Rates Are Down – Improve Your Deal

At the time of writing, 10 year rates are down 7 bps over the past week and 25 bps since the beginning of June. We won’t bore you with why, we’ll just skip to the point of this blast. If you underwrote a fixed deal based on a higher 10 year rate, the market has presented an opportunity to improve your terms via swaption. Readers of our content are probably familiar with swaptions at this point, but as a refresher, you purchase the right to pay a fixed rate at some point in the future (putting a ceiling on your rate) in exchange for an upfront premium.

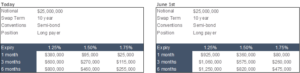

The table on the left below shows the cost of some generic swaption structures today and the table on the right shows the approximate cost a month ago.

A swaption doesn’t tie you to trading with a specific bank, it just puts a ceiling on the rate you’re locking at closing. Higher strikes and shorter terms are cheaper, lower strikes and longer terms are more expensive. If it’s in the money at expiry you would receive a cash payment which offsets the increase in rates. If rates are down further, it simply expires worthless. We’ve outlined the mechanics in greater detail here.

Remember, swaptions can also be used to hedge against falling rates. That type of structure can prevent market volatility from blowing up a disposition due to a spike in the prepayment penalty.

If you’d like to discuss how a swaption can be used to hedge your interest rate risk, give us a shout at 704-887-9880 or pensfordteam@pensford.com