Showdown – Business Investment vs Consumer Spending

Dramatically shortened week with Thanksgiving. Liquidity will start drying up Wednesday at lunch time, which won’t prevent trades from getting done but may cost a bit more to execute during that window.

Markets are closed on Thursday.

Friday markets are open until 2pm, but liquidity will be poor with all traders with more than two years’ experience taking a four-day weekend.

Last Week This Morning

- 10 Year Treasury dropped 0.06% to 1.77%

- German bund fell 3bps -0.36%

- Japan 10yr at -0.08%

- 2 Year Treasury mostly unchanged at 1.62%

- LIBOR at 1.70% and SOFR at 1.58%

- FOMC minutes showed increasing concern about downside risks

- The minutes also showed “All participants judged that negative interest rates currently did not appear to be an attractive monetary policy tool in the United States.”

- Basically, the US is going to have negative interest rates at some point…

- Bloomberg released a report illustrating that Trump’s tweets have the same impact on markets as the monthly job report

- Regardless of what side you are on, questioning the loyalty of a Purple Heart recipient is off limits, particularly if you have never put on a uniform

- I guess Tesla is a big believer in broken windows theory

Showdown – Business vs Consumer

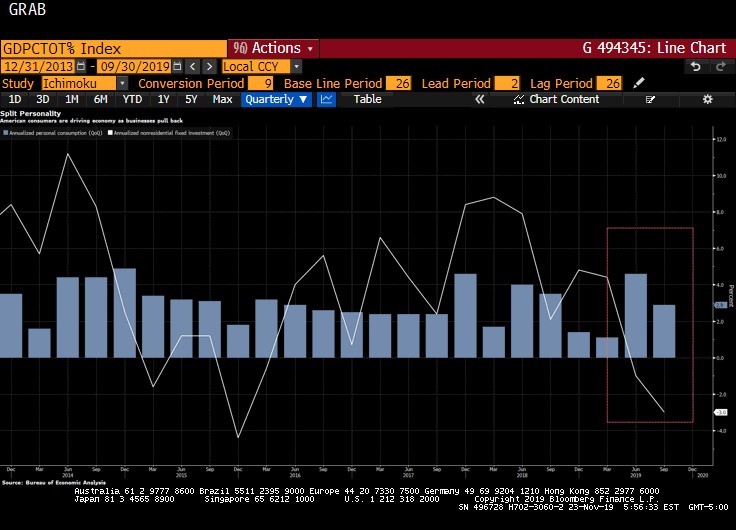

Consumer spending drives about two thirds of GDP and has been surprisingly resilient this year. Contrast that with business investment, which has fallen off a cliff. Here’s a graph from a Bloomberg article this week illustrating the divergent paths.

When the Fed mentions downside risks, consumer spending has to be near the top of that list. If consumer spending takes a turn for the worse, more rate cuts are on the table. If not, the Fed could be rightly proud of itself for achieving the ever-elusive soft landing.

Consumers weathered the storm in 2016 despite a drop off in business investment, and that likely prevented the US from dropping into a recession. Consumers very well decide how 2020 goes because it’s clear that businesses have altered their behavior this year in anticipation of a slowdown.

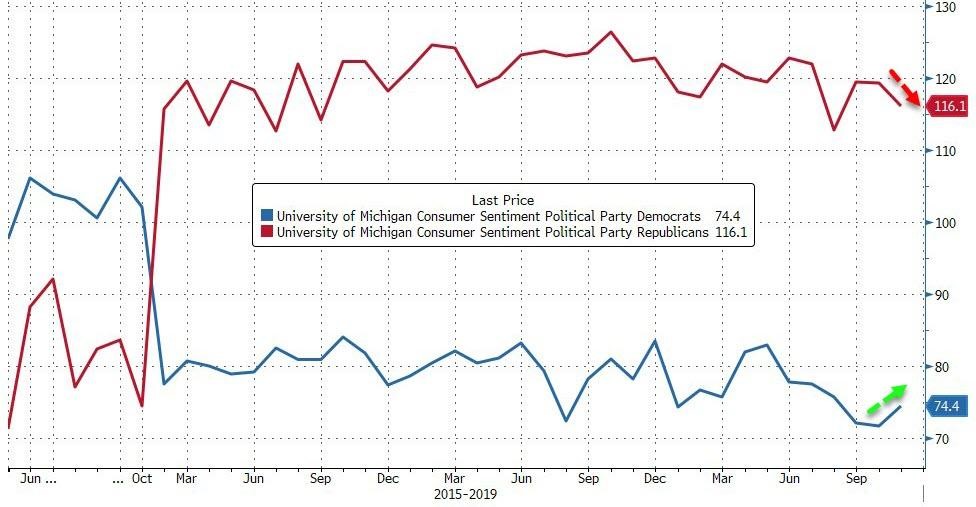

Of course, whether consumers believe the economy is in good shape is highly correlated to their political affiliation. Here’s consumer confidence bifurcated on political affiliation (GOP=red and Dem=blue). Next year’s election should have a fun effect on this graph.

The Leading Indicator Index is flashing warning signs, similar to those in 2012 and 2016. With business investment already in 2016 territory, it will be interesting to see if we repeat that slow down or if GDP actually contracts next year.

10 Year Treasury

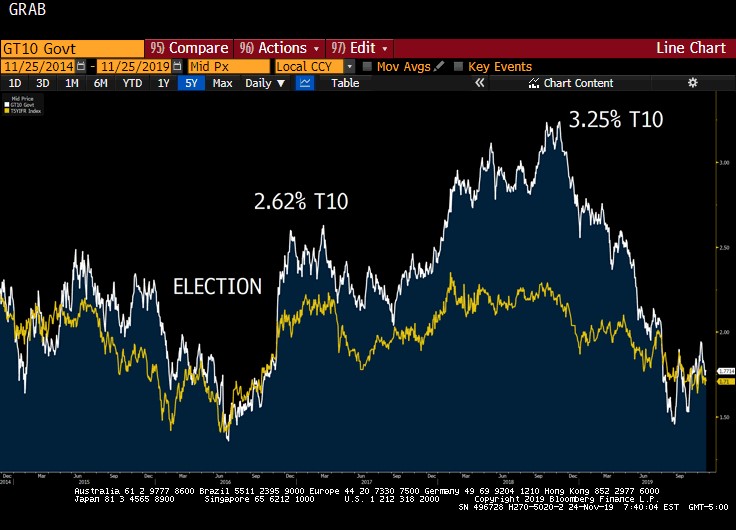

Intraday volatility will continue to be dominated by news on the China trade dispute. But longer-term movements will continue to be driven by projections for inflation. Below is a graph comparing the T10 against inflation expectations.

Inflation expectations spiked after the election, and then again after the tax cuts. That put a ton of upward pressure on long term yields.

But when that inflation failed to materialize, the T10 plunged.

The 10 Year Treasury yield is now trading on top of inflation expectations, so while news on the China front will undoubtedly cause rates to swing, don’t expect a long-lasting, fundamental shift in rates until inflation expectations change.

This Week

Ton of economic data this week, most notably Wednesday’s Q3 GDP and Core PCE (the Fed’s preferred measure of inflation). While huge swings are unlikely, reduced liquidity could translate into outsized movements.