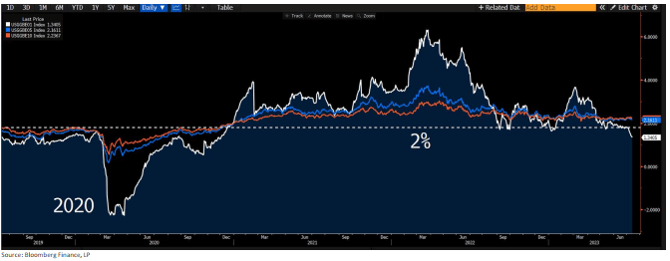

Expectations

Inflation expectations plunged last summer. While this was really the first W the Fed could claim with inflation, controlling expectations is also the likely culprit for hawkish tone even when the Fed stops hiking.

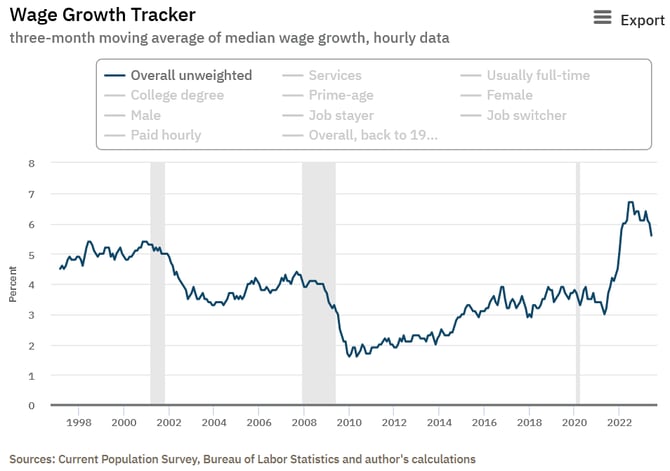

And even though some cling to the old belief that wage pressure creates inflation (even though growing research suggests it doesn’t), how about the Atlanta Fed’s Wage Growth Index. While not perfect, it also shows progress.

That’s a lot of progress in 15 months, right? And during that time, Fed Funds averaged 3.16%. How much more impactful will a sustained FF > 5% be?

I think the inflation battle is closer to being won than the pundits believe.

Something Has to Give

Although the Fed seems certain to hike, this month’s CPI and PPI only further reinforce my feeling that they shouldn’t. A hike this month does nothing for next month’s inflation reading, so I just don’t get the logic. I would be more easily persuaded by a hike to 6%, breaking stuff, and declaring victory, than limping along in the hopes of achieving a soft landing and risking a rebound a la 1970’s.

With market odds of a hike on the 26 stand at 92%. Since that is paired with a nice little stock rally, the market is basically giving the Fed permission to hike. They will take it and hike to 5.50%

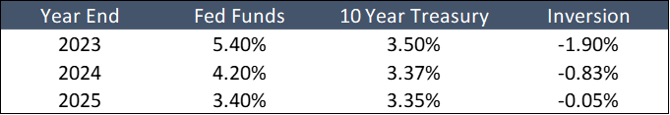

They are done after that, but cuts won’t come until next year. I’ve been of the mind that cuts would come Q1 2024, but the chances are growing that cuts don’t come until even later.

If anything, last week’s inflation data takes the pressure off to remain full hawk next week at the meeting. Don’t be surprised if they soften the tone about future hikes.

This will keep cap costs elevated for the time being, but once we have a line of sight for cuts, the prices should come down.

The T10 fell back below 3.92%, keeping that as the top end of the range for now.

Oddly, the steep inversion remains deep and long-lasting, with no end in sight. There is no precedent for an inverted curve lasting this long, so something’s gotta give.

Week Ahead

This week will be a slower week as markets continue to digest this week’s major releases and continue to look ahead to the July Fed meeting.

Me

Can you ask my mom to stop lecturing me about ending a sentence with a preposition? She was a math teacher, not an English teacher.

ChatGPT

Dear [Your Mom's Name],

I hope this message finds you well. Your child has been working hard on their language skills, and it's wonderful that you're taking an interest in their grammatical proficiency.

As a language model developed by OpenAI, I wanted to share some perspective on the topic of ending sentences with prepositions. While traditional grammar rules have often suggested that sentences should not end with prepositions, modern linguists recognize that language is evolving, and these rules are not as rigid as they once were.

In fact, it's often more natural in English—both in conversation and in casual writing—to end a sentence with a preposition. The primary aim is to ensure clarity and comprehension, and sometimes following the traditional rule can make sentences sound overly formal or even confusing.

Of course, it's beneficial to know the traditional rules to make informed choices about language use. Yet, it's equally important to recognize that there's flexibility in these rules, particularly in informal or conversational contexts.

Please continue your wonderful support for your child's learning. Let's celebrate their progress and the nuances of the English language together.

Best regards, ChatGPT